Preface

The stock featured in today’s special report is among an elite group of high-quality companies known for paying their shareholders increasing amounts of income through both good times and bad.

These special stocks are called dividend growth stocks… and for many of the analysts we follow, they’re the consensus “investment of choice” for anyone looking to secure a lifetime of steadily-rising income no matter what’s going on in the economy.

What’s a dividend growth stock?

Put simply, it’s a company with a proven track record of paying and raising its dividend year-after-year.

These companies typically dominate their industry, realize steady and growing profits, and generate significant amounts of free cash flow.

And perhaps best of all, they pay their shareholders a generous amount of that cash in the form of a dividend that increases each and every year (often rising faster than the rate of inflation).

The beauty of owning a stock like this is that no matter what happens to its share price, as long as the company’s dividend is safe (meaning it has the ability to continue paying it), then we — as shareholders — stand to collect larger and larger payouts each year.

With this in mind, we’ve sifted through the analysis of a handful of our favorite investment analysts and singled out what we consider to be the best dividend growth stock on the market.

For this report, we’ve teamed up with one of our favorite analysts in this space, Brian Bollinger — a Certified Public Account (CPA) and the founder of Simply Safe Dividends.

Brian’s analysis is 1) rooted in the facts and 2) offers a balanced look at the pros and cons of a particular investment opportunity.

For this report, we’ve asked Brian to analyze our “#1 stock” on the merits of its:

- Dividend safety

- Dividend growth potential, and

- Key risks

Brian’s analysis takes into account more than a dozen fundamental factors that influence a company’s ability to continue paying dividends, such as:

- Earnings and free cash flow payout ratios

- Debt levels and coverage ratios

- Recession performance

- Dividend longevity

- Industry cyclicality

- Free cash flow generation

- Business volatility

- Near-term sales and earnings growth

- Return on invested capital

As you’re about to see, the following stock appears to be one of the safest dividend-payers AND growers on the planet.

It could be a core holding in a solid dividend-generating portfolio that produces safe, growing income for years to come.

Here at Trades of the Day, it’s our firm belief you will do well if you:

- Buy these stocks at a reasonable price (fair value or better)…

- Hold them for the long-haul (to allow for the power of compounding, and…

- Reinvest their dividends along the way (either selectively or automatically)

Without further ado, we’re pleased to introduce you to the January 2023 edition of our special report.

The #1 Stock to Own Right Now: Apple (AAPL)

Dividend Yield: 0.6% (12/6/22)

Sector: Technology – Computer Hardware

Dividend Growth Streak: 9 Years

Apple needs no introduction.

The stock has already minted many millionaires over the years, and here at Trades of the Day, we think it will continue to make money for long-term shareholders going forward… courtesy of its fast-growing dividend.

The company is about as high quality as it gets: It’s “AA+”-rated from S&P, it has spectacular profitability, a massive cash pile and an incredible balance sheet.

Thanks to its premium brand, Apple has unmatched pricing power that regularly delivers gross margins in excess of 35% (unheard of in its two main markets, PCs and smartphones).

As a result, the company is gushing free cash flow and is growing its dividend like crazy.

As you’re about to see, not only does Apple offer one of the safest dividends in the world, but its dividend growth potential going forward is nothing short of outstanding — making it an ideal core holding for long-term income investors.

Perhaps this is why legendary investor Warren Buffett is betting tens of billions of dollars on Apple…

Buffett Maintains Large Stake in Apple

According to the latest SEC filings, as of the end of September 2022 investing legend Warren Buffett’s Berkshire Hathaway owned about 895 million shares of Apple, or around 5% of the company.

And those shares will almost immediately pay off: Berkshire Hathaway stands to collect approximately $205 million in Apple dividends within the next three months alone.

With this in mind, we’ve used Simply Safe Dividends to analyze the safety and growth potential of Apple’s dividend, as well as any key risks investors should be aware of…

Dividend Safety Analysis

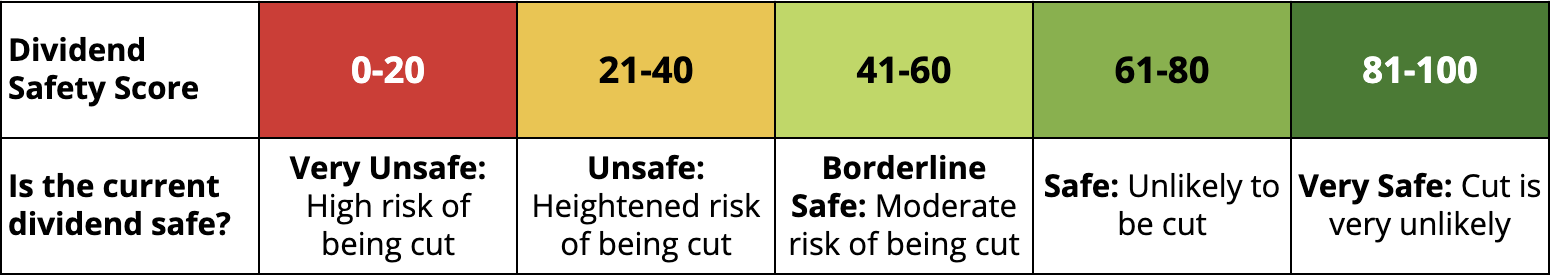

Simply Safe Dividends rates a company’s dividend safety by reviewing its key financial metrics. Dividend Safety Scores range from 0 to 100, and conservative dividend investors should stick with firms that score at least 60. You can review how scores are calculated, see their real-time track record, and learn how to use them for your portfolio here.

Apple’s Dividend Safety Score is 99, which indicates that the dividend is not only much safer than the average dividend-paying stock in the market, but actually one of the safest overall.

Apple’s excellent Dividend Safety Score is driven by the company’s relatively low payout ratios, healthy balance sheet, strong business economics, and low industry cyclicality.

Apple’s payout ratio over the last year stands at 15%, which is low and gives the company a large cushion to continue paying dividends.

Apple’s balance sheet provides even more assurance with more cash and marketable securities than book debt, earning the iconic company a strong investment-grade credit rating.

The firm generates predictable free cash flow for a technology company as well. Apple’s massive installed base of hardware users results in a steady flow of customers replacing their old devices and purchasing more high-margin software and services.

As long as Apple maintains its excellent iPhone margins, protects its brand, and grows the service revenue it gets from each device, the firm’s dividend profile will remain strong.

Dividend Growth Analysis

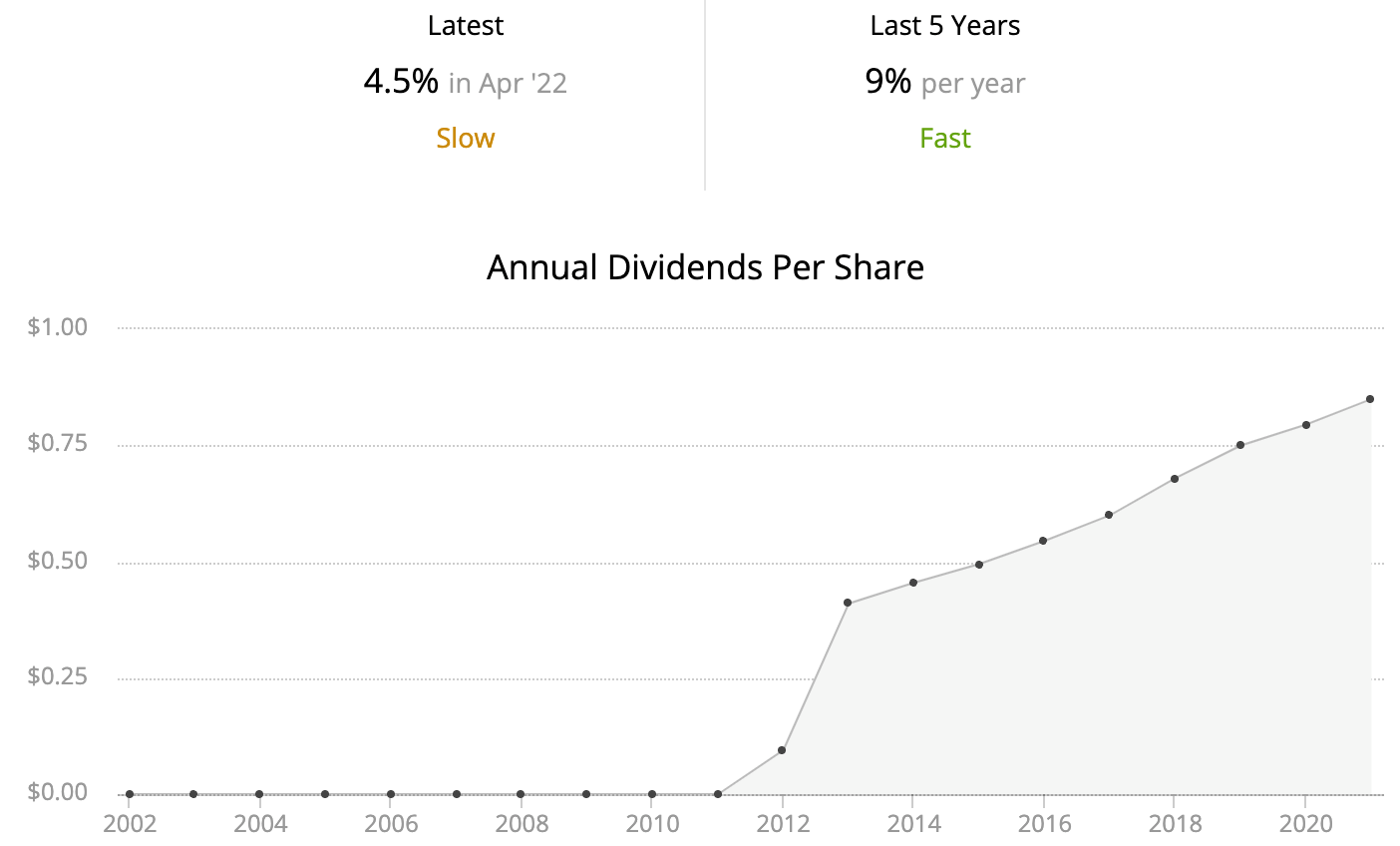

Apple initiated a quarterly dividend in 2012 and has since increased its dividend by over 100%. The last increase was a 7.3% boost announced in April 2021.

Within reason, Apple could probably grow its dividend as fast as it wants to. The combination of a relatively low payout ratio, an extraordinarily strong balance sheet, and end markets that should continue to grow over time (driven by high-margin services) can fuel strong dividend growth for many years to come.

Within reason, Apple could probably grow its dividend as fast as it wants to. The combination of a relatively low payout ratio, an extraordinarily strong balance sheet, and end markets that should continue to grow over time (driven by high-margin services) can fuel strong dividend growth for many years to come.

In reality, Apple is likely to keep up at least mid-single-digit dividend growth rate for some time. The company still views itself as a growth company and is willing to invest billions of dollars into high risk, but high reward business ventures in huge addressable markets (self-driving cars, payments, etc).

Key Risks

The iPhone drives around 50% of Apple’s overall revenue and has fueled the company’s high growth over the past decade. Apple’s strong brand, superior user experience, and bargaining power with suppliers have allowed it to capture high margins on its phones.

However, with the smartphone market becoming increasingly saturated and phone differentiation harder to come by, Apple could struggle to find its next major growth driver if hardware sales continue to slow, especially if a weaker pace of new device sales were to impact the growth rate of its lucrative services business.

There is also a chance that iPhone margins come under pressure as consumer preferences and buying habits evolve. Many conservative dividend investors choose to avoid the technology sector because of its fast pace of change.

Valuation

What’s a reasonable price to pay for a share of Apple today?

There are many ways to value a stock, but for this report we’re primarily using a method outlined in Dave Van Knapp’s lesson on valuation.

Based on our interpretation, Apple appears 40% overvalued at recent prices. Investors may want to wait for a pullback before purchasing.

Valuation estimated by TOD

Valuation estimated by TOD

Recent articles / videos on Apple (AAPL):

Apple (AAPL) Handed Warren Buffett $4.5 BILLION in Cash?! by Dividends and Income

These 3 Overlooked Technologies Could Send Apple (AAPL) Higher by Dividends and Income

This Stock Has Plenty Of Upside Ahead by Michael Robinson, Strategic Tech Investor

I Just Bought Apple (AAPL) For My Grand-Twins College Fund by Mike Nadel, Daily Trade Alert

High Quality Dividend Growth Stock for October: Apple (AAPL) by Dave Van Knapp, Daily Trade Alert

These 3 Stocks Are the Safest Dividend Plays Today by Michael A. Robinson, Strategic Tech Investor

These Four Stocks Can Put Your Grandchildren Through College by Keith Fitz-Gerald, Money Morning

Conclusion

Here at Trades of the Day, we’ve put a lot of effort into educating our readers on the wonderful world of dividend growth investing… and it’s our hope that you’ll benefit from today’s special report.

A very special thanks goes to Brian Bollinger of Simply Safe Dividends for analyzing the dividend safety, dividend growth potential and potential risks of the stock featured in today’s report. (By the way, if you’re curious why we have so much confidence in Brian’s dividend scoring system, simply look at his real-time track record.)

The reason we put this report together is because we truly believe that the best way to generate wealth in the stock market over the long-haul is to buy a select group of high-quality dividend growth stocks while they’re trading at reasonable prices… hold them for the long-term… and reinvest their dividends along the way.

We think any long-term investor will do well with that strategy.

Good investing!

Greg Patrick, Co-Founder

TradesOfTheDay.com