Finding an artificial intelligence (AI) trading at a sizable discount isn’t that common. There is a ton of hype in this industry, and investors need to be careful not get caught up in it. However, there are a few areas that aren’t quite fully valued yet, giving savvy investors a chance to scoop up potentially huge winners at a solid discount.

One stock I think is rather cheap is Nebius Group (NBIS). Nebius may look overvalued, but only if you don’t factor in the monster growth management is already telling us about.

Nebius should deliver explosive growth in 2026

Nebius’s business model is very similar to a cloud computing one pioneered by big tech companies over a decade ago. Nebius owns and rents out space in data centers, where it puts cutting-edge graphics processing units (GPUs) from Nvidia. Then it rents out its capabilities to clients so they can train and run artificial intelligence models. Because it offers a full-stack solution, clients don’t need to add ancillary services to make it work; they can get everything they need from Nebius.

That’s a huge advantage, which is why it’s expected to grow at a ludicrous speed in 2026. At the end of the third quarter of 2025, Nebius had an annual run rate of $551 million. By the end of 2026, that figure is expected to be between $7 billion and $9 billion. That’s huge growth, and it isn’t fully priced into the stock yet.

That’s a huge advantage, which is why it’s expected to grow at a ludicrous speed in 2026. At the end of the third quarter of 2025, Nebius had an annual run rate of $551 million. By the end of 2026, that figure is expected to be between $7 billion and $9 billion. That’s huge growth, and it isn’t fully priced into the stock yet.

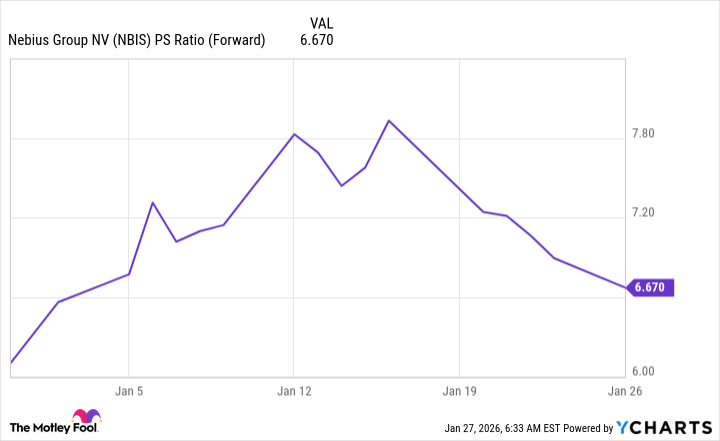

At first look, Nebius stock looks expensive at 60 times sales.

However, that’s using trailing revenue. If you know a company’s growth is going to explode in the next year, that’s the wrong measure to use. If you value the stock using analyst revenue projections, then it’s trading dirt-cheap.

However, that’s using trailing revenue. If you know a company’s growth is going to explode in the next year, that’s the wrong measure to use. If you value the stock using analyst revenue projections, then it’s trading dirt-cheap.

At less than 7 times projected sales, Nebius stock looks like an absolute bargain. However, there’s one item investors must keep in mind.

At less than 7 times projected sales, Nebius stock looks like an absolute bargain. However, there’s one item investors must keep in mind.

Nebius isn’t profitable. It’s going all-in on building out its AI computing capacity to capture market opportunity. This is a wise strategy, but the company will need to turn a profit eventually to be viewed more favorably by the market. Fortunately, several cloud computing companies have already reached scale, and a healthy operating margin isn’t out of the question once Nebius is fully mature.

That will take a few years, but I think the market will ultimately take notice and send Nebius shares soaring.

— Keithen Drury

Where to Invest $99 [sponsor]Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: The Motley Fool