Did you know that global IT spending could increase 10% in 2026 to a whopping $6 trillion?

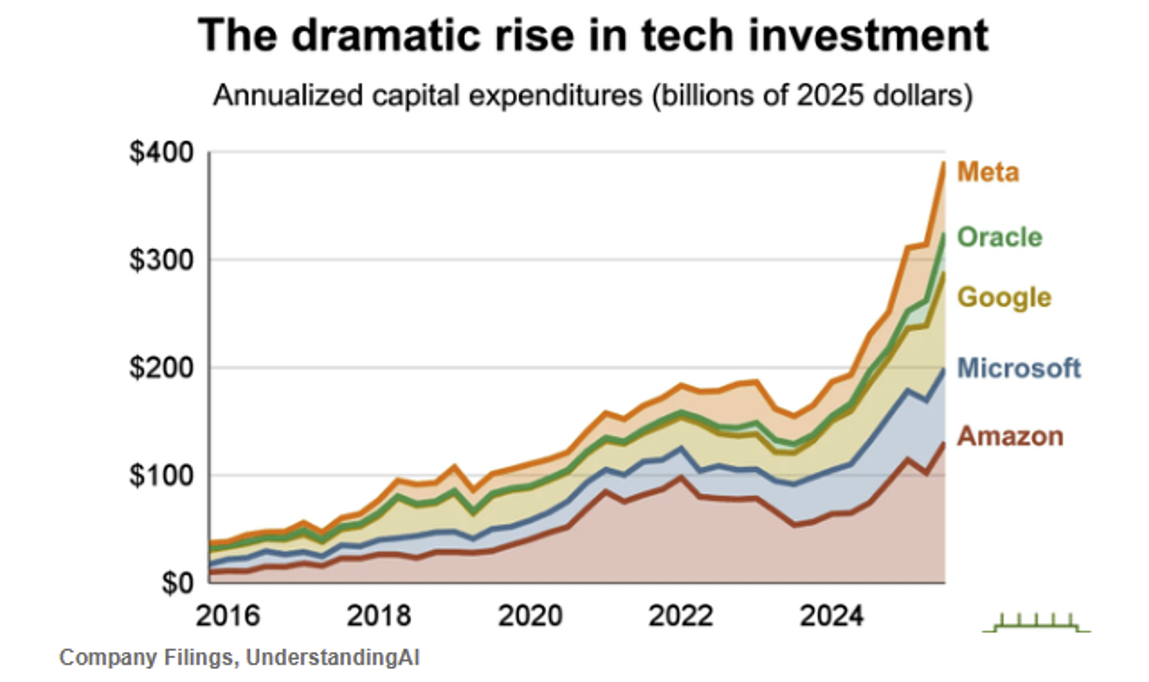

That’s what research firm Gartner is saying, and I wouldn’t at all be surprised if it were right. After all, artificial intelligence (“AI”) fervor just keeps spiking every single year, fueled in large part by Big Tech players like Alphabet (GOOG), Amazon (AMZN), Meta Platforms (META), Oracle (ORCL), and Microsoft (MSFT).

As shown below, around two-thirds of next year’s spending will likely come from just them.

Source: Seeking Alpha

Source: Seeking Alpha

This includes plenty of money devoted to powering and storing AI information. In fact, spending on data centers alone will grow nearly 20% next year to hit as high as $600 billion. And that’s a topic I’m very well-versed in.

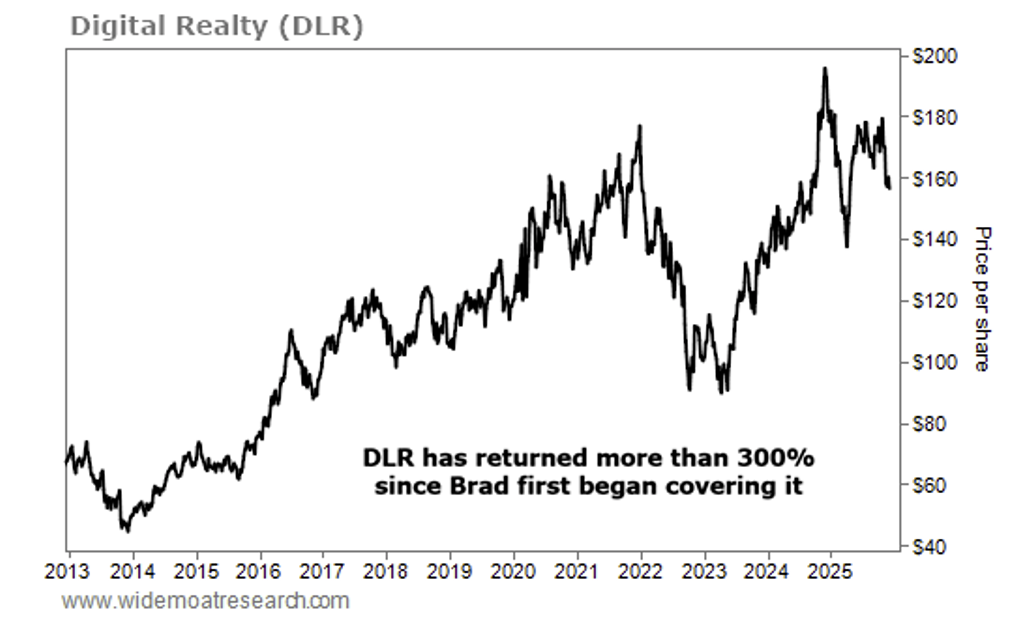

I began covering data centers around 12 years ago when I first recommended real estate investment trust (“REIT”) Digital Realty Trust (DLR).

Shares were then trading at $65.40, but they didn’t stay there. Including dividends, shareholders have netted more than 300% gains since.

And I don’t think DLR is finished yet. Not even close.

And I don’t think DLR is finished yet. Not even close.

That’s not my recommendation today, though, believe it or not. Today, we’ll go bargain hunting.

Some might argue that there are no bargains when it comes to AI investments. And as I shared in yesterday’s edition of The Wide Moat Letter, there certainly aren’t many.

But given the generally poor sentiment around real estate in recent years, data-center REITs might be the one area of the AI trade with attractive margins of safety.

A Crowded Market

Given the demand forecast, the data-center sector is getting downright crowded.

There are pure-play data-center REITs like Digital Realty or Equinix (EQIX). Or their smaller, cheaper – often riskier – competitors. And there are a growing number of other REITs entering the market as well.

For instance, we’ve seen warehouse giant Prologis (PLD) join the game. Since 2023, it has diversified its 5,800-plus property portfolio with $2 billion worth of data-center projects – to say nothing of the additional $1 billion it has under development.

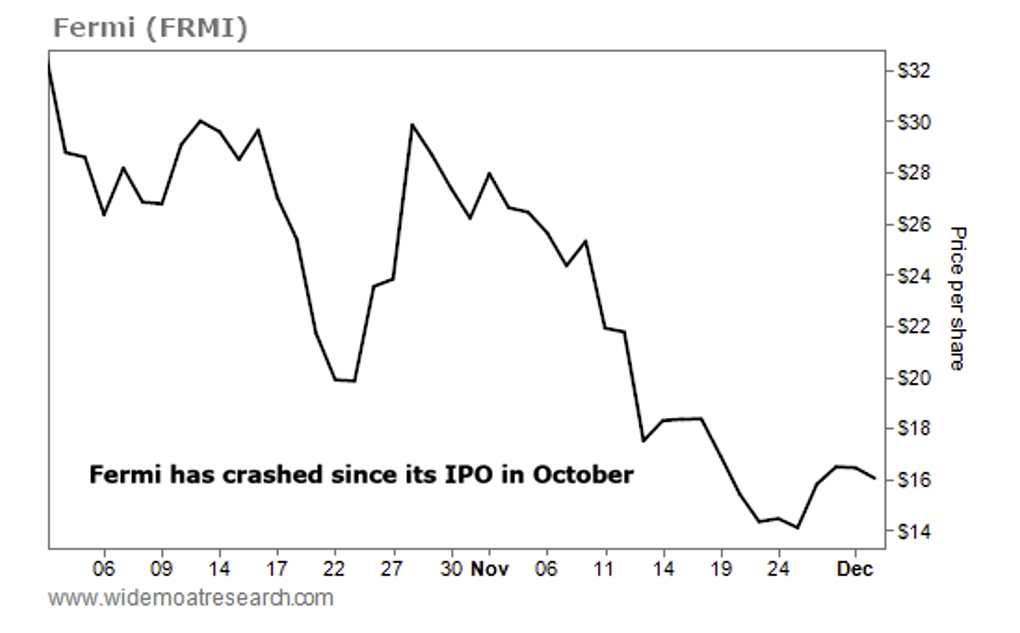

COPT Defense Properties (CDP) and net-lease REIT Realty Income (O) have also dipped their toes in the water. And then there’s Fermi (FRMI), a brand-new REIT altogether.

I wrote about it two months ago, noting how it was founded on January 10 and went public on September 30… at a valuation of around $13 billion despite having no operating assets whatsoever. Just a 6,000-acre plot of land.

Now, it expects to house 18 million square feet of AI-specific data centers over the next decade, with 1.1 gigawatts of power online by the end of 2026. But still. It doesn’t have those yet.

So it makes complete sense that Fermi shares have cooled off almost 50% since its IPO.

Keep that chart in mind next time you feel like purchasing AI investments without doing the proper assessments first. Or, for that matter, before you jump on IPOs at all, as I explain in this article.

Keep that chart in mind next time you feel like purchasing AI investments without doing the proper assessments first. Or, for that matter, before you jump on IPOs at all, as I explain in this article.

Blue Owl Capital on Display

When discussing AI in general or data centers specifically, it’s easy to overlook the financiers behind them. Easy, but not prudent, especially if you’re looking for a bargain.

Take Blue Owl Capital (OWL), an asset manager with three lines of business:

- Private credit by way of direct lending in private equity deals

- Direct lending business through Owl Rock

- Real assets in the form of net leases, real estate credit, and digital infrastructure

In the past two months, Blue Owl funds have committed more than $50 billion to build data centers for Meta, Oracle, and other AI hyperscalers. As co-CEO Marc Lipschultz recently explained in Barron’s:

Our real estate business pioneered triple-net, long-term leases to investment-grade corporate partners. Now, there are these AI data centers, and the three biggest ones being built in the past year are Blue Owl projects.

You’d think that would be enough to send the stock soaring. However, it has been getting some negative press in recent months. For starters, a recent Wall Street Journal article written by Jonathan Weil didn’t care for the financial engineering associated with Meta’s off-balance-sheet maneuver.

He specifically pointed to its 20% to 80% joint venture with Blue Owl for a new $27 billion data center in Louisiana. The financing structure “looked too good to be true,” he claimed, accusing Meta of wanting to use “other people’s money to pay for the” project.

With all due respect to Weil, I don’t think he fully understands sale-leaseback deals like the one he referenced. I covered this topic in another

Wide Moat Daily article, showing how this type of transaction actually has quite the track record of success when handled by the right parties.

REITs like W.P. Carey pioneered this type of structured finance back in the early 1970s. And it’s still serving them well today.

So while Meta will indeed keep the asset off its balance sheet in the partnership, Blue Owl will benefit from the property’s income and depreciation by dealing with that expense.

More Blue Owl Details to Know About

The biggest reason Blue Owl is trading cheaply – and it is – has nothing to do with its real estate business. Investors are much more spooked by its private credit division, which has seen defaults from auto-parts supplier First Brands and subprime lender Tricolor.

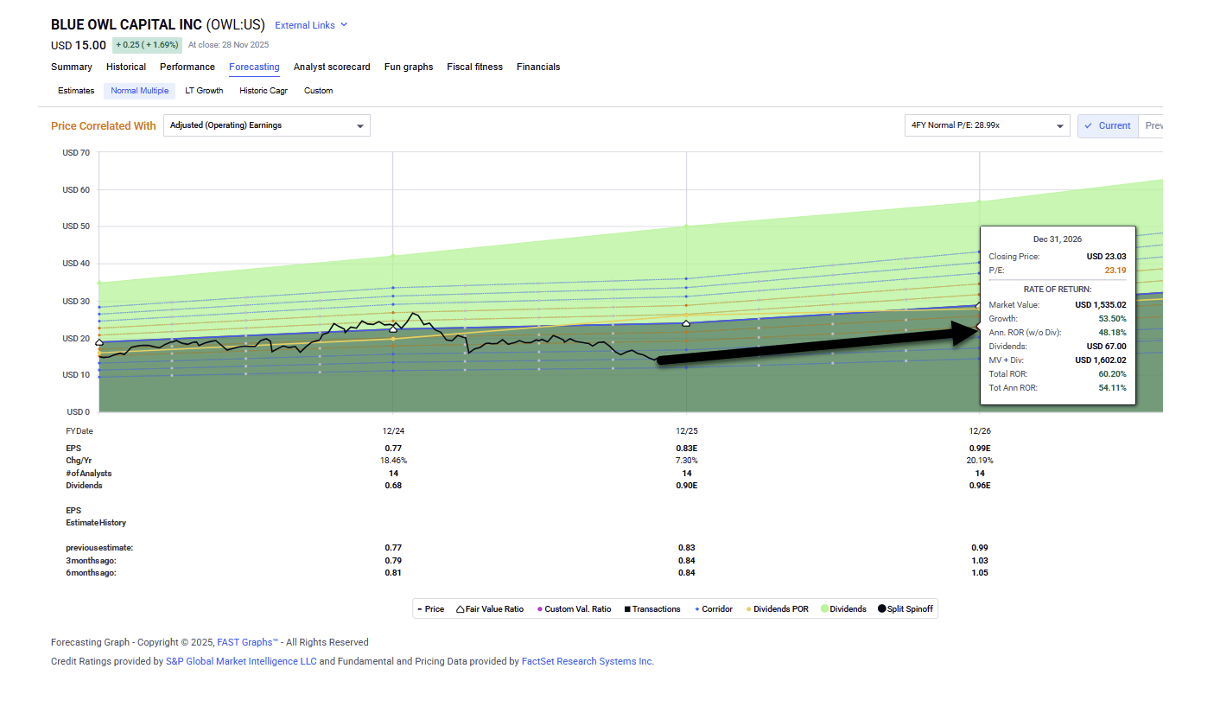

Even with those hits, however, I can’t see any reason why a company with Blue Owl’s “almost infinite” pipeline to trade at 18.3 times price to earnings (P/E) against its normal multiple of 29 times. To put it in further perspective, consider its larger peers’ valuations:

- Blackstone (BX) at 27.9 times

- KKR (KKR) at 24.1 times

- Brookfield (BN) at 19.6 times

As co-CEO Lipschultz explained in Barron’s, “We aren’t being valued like a company with a 20% growth rate, a durable business, and a high dividend.”

Speaking of dividends, Blue Owl has a mouthwatering 6% yield compared with Blackstone, which yields just 3.2%. And there’s a wide margin of safety here, as illustrated below.

Source: FAST Graphs

Source: FAST Graphs

The top five tech giants, like Meta, are all hyperscalers in the data-center world. They currently account for more than a third of all S&P 500 capital expenditures.

And Blue Owl is busy partnering with them. So, it only makes sense that analysts expect Blue Owl to grow 20% in both 2026 and 2027.

My conservative estimate is that shares will return 50% over the next 12 months. This would represent a 23 times multiple at year’s end 2026, plus 20% growth and a boost from its 6% dividend.

Source: FAST Graphs

Source: FAST Graphs

Mr. Market might not give a hoot about Blue Owl. But I do. And I expect Blue Owl to do well as the AI obsession continues into next year.

Regards,

Brad Thomas

The legendary stockpicker who built one of Wall Street's most popular buying indicators just announced the #1 stock to buy for 2026. His last recommendations shot up 100% and 160%. Now for a limited time, he's sharing this new recommendation live on-camera, completely free of charge. It's not NVDA, AMZN, TSLA, or any stock you'd likely recognize. Click here for the name and ticker.

Source: Wide Moat Research