After an impressive stock market debut earlier this year, shares of CoreWeave (CRWV) went on a parabolic ride upward thanks to enthusiasm for the company’s outstanding growth. However, the past three months have been difficult ones for investors as the stock has slipped 39% since hitting a high on June 20.

Artificial intelligence (AI) played a central role in giving CoreWeave’s business and stock price a boost since its initial public offering. But concerns about the company’s ballooning debt have weighed on the stock in recent months.

Investors should remember that CoreWeave operates in the lucrative cloud AI infrastructure market that’s set to grow at an incredible pace in the long run. Does this mean they have an opportunity to buy a potential long-term winner at a relatively attractive valuation following its recent slide? Let’s find out.

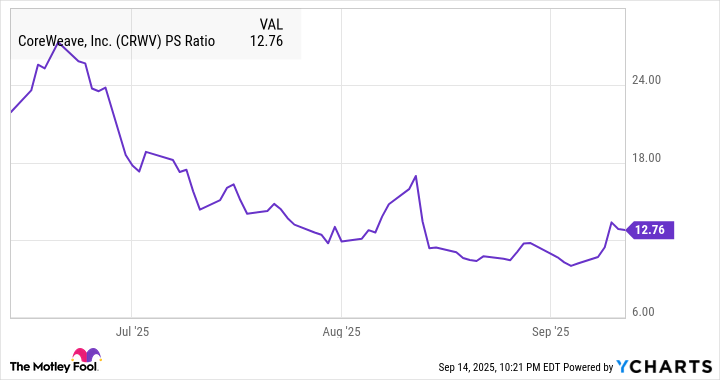

CoreWeave stock now trades at a significantly cheaper multiple

The recent slide brought the stock’s price-to-sales ratio (P/S) to 13. While that represents a premium to the U.S. technology sector’s average P/S of 8.8, it is half the peak it hit nearly three months ago.

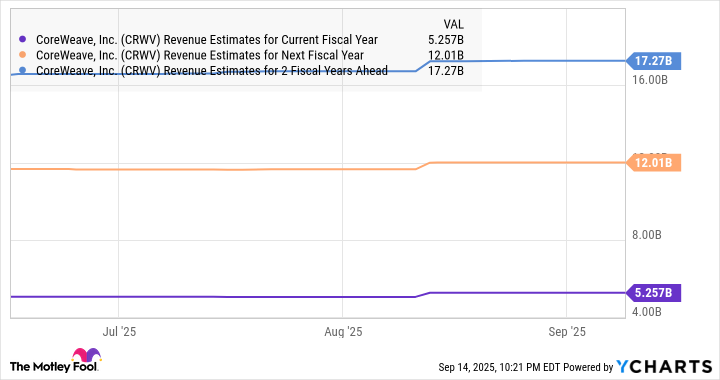

Also, the premium CoreWeave trades at right now seems justified based on its outstanding revenue growth. Its top line more than tripled year over year in the second quarter to just over $1.2 billion. The company projects $5.25 billion in revenue in 2025 at the midpoint of its guidance range. That would be a nearly 2.8x jump over the $1.9 billion in sales from last year.

Also, the premium CoreWeave trades at right now seems justified based on its outstanding revenue growth. Its top line more than tripled year over year in the second quarter to just over $1.2 billion. The company projects $5.25 billion in revenue in 2025 at the midpoint of its guidance range. That would be a nearly 2.8x jump over the $1.9 billion in sales from last year.

And analysts believe that CoreWeave could more than double its revenue in 2026, followed by another significant spike in 2027.

This potential justifies its sales multiple because its market cap could increase significantly from the current $55 billion if it can achieve $17 billion in sales after a couple of years while trading in line with the U.S. technology sector’s average multiple.

This potential justifies its sales multiple because its market cap could increase significantly from the current $55 billion if it can achieve $17 billion in sales after a couple of years while trading in line with the U.S. technology sector’s average multiple.

But investors may be wondering if it is worth buying the stock considering the company’s rising debt.

Here’s why you should consider looking beyond the debt

CoreWeave operates AI data centers and rents out its capacity to companies looking to build, deploy, and run AI models and applications in the cloud. The demand for this cloud-based AI infrastructure-as-a-service business model is phenomenal right now because it means companies don’t need to invest in expensive hardware and incur costs related to operating the infrastructure.

They can simply go to cloud AI infrastructure providers, such as CoreWeave, which purchase expensive hardware such as graphics processing units.

They can simply go to cloud AI infrastructure providers, such as CoreWeave, which purchase expensive hardware such as graphics processing units.

That means it needs to invest heavily in infrastructure to meet the demand for AI services in the cloud. This is why it has debt of more than $14.5 billion, which significantly exceeds its cash position of $1.1 billion. This high level of debt means that it has to bear significant interest costs as well. And the company is expected to take on more debt as it races to build enough capacity to satisfy its huge contractual backlog.

But that backlog stands at $30.1 billion, up by $14 billion from the previous quarter, substantially outpacing the growth in its revenue. And half of that huge backlog is set to be recognized as revenue in the next 24 months, suggesting that CoreWeave’s top line is on track to accelerate significantly.

That’s why it’s important for management to shore up capacity. And the contract backlog is likely to head higher since the AI-centric cloud infrastructure market is expected to generate $400 billion in revenue by 2028. So the company could be landing bigger contracts, just like the $15.9 billion deal it has signed with OpenAI this year.

This means the company’s potential revenue is far greater than the debt it currently has on its books. And the lucrative opportunity in the cloud infrastructure market is likely to help CoreWeave substantially accelerate revenue growth beyond the next couple of years, which may be sufficient to cover its debt and associated interest expenses.

That’s why savvy investors can consider using the recent slide in CoreWeave’s shares to buy this AI stock. The multibillion-dollar contracts being awarded for cloud infrastructure are going to be a long-term tailwind for the company.

— Harsh Chauhan

Where to Invest $99 [sponsor]Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: The Motley Fool