Global markets continue to grapple with uncertainty as geopolitical tensions and monetary policy decisions collide.

U.S. stock futures are seeing a slight uptick, with S&P 500 contracts rising modestly as investors monitor the possibility of more direct U.S. military involvement in the Middle East conflict. President Trump is calling for Iran’s “unconditional surrender” and warning “U.S. patience is wearing thin.”

The ongoing clashes between Israel and Iran, now in their sixth day, have intensified market volatility, driving Wall Street’s fear index past a critical level. Trump left the G7 meeting in Canada early to deal with the escalating crisis, but said he is not calling for the assassination of Iran’s Supreme Leader Ayatollah Ali Khamenei, “at least not for now,” heightening tensions further.

Oil prices, hovering around $76 per barrel, remain unstable due to fears of supply disruptions while U.S. Treasuries hold steady and the dollar weakens after a recent surge.

Attention is also fixed on the Federal Reserve’s upcoming policy announcement, with markets expecting rates to remain unchanged for now, though hints of future cuts are likely. Investors anticipate gradual rate reductions later this year, shaped by challenges like fluctuating energy prices, geopolitical risks, and fiscal pressures.

The Fed must carefully navigate these complex dynamics, waiting to see how they evolve before setting a clear path. Markets are highly sensitive to both policy signals and global events, creating an environment where investors must stay alert and adaptable to manage risks effectively.

Navigating Market Turmoil: Why Tech Shines

The Middle East conflict, while escalating, appears priced in by markets as a short-term issue, diminishing the allure of oil and defense stocks. Brent crude, despite a 10% rally, lingers around $76 per barrel, far from the $120 levels many feared, signaling limited concern of supply disruptions.

The S&P 500’s near-record highs and a VIX above 20 reflect volatility, but not widespread panic, suggesting investors anticipate any geopolitical fallout will be contained. Oil and defense sectors, often tied to prolonged conflicts, face uncertainty if tensions ease, making them less appealing compared to sectors with consistent growth potential, like technology.

Tech’s Resilience in Volatile Times

The tech sector offers stability and long-term upside amid uncertainty. Companies with recurring revenue models, such as software-as-a-service (SaaS), generate steady cash flows and innovation-driven growth, largely insulated from geopolitical shocks.

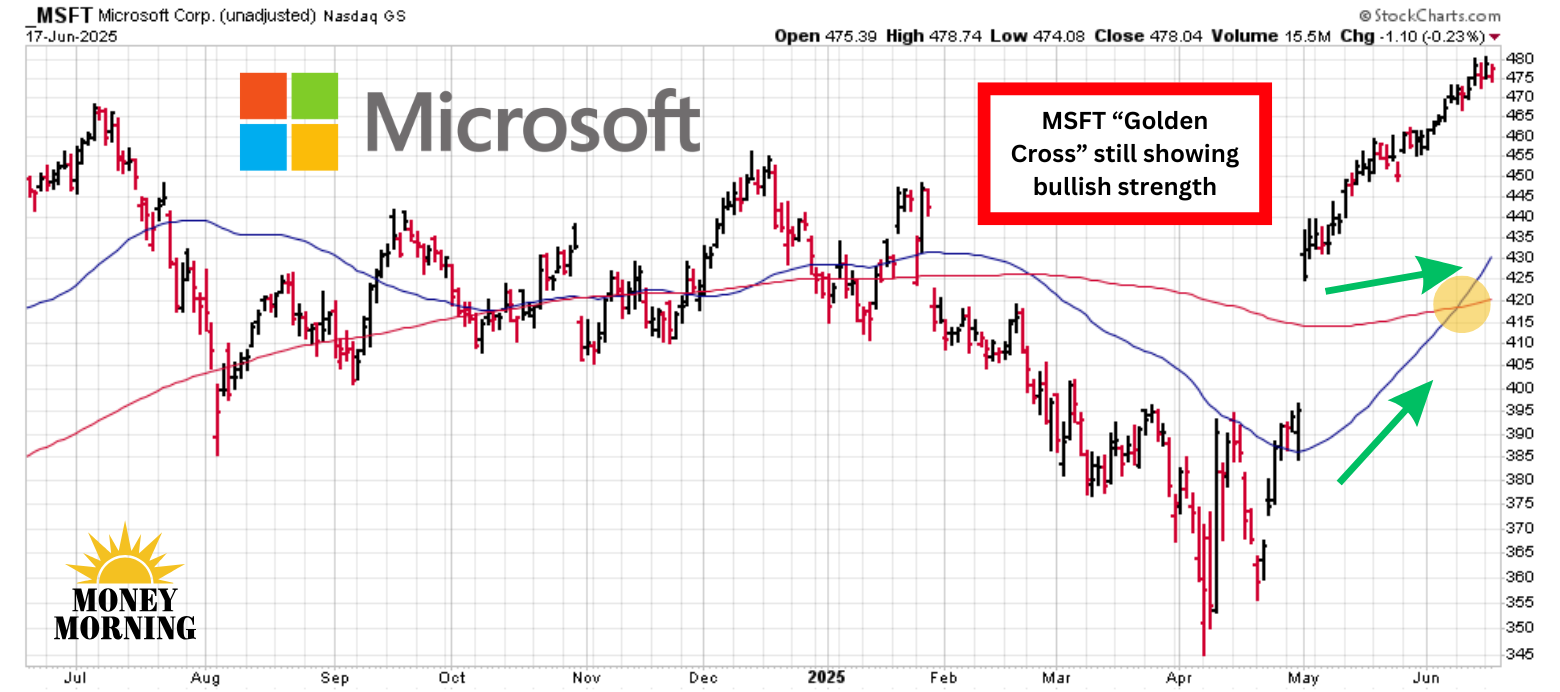

Microsoft (MSFT) emerges as the standout tech stock to navigate this environment. Its diversified portfolio – spanning cloud computing (Azure), productivity tools (Microsoft 365), and AI integration – positions it to capitalize on digital transformation. Azure’s 31% year-over-year growth, fueled by AI services, underscores its dominance in cloud infrastructure, a vital foundation for global businesses.

Microsoft’s AI Ambitions and OpenAI Tensions

Microsoft’s $80 billion investment in AI-enabled data centers in 2025 ensures it meets surging demand, reinforcing its competitive edge. However, its partnership with OpenAI, backed by nearly $14 billion, faces strain.

Reports indicate OpenAI’s frustration with Microsoft’s control over its products and compute resources, with talks of antitrust concerns. MSFT is scaling back some data center projects amid AI infrastructure oversupply adds complexity.

Both sides express confidence in their ongoing collaboration, but a fractured relationship could limit Microsoft’s access to cutting-edge AI models like ChatGPT, potentially slowing innovation in products like Copilot.

Why Microsoft Remains the Top Pick

Why Microsoft Remains the Top Pick

Despite these risks, MSFT is the best tech stock to buy. Its diversified revenue streams, including LinkedIn, Xbox, and Activision Blizzard, mitigate AI-specific concerns. MSFT just announced a multi-year deal with Advanced Micro Devices (AMD) to develop custom chips for the next generation of Xbox systems.

With a forward P/E ratio of 35, slightly elevated compared to its five-year median, but with a strong balance sheet showing almost twice as much cash ($79 billion) than debt ($40 billion), MFST offers value and stability. Its leadership in AI, cloud growth, and resilience to geopolitical volatility make it the compelling stock choice for investors navigating today’s market.

— Rich Duprey

Out of 23,281 Stocks... Only ONE is This Profitable and Undervalued. [sponsor]$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.

Source: Money Morning