Added to the Zacks Rank #1 (Strong Buy) list this week, Stride (LRN) stock is standing out near its 52-week high of over $140 a share. As one of the stock market’s top performers, Stride stock has soared more than +30% in 2025, and the eye-catching performance could continue thanks to a pleasant trend of postivive earnings estimate revisions.

The premier provider of K-12 education curriculum has benefited from strong enrollment growth, while online learning platforms such as Chegg (CHGG) struggle with declining subscriber numbers amid a disruption from AI-powered tools that provide students with free or low-cost academic assistance.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Stride’s Strong Enrollment Growth

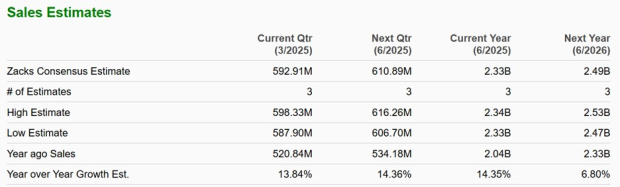

Adding to Stride’s strong enrollment growth is the company’s career learning programs for middle and high school curricula and professional skills training for adult learners. This has led to a sharp uptick in revenue, with Stride’s total sales expected to increase 14% in fiscal 2025 and projected to spike another 7% in FY26 to $2.49 billion. Furthermore, FY26 sales projections would reflect 139% growth since the pandemic, with 2020 sales at $1.04 billion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

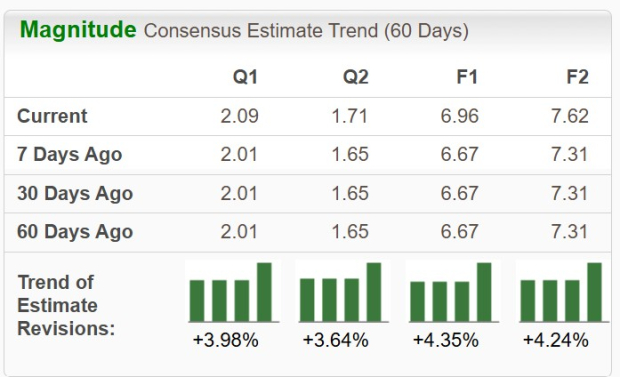

Stride’s Positive EPS Revisions

Bolstering Stride’s increased probability is that FY25 and FY26 EPS estimates have increased over 4% in the last 60 days, respectively. Stride’s annual earnings are now slated to soar 48% this year to $6.96 per share versus EPS of $4.69 in 2024. Plus, FY26 EPS is projected to rise another 9% to $7.62.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

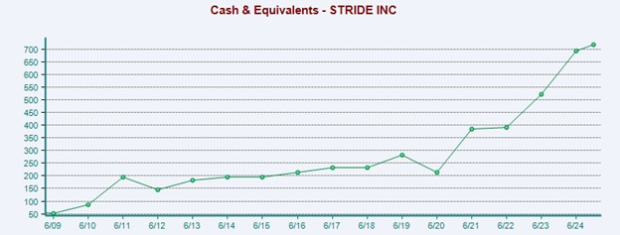

Stride’s Improved Balance Sheet

Capitalizing on its expansion, Stride’s cash on hand has ballooned to $692 million from $212 million in 2020. More reassuring is that Stride has $1.92 billion in total assets compared to $744 million in total liabilities.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

LRN Valuation Comparison

Despite such an extended rally in recent years, Stride stock still trades at a reasonable 20.6X forward earnings multiple.

Trading roughly on par with the benchmark S&P 500, Stride is at a slight premium to its Zacks Schools Industry average of 15.3X forward earnings but has been a clear leader in the space with some noteworthy peers being Adtalem Global Education (ATGE) , American Public Education (APEI) , and Universal Technical Institute (UTI) .

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Generating strong cash flow, it’s also noteworthy that Stride’s cash flow per share (CFPS) ratio of 8X towers over the industry average of 0.4X and edges the benchmark’s 6.1X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Stride is one of the most appealing stocks to consider in the consumer discretionary sector, and it would be no surprise if higher highs are in store for LRN shares. That said, now may be an ideal time to buy with Stride stock checking an overall “A” VGM Zacks Style Scores grade for Value, Growth, and Momentum.

— Shaun Pruitt

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks