Few technology stocks avoided the tech-driven selloff to start 2025. The ones that have are worth paying close attention to as the stock market tanks following the release of Trump’s reciprocal tariff plans.

The U.S. and global economies are likely headed for extreme volatility in the near term. The next several weeks could be brutal for stocks if panic takes hold and Wall Street goes deeper into risk-off mode.

Despite Thursday’s tumble, the S&P 500 is up almost 40% in the past two years and 110% in the last five. A major selloff was due, and another big drop in the coming weeks could mark the start of a strong buying opportunity for long-term investors.

No tech companies will be immune from trade levies altogether in a globally integrated economy.

Instead of moving to the sidelines (which can have devastating negative impacts on your long-term performance, since calling a bottom in real time is next to impossible), investors should buy best-in-class stocks that will be impacted by tariffs less than the broader tech sector.

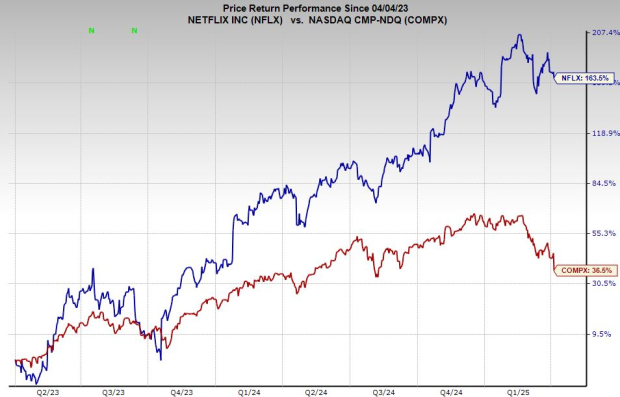

Streaming entertainment and technology standout Netflix (NFLX) has edged 3% higher year-to-date, compared to the Nasdaq’s 14% slide. NFLX’s 50% climb over the last year is even more impressive, since it wasn’t fueled by artificial intelligence hype.

Buy Netflix Stock as the Magnificent 7 Tumble on Tariff Fears

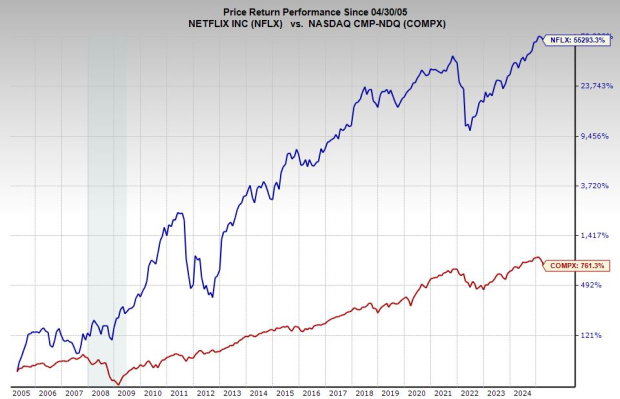

Netflix was one of the standout technology stocks of the 2010s, as Wall Street dove headfirst into the company that forever changed entertainment and Hollywood. NFLX stock crushed almost all of the biggest technology companies over the past 20 years, and it is even neck-and-neck with Nvidia during that stretch.

Netflix’s first-mover advantage, coupled with its big push into original content, helped it stay at the top of a growing pile of streaming TV companies that includes Disney, Apple, and Amazon.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Netflix’s expansion into live sports (deals with the NFL, WWE, and boxing), reality TV, blockbuster movies, and more has helped it retain and gain subscribers. Netflix has also been wildly successful in launching reality TV content, and it is in the early stages of video game content.

The streaming company’s successful pivot toward profitable growth helped Netflix stock roar back to life from its 2022 lows, outclimbing all of the Magnificent 7 stocks in the last three years except Nvidia.

Netflix rolled out a lower-cost, ad-supported subscription plan in the fall of 2022. Netflix’s ad tier accounted for more than 55% of Q4 sign-ups in countries where it was available. The company added 18.9 million paid subscriptions in the final quarter of 2024, nearly doubling projections.

Better yet, Netflix said it was the “biggest quarter of net adds in our history,” blowing away the second-place record of 13 million from Q4 FY23.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

It closed 2024 with 301.63 million global streaming paid memberships, up 16% year-over-year. Netflix is successfully differentiating itself from a pricing standpoint, with its $7.99 per month ad-based plan coming in lower than Disney’s $9.99 ad-supported plan and solidly below its various bundling options with Hulu and Max.

Diving into Netflix’s Other Impressive Fundamentals

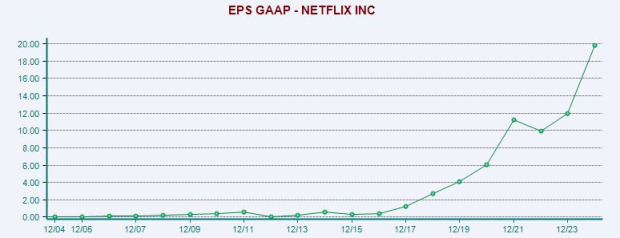

The streaming powerhouse grew its revenue by 16% in 2024 to $39 billion. Netflix’s top-line growth might never return to its pre-COVID levels, but its recent growth marks a return to solid double-digit expansion following back-to-back years of 7% sales growth in FY22 and FY23.

It is projected to grow its revenue by an average of 13% in 2025 and 2026, reaching roughly $50 billion in FY26, doubling its 2020 total.

NFLX is projected to grow its earnings by 24% in 2025 and 21% in FY26, reaching $29.66 per share, following 65% year-over-year expansion last year. Netflix’s price hikes, streaming efforts, and more are set to help it roughly quintuple its GAAP earnings compared to 2020.

The entertainment powerhouse has improved its balance sheet, and its board authorized an additional $15 billion stock buyback program.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Netflix shares have soared 1,300% in the last 10 years, blowing away the Nasdaq’s 230% and every Magnificent 7 stock except Nvidia (NVDA) . The stock has skyrocketed 55,000% in the past 20 years, matching NVDA.

NFLX has jumped 130% in the past three years, outclimbing the Nasdaq’s 14%. NFLX is up 165% in the past two years, compared to the Nasdaq’s 35%, and 48% in the past year, compared to the index’s 3%.

The streamer’s recent outperformance stems from the fact that its growth outlook isn’t based on a speculative AI revolution, and it doesn’t involve hundreds of billions in capex.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

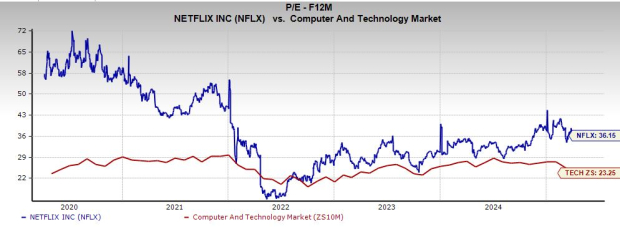

Valuation-wise, Netflix trades at over a 90% discount to its 10-year highs (50% below its five-year highs) and at a 38% discount to its 10-year median at 36.2x forward earnings. NFLX’s price-to-earnings-to-growth (PEG) ratio of 1.8 is near Tech’s 1.5, even though Netflix has crushed the sector.

NFLX is holding its ground at its 21-week moving average and near some of its pre-Q4 release breakout levels.

Now might be the time for investors looking to stay exposed to the stock market amid tariff worries to buy Netflix.

Simply put, at-home entertainment is something most people will keep spending on during good times and bad. Netflix is not as exposed to tariffs as its big tech peers. On top of that, it could be due for a stock split.

— Benjamin Rains

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks