The last two weeks have seen a surge in activity with a few utility companies with nuclear-related stocks as Microsoft (MSFT) and Google (GOOGL) broke the seal on tapping nuclear power to help solve AI’s growing energy needs.

Amazon (AMZN) joined the other Magnificent Seven companies, announcing that the company would be working with Dominion Energy (D) to develop small modular reactors.

Shares of Dominion are trading 3% higher for the day on the news – Amazon shares are trading 1% lower – but the market is jumping all over two stocks that we talked about almost exactly one month ago.

It’s time to check in on their performance and outlook.

One Stock is 30% Higher After Amazon’s Announcement

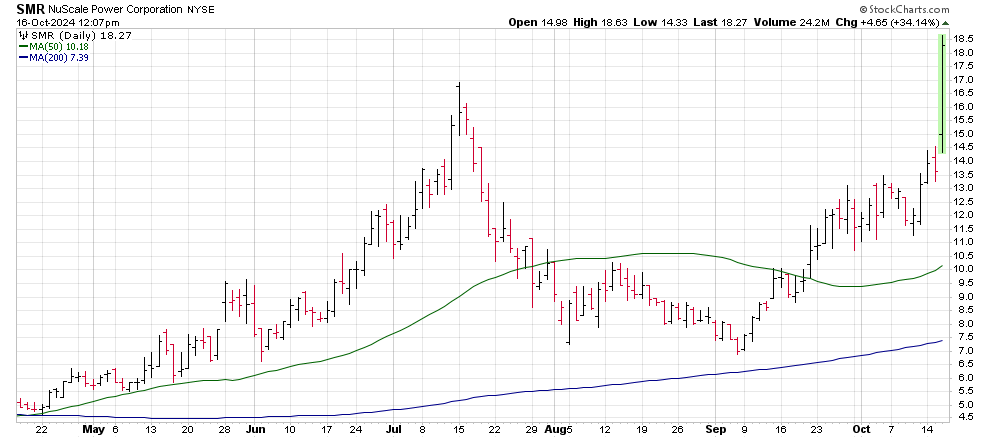

Those three words, Small Modular Reactors, that’s the thing that’s got Wall Street’s attention today and it’s the reason that shares of NuScale Power Corporation (SMR) are trading 34% higher.

NuScale Power Corporation is a leader in small modular reactor (SMR) technology.

The company was established in 2007, and designs and sells modular light water reactor nuclear power plants aimed at a variety of applications.

Electrical generation, district heating, and desalination and the top uses, but the two letters AI may be ready to take a lead role.

NuScale’s “Power Module” can produce 77 megawatts of electricity, with their larger VOYGR power plant designs offering scalable configurations that can accommodate multiple modules to meet diverse energy needs including AI applications.

NuScale is a of Fluor Enterprises, Inc., a Texas based engineering company that is well known for their work with industrial infrastructure.

NuScale’s ticker symbol is appropriately “SMR”

What the Market is Saying

The market is embracing the idea of nuclear-powered AI, note that I said “the market”

We’re seeing a heavy increase in interest of reviving the nuclear energy industry, but this is a movement that will take years to just get through regulatory review and approval.

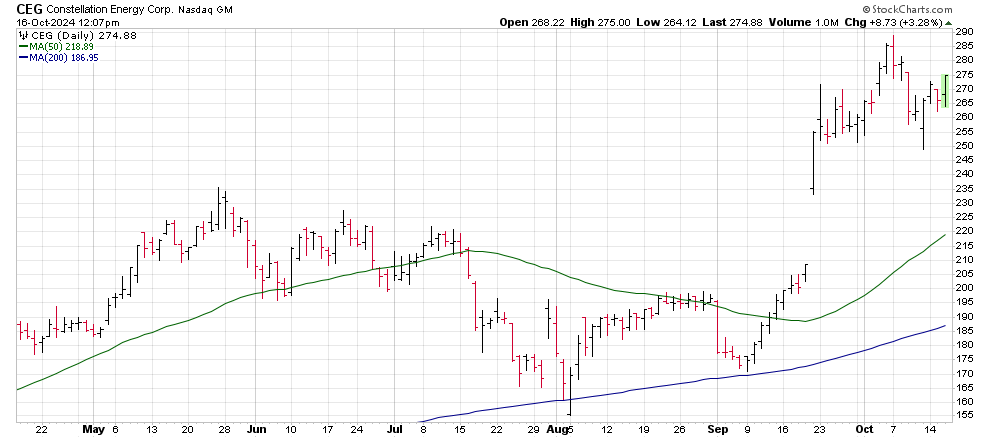

Microsoft’s announcement a few weeks ago to partner with Constellation Energy (CEG) resulted in a 30% rally over the following two weeks. That plan includes restarting one of the facilities at the storied Three Mile Island site.

But the market is clearly favoring the approach of companies partnering with small modular reactor developers as the real future of the industry.

But the market is clearly favoring the approach of companies partnering with small modular reactor developers as the real future of the industry.

The road will be longer in terms of fully developing products specifically for the AI industry and data centers, along with their approval. But the possibility opens much wider in the market after that point.

Investors that are looking at the “horizon” see SMR technology that can be dropped in data centers as needed, where needed.

What Happens from Here

Two stocks remain high on the list here with more to surely come.

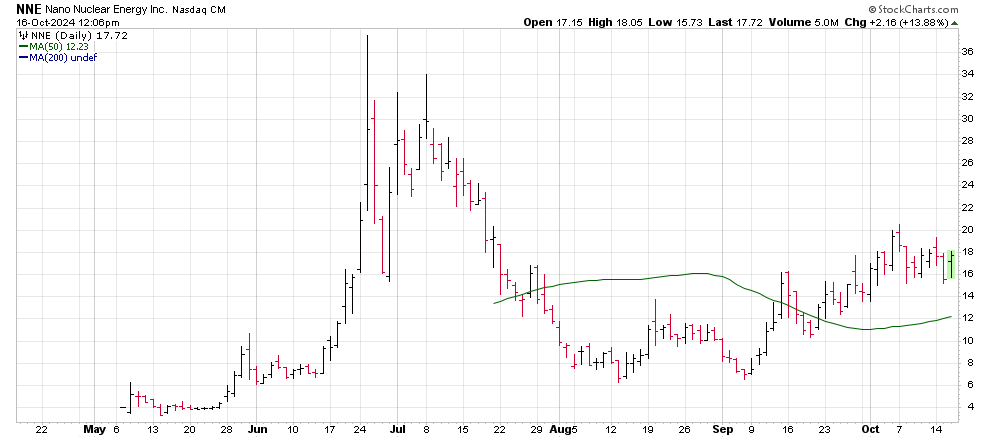

NuScale Power Corp (SMR) and Nano Nuclear Energy (NNE) are two of the developmental companies that are going to be attracting long-term investor’s attention.

A Closer Look at NuScale

A Closer Look at NuScale

Nuscale shares are trading more than 450% higher year-to-date. The stock is only 250% higher over the last 12 months.

Investors that are paying attention to that will know that SMR shares had a rough fourth quarter in 2023. The stock lost 67% from October 2023 through February 2024.

My point is that these stocks are volatile, which is part of any developmental company.

NuScale went through layoffs and other cost-cutting to curb losses last year. A move that is paying off in 2024 and is likely to improve as we head into 2025.

Shares just posted new all-time highs with [Wednesday’s] rally and average volume is on the rise.

The stock just broke out of the sub-$10 price range which means that the analyst and institutional trading world is going to start taking more notice. Currently, only 40% of the stock is held by institutions, look for that to change over the next six months.

[Wednesday’s] surge is likely to turn to short-term profit-taking, which will allow prices of SMR to drop, but investors shouldn’t expect to pick this rising start up for less than $10 unless something goes dramatically wrong.

How to Trade it

Buy and hold is the name of the game with the SMR companies, at least from most investors’ perspective.

These stocks will rage with volatility over time and then begin to smooth out as the first wave of speculators settle in for a long-term ride.

The stock is optionable, which opens opportunities for those looking to leverage long-term moves with a LEAPs strategy, but remember that volatility means higher option prices.

Those investors that are more advanced could choose to sell put options with the intention of having the stock assigned to them as a long-term hold strategy.

In other words, there are all kinds of options– no pun intended – for long-term investors in NuScale Power.

Over the short-term, expect [Wednesday’s] swell in price to give way to the $15 price level which is likely to be met with technical buying to drive the stock towards $20 over the short-term.

— Chris Johnson

— Chris Johnson

$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.

Source: Money Morning