JD.com, Inc. (JD) , the Chinese online retail and supply chain giant, is dirt cheap. This Zacks Rank #1 (Strong Buy) has plunged to 5-year lows but earnings are expected to rise by the double digits this year.

JD.com is a Chinese supply chain-based technology and service provider. It seeks to enable consumers to buy whatever they want, whenever and wherever they want it.

$5 Billion Share Repurchase Plan Announced

How cheap are JD.com shares? So cheap that on Aug 27, 2024, JD.com announced a new share repurchase program effective as of Sep 2024.

The company can repurchase up to $5 billion in shares over the next 36 months, or through the end of Aug 2027.

Another Earnings Beat for JD.com in the Second Quarter

On Aug 15, 2024, JD.com reported its second quarter earnings results and beat on the Zacks Consensus by $0.43. Earnings were $1.29 versus the consensus of $0.86.

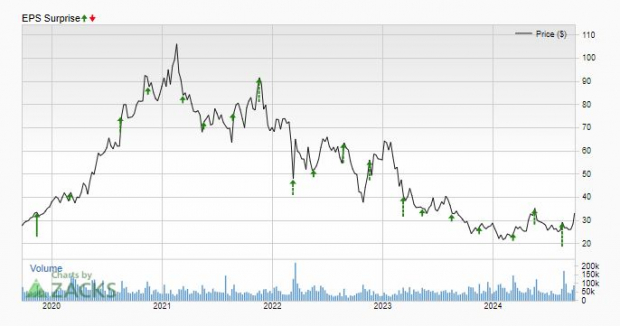

It has an impressive earnings surprise track record, having beaten every quarter for 5 years. That includes the difficult quarters during the pandemic when global economies were shut.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Revenues were up just 1.2% to $40.1 billion year-over-year, however, as electronics and home appliances cooled from a year ago but the general merchandise category, especially supermarket, remained strong.

Gross margin rose 137 bps to 15.8%.

Analysts Still Bullish on JD.com

Investors may be bearish on the company, but the analysts are not.

2 earnings estimates were revised higher for 2024 in the last 60 days which pushed the Zacks Consensus Estimate up to $3.97 from $3.40. JD.com made just $3.12 in 2023, so that is earnings growth of 27.2%.

Similarly, 2 estimates were also revised higher for 2025 in the last 2 months. The Zacks Consensus jumped to $4.15 from $3.64, which is further earnings growth of 4.5%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

JD.com is Dirt Cheap

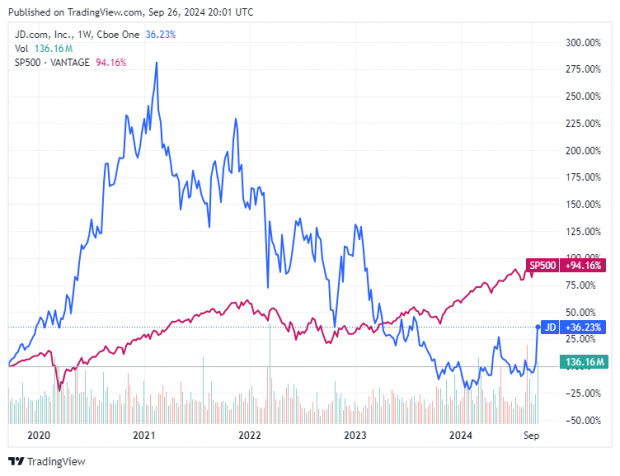

Shares of JD.com have been falling the past few years and hit a 5-year low earlier in 2024. They have since spiked higher after the Chinese central bank, the PBOC, cut interest rates and injected more liquidity into both the stock market and the economy to provide a boost to the sluggish economy.

Shares are still underperforming the S&P 500 over the last 5-years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock remains dirt cheap, even with the recent spike in the shares. It has all the hallmarks of a classic value stock including a price-to-earnings (P/E) ratio under 10 at just 8.4.

It has a PEG ratio of just 0.5. A PEG ratio under 1.0 indicates a company has both growth and value.

JD.com also has a cheap price-to-sales (P/S) ratio of just 0.3. A P/S ratio under 1.0 means an investor is buying the sales at a discount. In this case, a JD.com shareholder is getting $1.00 of sales for just $0.30.

In addition to the share repurchase program, JD.com also pays a dividend, yielding 2.2%.

For investors looking to invest in the hoped-for Chinese economic rebound in 2025, e-commerce industry leader, JD.com, should be on your short list.

— Tracey Ryniec

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks