Traders rejoiced on Wednesday after the Federal Reserve event ended. Fed chair Jerome Powell delivered their decision pertaining to their monetary policies. The new was bad as they expressed as extra hawkish. Yet equity markets rallied ferociously as if he had restarted the quantitative easing.

Meanwhile, we are in full swing of an earnings season. This is the time to search for potential diamonds in the waste bin. Today we seek to find travel stocks to buy that investors erroneously punished after their reports.

The rally was most likely a relief rally that the potentially scary event is no longer ahead. Regardless why it happened, it will help our three travel stocks recover footing faster. The idea is to identify tickers that have quality or technical support, against which we can lean. Having both would be ideal, as it would raise my level of conviction a few notches.

The rally after the Fed event was substantial. The indices flipped from red in the morning to bright green as the day progressed. Going into the close the S&P 500 had risen 3%. Even though I am sharing ideas of stocks to buy on dips, I caution against blindly chasing upside potential. The indices will need to first prove sustainability before counting on new highs. Rallies have not been the problem, but it’s the follow through where disappointment shines.

Unlike most experts, I still think markets can make new highs this year. So, I am willing to look for stocks to buy on dips. The earnings reaction is where the investors make the easy mistakes. The reactions to those is highly emotional. If the indices do well, these three travel stocks can also have upside potential and more just to catch up.

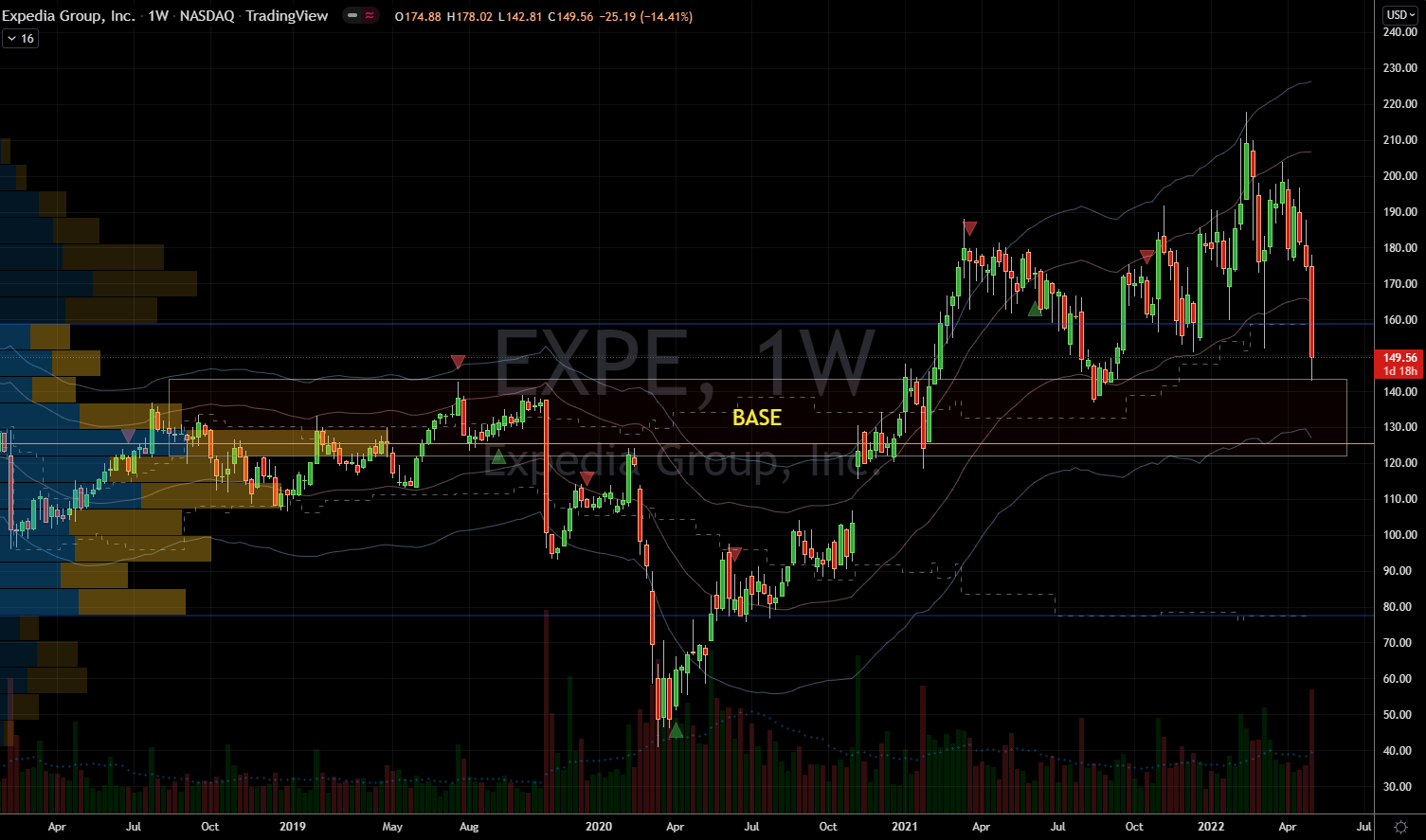

Travel Stocks to Buy: Expedia (EXPE)

Source: Charts by TradingView

Source: Charts by TradingView

Expedia (NASDAQ:EXPE) stock doesn’t always follow the indices too well. Maybe the effects of the lockdown still haven’t worn off. Travel and leisure business took it hardest on the chin since their entire earnings powers comes from crowds. For example, EXPE stock most hardest bounce came last summer. At that time, the indices were busy breaking records.

Today my thesis for adding EXPE to the list of stocks to buy relies on that August low. This week management reported earnings but Wall Street hated it. The stock fell 20% as investors threw a fit. Clearly this was more to do with emotions than quality of results. Expedia almost doubled its sales and cut its losses drastically. Since the business is improving and EXPE is near support, I would prefer to buy it. While there isn’t a P/E to mention, its 2.8 price-to-sales is modest enough to not show bloat.

Lyft (LYFT)

Source: Charts by TradingView

Source: Charts by TradingView

Our first of the travel stocks to buy deals with facilitating peoples’ travel. Our second, Lyft (NASDAQ:LYFT), actually moves them. Therefore, its fundamentals are still suffering from the pandemic disruption. This, however, did not give investors consolation, so they sold it down 30% on Wednesday. The move came from their disappointment over the LYFT earnings. The report wasn’t nearly as horrific as the stock price action was.

This again had more to do with over-exuberant expectations and a tantrum. The fear came from potential labor costs, so an analyst downgraded it in panic. In all honesty, those opinions don’t matter much especially when they are reacting in hindsight. The stock is now trading 60% below their average price target. In reality, Lyft’s business did not suddenly collapse. The market will come back to it and soon.

My bet is that as it nears its lifetime lows, it will find buyers. At the close Wednesday, LYFT stock was falling into levels that served for two hard bounces. In October 2020, the stock rallied 227% from $20. And before that, Lyft rallied 95% from the pandemic abyss. The financial metrics are still a bit murky, but the price-to-sales suggests that investors now have realistic expectations.

Airbnb (ABNB)

Source: Charts by TradingView

Source: Charts by TradingView

Airbnb (NASDAQ:ABNB) stock did not have the privilege to trade during the onset of the pandemic. ABNB came to market late 2020, and it set its all-time low within a week. Investors then piled in and drove it up 66%. Sadly, they gave it all up by May, but then they bounced hard once more.

ABNB fans have proved they are serious buyers below $140. This week, the bears are testing that resolve. My bet is that the bulls will prevail again, especially if markets hold up. Other than the 2020 profit-and-loss disruption, Airbnb growth remains impressive. Last year’s revenues were 60% larger than 2018. While its price-to-sales is a bit high, at least the company created $2.2 billion of cash from operations.

The company is fueling the growth with funds it generates. This is an important nuance in a rapidly rising-rate environment. Borrowing to grow may not be easy next year. Airbnb won’t be suffer too much from this, so investors could do well betting on upside this year.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place