Roku (NASDAQ:ROKU) stock is a high-quality, high-growth company. However, because it’s in the latter category — high growth — it has been hammered.

Despite the recent bounce off the lows, Roku stock remains almost 50% below its all-time high.

This one is particularly painful, as it rallied to new all-time highs earlier this summer after the bear market low in May.

Despite a few months of pain earlier in the year, longs thought they were free and clear. Not quite. That said, I am a proponent of accumulating these high-quality names on 40%-plus corrections.

We’ve seen it multiple times in Roku even as the stock has gone on to generate multi-fold returns. It’s also how many of the early days were for Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL) and others.

I like Roku for the long term for three simple reasons: It has secular growth in a secular growth industry, the platform revenue it contains to gain momentum and oversold breakdowns are a gift for long-term investors.

Streaming TV Is Only Going Up

It’s incredibly difficult to argue the trend in cord-cutting and streaming video. It can be seen in the statistics from AT&T’s (NYSE:T) HBO Max and Disney’s (NYSE:DIS) various platforms.

It can also be seen in the robust growth in connected TV advertising statistics, like what you’d hear from one of the few growth stocks not getting crushed — The Trade Desk (NASDAQ:TTD).

Or you could simply listen to the statistics from Roku.

Last quarter it generated 18 billion hours of streaming, up 21% year over year. Active accounts climbed too, up 23% year over year to 56.4 million customers.

That alone gives it to investors in a nutshell. But there are a few other things to point out, such as e-commerce. Streaming TV has only accelerated during the pandemic. That said, neither industry grew only as a result of the pandemic — they were already secular growth themes.

The pandemic accelerated the growth of streaming TV and while many providers have seen underwhelming results in the recent quarter — and the market has treated Roku that way, too — the numbers remain impressive.

In Q2 and Q3 2020, Roku had active accounts of 43 and 46 million, respectively. During the same periods, the company had 14.6 billion and 14.8 billion streaming hours, again, respectively.

Arguably, one would expect this to be “peak streaming,” as it was the two quarters with the most intense Covid-19 lockdowns and restrictions.

Despite a summer that was as close to normal as we’ve seen in two years though, the company still found ways to generate solid results (as noted above). Across the board, we’re seeing growth rates slow, but not reverse from the Covid catalyst. That’s great news for investors.

Roku Growth Projections

Admittedly, the rate of growth has slowed from the 2019 to 2020 period vs. the 2020 to 2021 period, but anyone who expected otherwise was simply too optimistic.

There’s no reasonable way that Roku could top its 2020growth numbers in 2021. That said, I still found the growth pretty impressive.

Can we talk about the fact that, despite account growth of “just” 23% last quarter, that Roku was able to generate average revenue per user (ARPU) growth of 49%?

Then there’s this: Platform revenue growth of 82%, total revenue growth of 51% and gross profit growth of 69%.

Analysts expect decelerating growth to continue, with revenue estimates calling for growth of 57% this year, 36% growth in 2022 and 32% growth in 2023, but friends, that’s what growth tends to do — it slows over time!

Let’s forget the idea that Roku could actually exceed these estimates, just as it has done in 16 of 17 quarters, with its lone sales miss coming in at less than $1 million. But even just in-line results will leave Roku with $5 billion in revenue in 2023.

If we get the same 10x current sales valuation we have now, we’re talking about a stock that’s trading at about $500 — just over the all-time high.

If that’s the case, we would be talking about a 130% stock gain in two years, plus or minus six months.

Thus far though, we have ignored the fact that Roku has become profitable or that its trailing gross margins are at a record 52.3%. Free cash flow is positive and growing quickly too, up 300% year over year.

Income from operations was up 475% year over year last quarter, too.

Trading Roku Stock

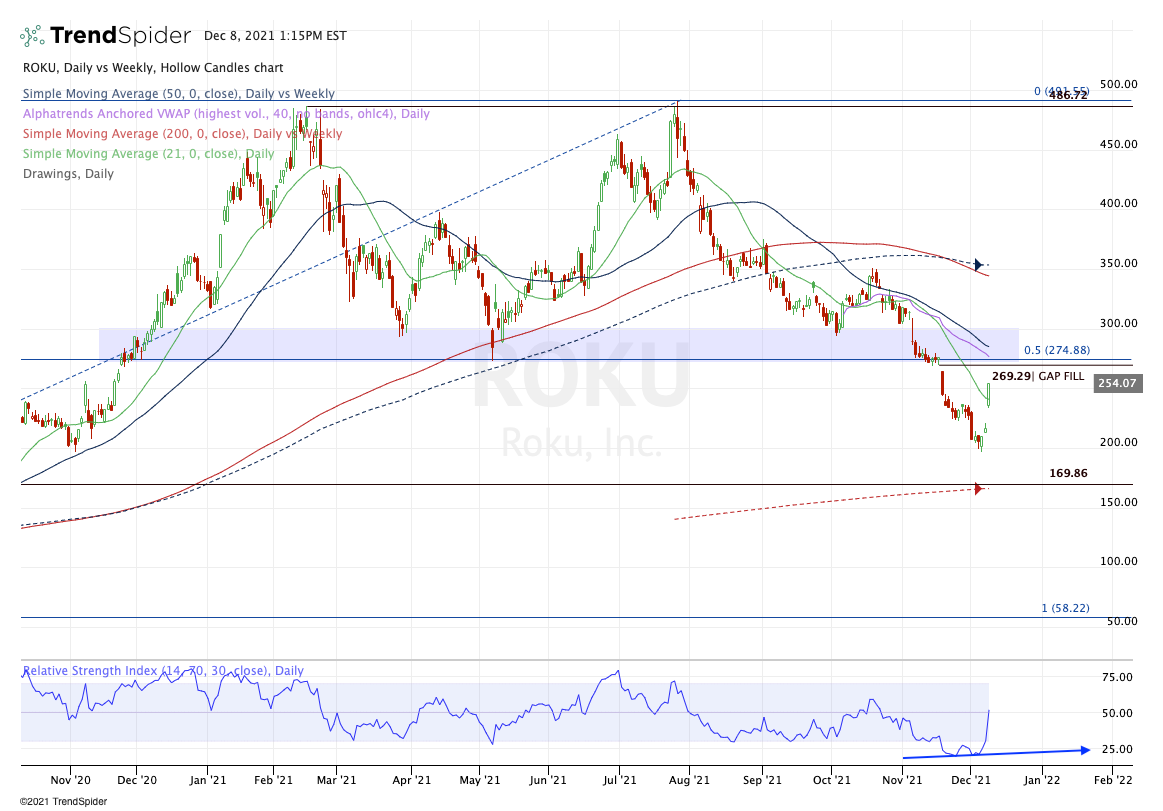

Source: Chart courtesy of TrendSpider

Source: Chart courtesy of TrendSpider

At $450-plus, maybe it would be hard to ignore some of Roku’s shortcomings, such as its valuation at that price or the potential risk from larger competitors. But down 59.5% at the lows, how much more pessimistic can we be?

The company is the leading streaming platform in a secular growth industry, which continues to grow its bottom line and is now focusing on international expansion.

Roku has also now come to a multi-year agreement with Alphabet’s (NASDAQ:GOOGL, NASDAQ:GOOG) YouTube.

Yes, there are things that can go wrong, but as the stock has been more than cut in half, I believe those risks are property discounted. That’s why I remain supportive of accumulating this stock on the dip.

— Bret Kenwell

The Guy Who Beat Buffett Shocks the World Again… [sponsor]The New York Times called him "an icon among growth stock investors." The Wall Street Journal said "Most money managers can only dream of having the same success" he's had. His investment fund produced a 4,000% return over a 15-year span, outperforming even the great Warren Buffett. His name is Louis Navellier. And he's just issued an astonishing financial prediction. Click here to see it.

Source: Investor Place