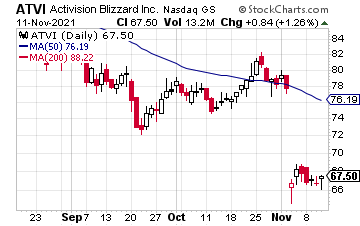

After Activision Blizzard’s (ATVI) share priced gapped from $77.50 to $67, the gaming stock is oversold on the relative strength index (RSI), moving average convergence divergence (MACD), and Williams’ %R momentum indicator. In fact, the last few times these indicators were this oversold, shares of ATVI pushed higher shortly after.

At the same time, it’s tough to ignore the concerns with ATVI.

At the same time, it’s tough to ignore the concerns with ATVI.

For one, the company caught the attention of the California Department of Fair Employment and Housing on accusations of a “frat boy workplace culture.”

Two, the company has announced the delay of both Overwatch 2 and Diablo IV, which caught investors off guard.

However, most of the chaos with ATVI may have been priced in.

As Baird analyst Colin Sebastian explained to Barron’s: “While shares will trade lower, embedding the push-out of revenues and earnings, compounding already frayed management credibility, we’d remind investors that it’s not unusual for Blizzard to delay new releases, and that other competing console/PC titles were pushed out at least a year.”

In addition Activision Blizzard just launched Call of Duty: Vanguard.

In addition Activision Blizzard just launched Call of Duty: Vanguard.

Video game sales were up to $28.9 billion for the first half of 2021, up 15% year over year.

Year to date, sales are now up to $42.3 billion, a 12% year-over-year jump.

For September 2021, sales hit a record $4.4 billion, a 3% year-over-year jump.

“Consumer spending on the video game segment continued to grow in the third quarter, driven by console hardware such as the PlayStation 5, Switch and Xbox Series, and the subscription and mobile content segments,” said Mat Piscatella, an analyst at NPD Group.

As we head into the 2022 holiday shopping season, sales could continue to climb.

While we can’t excuse the “workplace culture” issues at the company, or the game delays, it does appear that most of the negativity has been priced into ATVI’s stock. If management can now get its act together, and rebuild trust, ATVI may be able to refill its bearish gap soon.

— Ian Cooper

Your 12 income checks supercharged with 21% yields [sponsor]Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Investors Alley