Angenus (AGEN) is a biotech company focused on clinical-stage immuno-oncology, with 17 candidates in development. Nine of those candidates are company owned, while the rest are with partnerships of some well-known drug makers.

AGEN also has three experimental vaccines in clinical studies, as well as two adjuvants, which are substances that enhance the body’s immune response to an antigen. One of the adjuvants is for shingles and the other is for the treatment of malaria.

The shingles vaccine contains AGEN’s QS-21 Stimulon adjuvant and was approved in October 2017 by the FDA and in partnership with GlaxoSmithKline (GSK). The QS-21 is also being used by the same two companies for its malaria vaccine, which is awaiting regulatory approval.

The 17 candidates in clinical development are in several different phases that must go through regulatory hurdles, with three of them in phase 2 clinical trials through a partnership with Betta Pharmaceuticals. The rest are in phase 1 or pre-clinical stages through partnerships with Bristol-Myers Squibb (BMY), Merck (MRK), Gilead Sciences (GILD), and Incyte (INCY).

It is important to note that the immuno-oncology space is crowded with thousands of immunotherapies in development. While there is a good chance many of AEGN’s initiatives could get final regulatory approval, some treatments might also still fail commercially.

For its most recent quarter, AEGN reported a loss of $0.37 per share on revenue of $10.7 million, versus forecasts for a loss of $0.24 on revenue of $20.4 million.

There are only three Wall Street analysts covering the stock, with two strong buy ratings and one buy. In late June, one analyst raised the price target on AGEN to $11, up from $8.

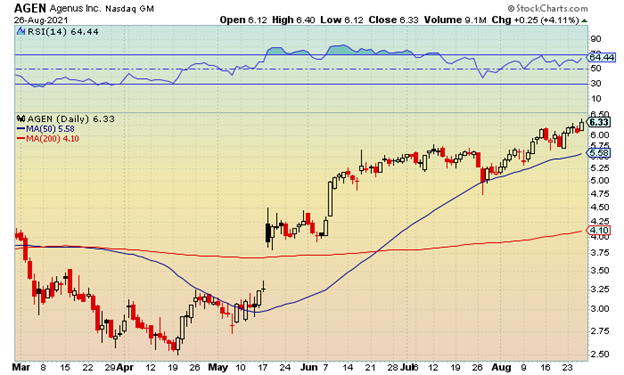

As far as the technical outlook, shares have been making fresh 52-week highs and have doubled in 2021 after coming into the year at just over $3. From the chart below, you can see shares are in a nice uptrend since mid-May after bottoming at $2.50 in April. Resistance is $6.50–$6.75 going forward with support at $6–$5.75. A close below $5.50 and the 50-day moving average would signal a possible near-term peak.

The company currently has a market-cap of $1.5 billion and investing in small biotech has it risks. AGEN is still losing money but has revenues and receives royalty payments.

The company currently has a market-cap of $1.5 billion and investing in small biotech has it risks. AGEN is still losing money but has revenues and receives royalty payments.

Conservative traders can buy AGEN at current levels while writing near-term covered calls. Although this strategy will lower the cost basis in the stock, it also caps your upside if shares are called-away at slightly higher strike prices.

Aggressive traders can target the January 2022 $10 call options that are currently trading for $0.60, or $60 per contract. These options do not expire until January 21, 2022, giving you five months to play a possible run past $10. If shares are at $11.20 by expiration, these options would double from current levels.

— Rick Rouse

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley