Suddenly, investors think AI is bad for software companies.

The truth? This whole story is a red herring. The real tale here is one of gains—and dividends—not losses. And we can nicely tap in with a fund sporting unique “downside insulation” and an 8% dividend, too.

Why the Software Selloff Is Overdone

Truth is, the premise of this whole argument is wrong, especially from an investment standpoint, and the reason why has a lot to do with timing: This bear market in software that’s shown up in less than a month and on news that’s, frankly, flimsy.

To wit, the selloff began because of a new product by Anthropic. The argument is well-summarized in a piece from the UK’s Observer, where Patricia Clarke writes: “The so-called ‘SaaS-pocalypse’ is driven by concern that agentic AI will bypass or replicate software products and ultimately prove existential for companies that are unable to adapt.”

That sounds plausible on the surface. But there are plenty of reasons to believe it’s not.

For now, though, let me point out what’s most important to us as investors, and that’s the timeline here: Software-development tool Claude Code was released in November 2024, so roughly a year and a half ago. That spawned the term “vibecode”—or coding with the help of an AI assistant. The newest version of Claude Code came out in September 2025.

In other words, this selloff is months late. That fact alone tells us that the smart money is not driving it.

This is an important dynamic for us CEF investors because it means we can leverage mainstream-investor worries to buy strong tech firms at discounts unlikely to last. A good way to do that is through the Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX).

The fund holds the stocks of the NASDAQ 100, including software-focused blue chips like Microsoft (MSFT). It then sells covered-call options on that index. That’s a good way to generate extra cash because under this approach, the fund sells the right for investors to buy its stocks at a fixed future time and price.

If the stock hits that price, it’s likely to be sold. If not, nothing happens. But either way, QQQX keeps the fee it charges for the option—and uses that income to support its 8.2% dividend.

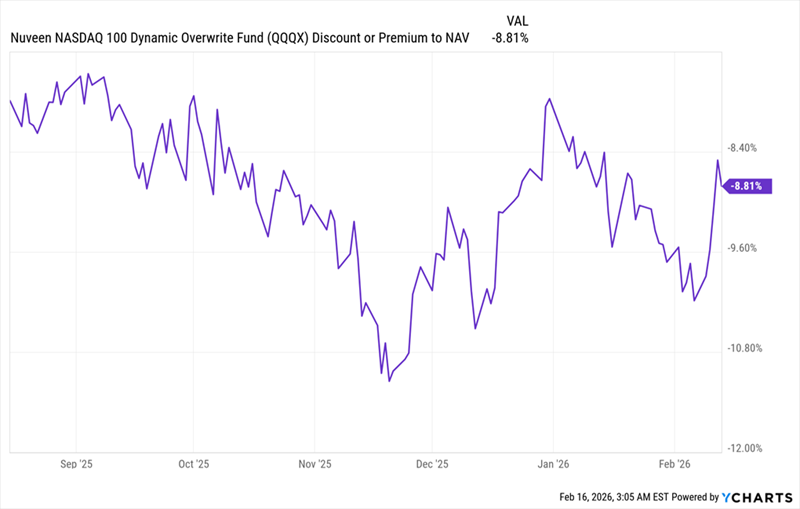

Which brings me to QQQX’s discount to net asset value (NAV, or the value of its underlying portfolio):

QQQX’s Discount Rebounds

As I write, this markdown is very much in a “sweet spot”: still wide, but swiftly moving toward par. Now let’s look out over the longer term:

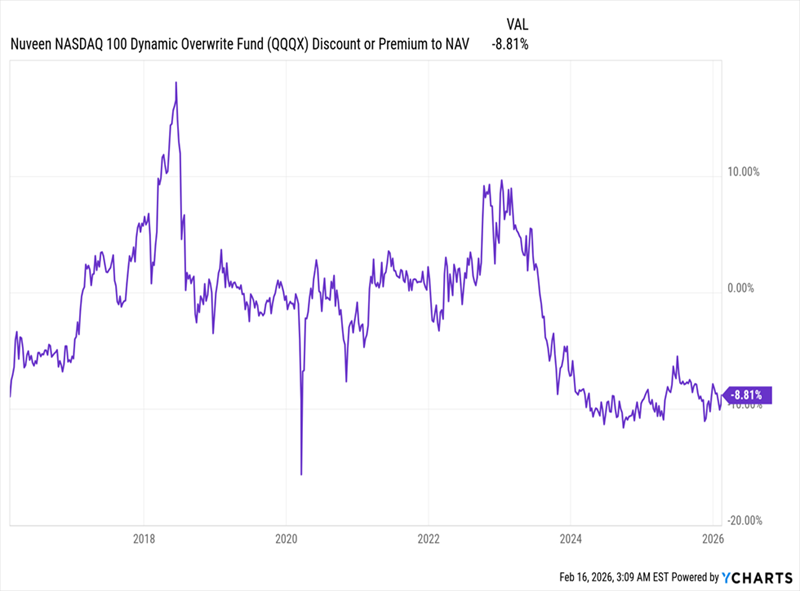

As I write, this markdown is very much in a “sweet spot”: still wide, but swiftly moving toward par. Now let’s look out over the longer term:

A Big Discount Appears

In the last decade, QQQX has averaged a 1.9% discount to NAV, so the current level is well below that mark. The current 8.8% markdown is even more unusual when you consider the fact that QQQX averaged a premium until the start of 2024. That was because 2023, 2024 and 2025 were all solid years for stocks as they recovered from the 2022 crash.

In the last decade, QQQX has averaged a 1.9% discount to NAV, so the current level is well below that mark. The current 8.8% markdown is even more unusual when you consider the fact that QQQX averaged a premium until the start of 2024. That was because 2023, 2024 and 2025 were all solid years for stocks as they recovered from the 2022 crash.

So why the persistent discount now? It has to do with the fund’s covered-call strategy, which I discussed earlier. This approach is less desirable in bullish years, as one of the downsides of selling covered calls is that when QQQX’s portfolio holdings rise swiftly, they’re often sold, limiting their upside.

That’s why the discount has stuck around. But if we’re going into panic mode on stale news, that will cause higher volatility, which drives up the value of the options QQQX sells. That, in turn, should entice more investors to come back to the fund, especially if the selloff lasts a while, helping narrow its discount.

The bonus, of course, is that you’ll collect an 8.2% income stream while you wait for that discount to shrink—and the share price to gain in tandem.

— Michael Foster

You Only Have A Few DAYS Left to Claim This Incredible 11% Dividend [sponsor]

The clock is ticking toward the “drop date” of my top income fund’s next big dividend, and the time to make our move is now. Massive payouts of $1,000, $2,000 and $3,000+ could be at stake. Don’t miss this chance to get in while you still can. Click here to unlock the full story.

Source: Contrarian Outlook