Fastly (FSLY) is an infrastructure software firm that offers cloud computing, image optimization, security, edge computer technology, and streaming solutions. The company’s specialized platform allows businesses to deliver secure, high-performance digital experiences.

FSLY’s network differs from traditional content delivery networks (CDNs) because it operates on Varnish, a web accelerator that empowers developers to run custom code, including AI logic, directly at the “edge of the internet.” The edge of the internet means that devices such as computers and smartphones interact with a local area network instead of having all data sent to a centralized cloud data center for processing. This network framework enables real-time decision-making and delivers benefits such as lower latency, bandwidth costs, and security.

The Agentic AI Era is Here

The early innings of the AI boom were characterized by large language chatbot AI models such as OpenAI’s “ChatGPT” and Alphabet’s (GOOGL) “Gemini.” These models have grown dramatically in popularity and driven the massive spending and interest from America’s largest tech companies.

That said, “agentic AI” is the next (and likely larger) phase of the AI boom. Unlike “conversational AI” chatbots, agentic AI agents can run without human supervision. In other words, it consists of AI agents and machine learning models that mimic human decision-making to solve problems in real time.

Agentic AI just had its ‘ChatGPT Moment.’ ClawdBot (now known as OpenClaw) launched in January 2026. The self-hosted AI agent can execute tasks directly from messaging apps such as WhatsApp, Telegram, and Slack. Unlike traditional LLMs that merely generate text responses, OpenClaw can read and write files, browse the web, and interact with other applications, all while running 24 hours a day, seven days a week. OpenClaw has exploded in popularity, gaining a mind-boggling 20,7000 GitHub stars in a single day. Meanwhile, AI agent integration searches exploded from just 110 to more than 12,000 in a single month.

Fastly is Positioned to Benefit from the Coming Agentic AI Boom

Unlike many software companies that are witnessing falling stock prices and investor doubts, Fastly positioned itself early to take advantage of the agentic AI boom. Not only is Fastly not being disrupted by this new technology, but the company is position perfectly to support agentic AI via its AI accelerator. FSLY’s AI accelerator makes it more cost effective to run agentic AI.

William Blair analyst Jonathan Ho was one of several analysts to upgrade FSLY shares after the company reported blowout earnings last night. In his note, Ho beautifully articulates how FSLY is set to benefit from the agentic AI revolution:

“Fastly delivered a stellar quarter driven by rising contribution from agentic AI traffic, which we believe is still in its infancy. At the same time, customers signed larger deals with Fastly, reflecting broader commitments across network delivery, security, and compute. The rationale for our upgrade is that we believe Fastly is likely to represent an underappreciated play on the growth in both large language model use and agentic AI. Large language models and agentic AI, particularly with search and deep reasoning functions, access many websites to look up and synthesize information. This is driving significant volume increases to content delivery networks that are leading customers to have to pay more as traffic levels surge. Given how early we are in the agentic AI journey, we view this as a positive sign that there is likely much more room for growth over time. In addition to traffic drivers, customers are also seeing a broader need to secure their AI agents, with Fastly helping customers segregate bots that bring positive traffic from malicious bots that scrape websites or are part of broader distributed denial-of-service attacks. From that perspective, Fastly is also seeing stronger growth as a strategic partner to customers looking at how they can navigate the world of agentic AI. Part of the success this quarter also stems from its competitive differentiation from a performance and reliability perspective, which has allowed it to take share in the broader market.”

Fastly’s Inflection Point

Wednesday night, Fastly reported that blew away Wall Street expectations. Revenue jumped 23% year-over-year to $172.6 million, beating the $161.4 million estimate. Meanwhile, adjusted EPS of $0.12 double Wall Street expectations. Most impressively, net income swung from a $2.4 million loss in Q4 2024 to a $20.1 million gain in Q4 2025.

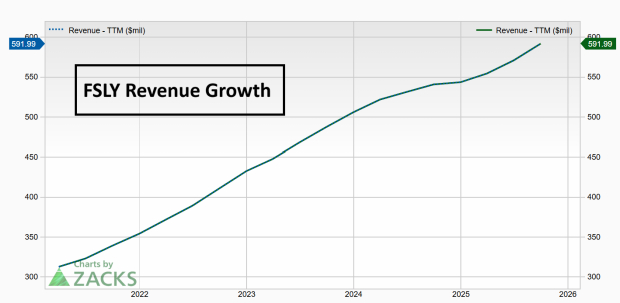

However, what really got Wall Street excited was the massive guidance. Fastly expects full-year 2026 revenue to soar to $700 million. For context, FSLY’s annual revenue was ~$543 million in 2024. While the guide is impressive, I believe it is conservative based on the massive growth and momentum in the agentic AI market.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Meanwhile, Fastly is not only taking advantage of the agentic AI revolution. The company helps LLMs store AI query responses, helps businesses manage AI scrapers to prevent content theft, and helps to protect AI-powered applications from cybersecurity attacks.

FSLY: A Classic Breakaway Gap

A breakaway gap occurs when a stock or index gaps out of a multi-week or multi-month consolidation. Power gaps, or breakaway gaps, mark the start of a fresh trend.

Traits:

- Large magnitude (2% or more in an index, 5% or more in a stock).

- Massive volume (ideally, volume is 50% or more above average; the more, the better)

- Closes at the top of the range (75% or higher; the closer to the high of the range, the better).

- A significant bullish catalyst (earnings, drug approval, change in monetary policy).

FSLY is showing all the classic signs of a breakaway gap. Shares are breaking out of a multi-month base structure in reaction to the positive earnings report. Meanwhile, demand is insatiable. At the time of this writing (11 am EST), FSLY had traded ~40 million shares. On an average day, the stock trades just 4.5 million shares. Such heavy volume only means one thing – institutional demand.

Image Source: TradingView

Image Source: TradingView

— Andrew Rocco

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks