You may not immediately recognize the name Abbott Laboratories (ABT), but you’ve probably come into close contact with one of the company’s many products — from a coronavirus test to Ensure nutrition shakes.

Over time, these and other products have helped Abbott build a long track record of earnings growth and the financial strength needed to sustain a long-lasting dividend program. Abbott is a Dividend King, meaning it’s increased its dividend payments for more than 50 consecutive years.

Due to this overall strength, Abbott is a healthcare dividend stock I’d happily hold forever. Let’s take a closer look at this company investors can count on for steady growth and safety over the long term.

A well-diversified company

First, what I like most about Abbott is the fact that it’s a well-diversified healthcare company. It has four business units — diagnostics, medical devices, nutrition, and established pharmaceuticals — and this structure offers the company and its shareholders an element of safety. If one particular business faces headwinds, another may compensate. For example, in recent times, as the diagnostics business suffered from declining coronavirus testing sales, the medical device business has delivered gains. In the latest quarter, the medical device unit reported double-digit sales growth.

Abbott also sells many market-leading products, from the Ensure nutrition drinks I mentioned above to the FreeStyle Libre continuous glucose monitor. Sales of glucose monitors climbed 15% in the recent quarter. Abbott’s commitment to innovation, as well as its moves to boost growth through acquisitions, should help power earnings growth in the years to come. One key growth driver ahead may be the integration of Exact Sciences, a leader in the cancer screening market — Abbott announced the acquisition late last year, and it’s expected to close in the second quarter.

Abbott also sells many market-leading products, from the Ensure nutrition drinks I mentioned above to the FreeStyle Libre continuous glucose monitor. Sales of glucose monitors climbed 15% in the recent quarter. Abbott’s commitment to innovation, as well as its moves to boost growth through acquisitions, should help power earnings growth in the years to come. One key growth driver ahead may be the integration of Exact Sciences, a leader in the cancer screening market — Abbott announced the acquisition late last year, and it’s expected to close in the second quarter.

A passive income machine

All of this means Abbott is well-positioned to continue delivering earnings growth over time. Meanwhile, as I mentioned above, you can also rely on this company for passive income. Last year marked Abbott’s 54th year of dividend increases — and the dividend has increased 70% in just five years.

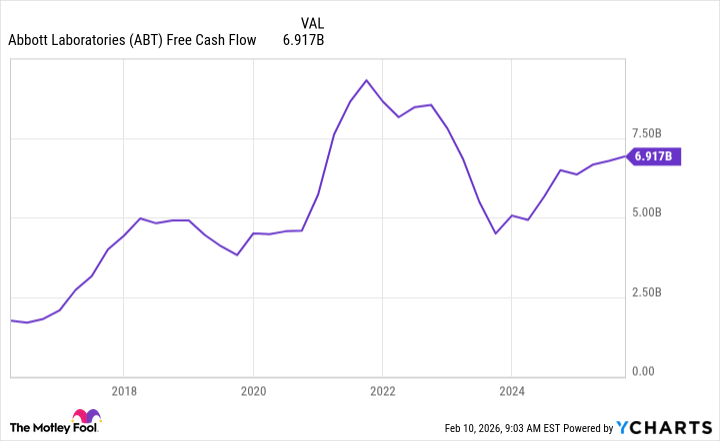

Abbott has the financial strength to keep this going, as it’s maintained high levels of free cash flow over time.

Today, Abbott pays a dividend of $2.52, representing a dividend yield of 2.2% — that’s higher than the 1.1% dividend yield of the S&P 500.

Today, Abbott pays a dividend of $2.52, representing a dividend yield of 2.2% — that’s higher than the 1.1% dividend yield of the S&P 500.

Dividend stocks, particularly those with a track record of dividend growth, are great to hold onto over time as they pay you just for owning the shares. This offers you an additional boost during good times, but you may particularly appreciate owning this type of stock during tough times, as it may protect you from declines — or at least limit your declines.

All of this makes Abbott a fantastic stock to buy and hold forever.

— Adria Cimino

Source: The Motley Fool