Finding a company with a reliable double-digit payout is like finding a needle in a haystack. Today, I believe we’ve found that needle in Trinity Capital (Nasdaq: TRIN).

Trinity Capital is a business development company, or BDC, that lends money to growth companies. It has some big names in its portfolio, such as Athletic Brewing Co., Impossible Foods, Rocket Lab, and Matterport. Trinity’s investor report lists 178 companies in its active portfolio, and it is expanding its operations every year.

The last time we reviewed Trinity was in 2024. At the time, we gave it a “B” grade. Let’s see whether that grade was accurate – and where the company stands today. (Shoutout to Wealthy Retirement readers Roy and Frank for getting it back on our radar.)

As of this writing, the company’s dividend yield sits at over 12% based on a $0.17 per share monthly payout. This is the same payout per share as when Chief Income Strategist Marc Lichtenfeld reviewed the company back in 2024. Thus, our prediction has been confirmed. This was a safe dividend with low risk of being cut.

Now let’s see whether it’s still as safe as it used to be…

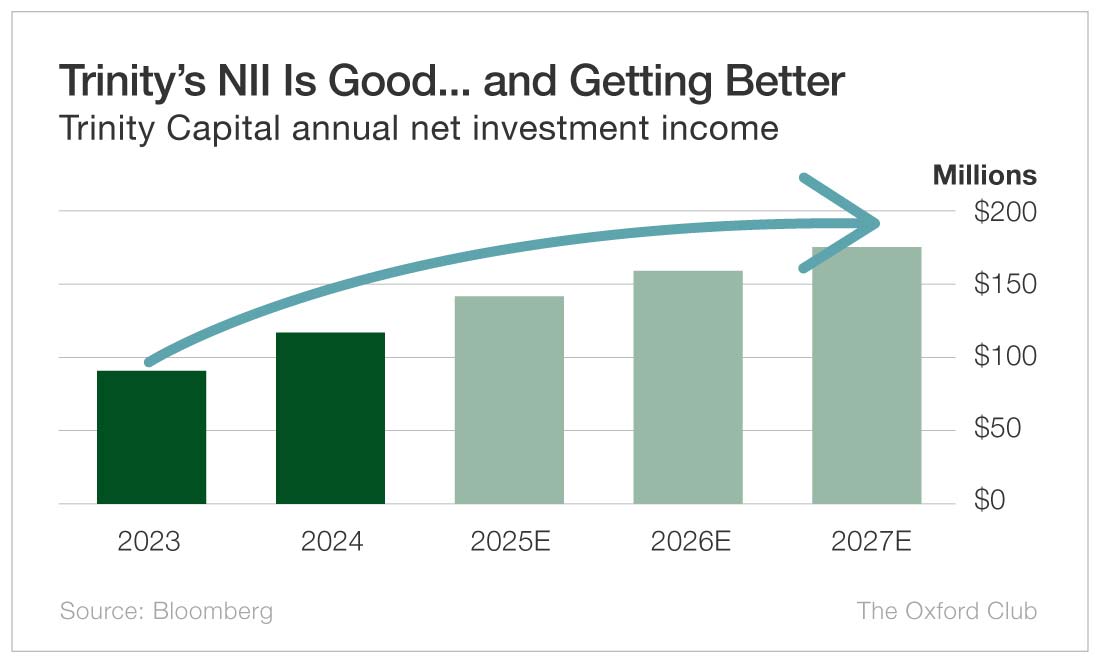

As with any BDC, we track free cash flow in terms of net investment income, or NII. This metric measures how much the BDC brings in from its investments, minus expenses. The terminology is important, as the company doesn’t generate any money itself since it has no product besides its investments.

Since we last reviewed the stock in 2024, Trinity’s NII has done nothing but go up and up. The company brought in $90 million in NII in 2023 and $116 million in 2024. NII from 2025 is expected to come in around $141 million (full-year results will be released on February 25), and it should reach nearly $160 million this year.

The dividend payout ratio is projected to increase, but only slightly. It was 89% back in 2024, and it’s expected to have climbed to 94.5% in 2025 with the higher NII and the steady dividend.

The dividend payout ratio is projected to increase, but only slightly. It was 89% back in 2024, and it’s expected to have climbed to 94.5% in 2025 with the higher NII and the steady dividend.

For BDCs, Safety Net looks for payout ratios below 100%, so Trinity continues to be safely below our threshold.

Trinity blew predictions out of the water in 2025 with impressive growth in its NII. BDCs don’t usually report individual investment returns, so we have to assume that the portfolio as a whole is doing well and that the company is receiving its loan repayments on time.

In 2024, Marc wrote that this dividend could be “angelic.” I’m here to parrot that possibility, with estimates looking up for 2026.

Dividend Safety Rating: A

— John Oravec

— John Oravec

The legendary stockpicker who built one of Wall Street's most popular buying indicators just announced the #1 stock to buy for 2026. His last recommendations shot up 100% and 160%. Now for a limited time, he's sharing this new recommendation live on-camera, completely free of charge. It's not NVDA, AMZN, TSLA, or any stock you'd likely recognize. Click here for the name and ticker.

Source: Wealthy Retirement