Last July, I reviewed Main Street Capital (NYSE: MAIN) for dividend safety. The company received an “A” rating. Now that more than a year has passed, is the dividend just as safe?

Main Street Capital is a business development company, or BDC. It invests in or lends money to privately held companies.

Its portfolio companies include…

- IG Holdings, an 82-year-old company based in Providence, Rhode Island, that designs insignias

- PPL RVs, which has been around since 1972

- Willis Group, which provides staffing and recruitment services and is based in Houston.

When we measure dividend safety for BDCs, we use a metric of cash flow called net interest income, or NII.

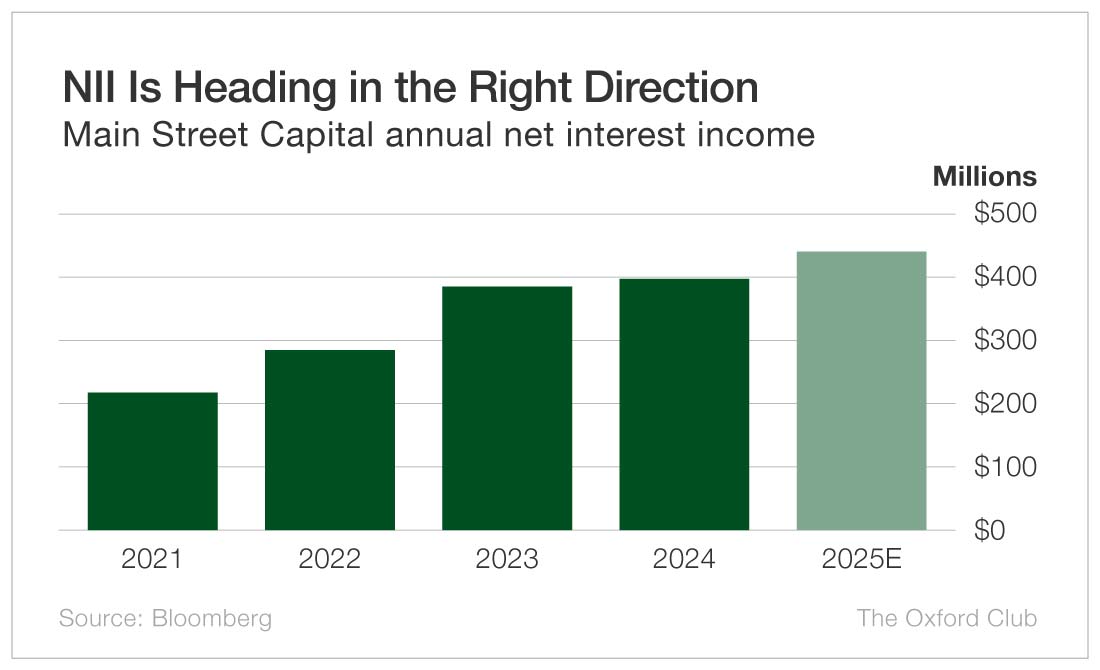

Main Street Capital’s NII has been steadily rising for a number of years.

In 2024, NII rose 3% from $384 million to $395 million. This year, NII is projected to grow 11% to $438 million.

By law, BDCs must pay out 90% of their profits to shareholders in the form of dividends. NII is different from profits, but as a result of that law, BDCs often pay out all or nearly all of their NII in dividends.

By law, BDCs must pay out 90% of their profits to shareholders in the form of dividends. NII is different from profits, but as a result of that law, BDCs often pay out all or nearly all of their NII in dividends.

For that reason, I’m comfortable with a payout ratio of 100% of NII or lower. If it’s above 100%, the company isn’t generating enough cash flow to pay the dividend. But as long as it’s below 100%, that’s okay.

Last year, Main Street Capital paid shareholders $320 million, or 81% of NII. This year, the forecast is $362 million, which comes out to a safe payout ratio of 83%.

Main Street also continues to pay a special dividend each quarter. For the past two years, the quarterly special dividend was $0.30 per share.

We don’t take into account the special dividend when determining dividend safety, because it is an irregular dividend (even though Main Street has been paying it consistently for a while now).

We only consider the regular dividend, which is $0.255 paid each month. That comes out to a 4.7% yield. Add in the $0.30 special dividend, and the yield climbs to 6.5%.

Main Street has raised the monthly dividend every year since 2011.

Given its stellar dividend-paying track record, steady NII growth, and reasonable payout ratio, Main Street Capital’s dividend remains very safe.

Dividend Safety Rating: A

— Marc Lichtenfeld

— Marc Lichtenfeld

$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.

Source: Wealthy Retirement