Nuclear energy upstarts NuScale Power Corporation and Oklo Inc. have soared over 200% since early April as Wall Street dove back into risk assets with massive long-term upside.

The U.S. government, Wall Street, and big tech have thrown their collective weight behind nuclear energy expansion to support the power-hungry artificial intelligence revolution and economic growth, while gradually weaning off fossil fuels.

The U.S. government has launched various initiatives to support the nuclear energy revival, aiming to triple nuclear capacity by 2050. President Trump signed an executive order in late May to accelerate the expansion and innovation of nuclear power.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Meta and Amazon made high-profile nuclear energy deals in just the last few weeks as part of a wave of long-term power agreements between AI hyperscalers and nuclear power companies.

Should investors buy soaring nuclear energy stocks such as NuScale and Oklo right now, or wait for a pullback since they have already climbed over 100% in the past month?

The Bull Case for Home-Run Nuclear Energy Stock SMR

NuScale Power Corporation (SMR) is one of just a few pure-play small modular nuclear reactor (referred to as SMRs, just like its ticker) stocks on the market. SMR is a straightforward, speculative bet on the future of small-scale, mass-produced next-generation nuclear energy technology.

The Oregon-based company remains the first and only SMR technology to receive design approval and certification from the U.S. Nuclear Regulatory Commission. NuScale in late May said it received design approval from the NRC for “its uprated 250 MWt (77 MWe) Power Modules” and confirmed it “remains on track for deployment by 2030.”

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

NuScale is at a potential pivot point as it gets closer to launching its small-scale nuclear energy reactors. “Alongside our exclusive commercialization partner ENTRA1 Energy, we are in advanced dialogue with several prospective customers across governments and industries, including data centers, utilities, coal plant operators transitioning to nuclear, and petrochemical and energy companies,” CEO John Hopkins said in Q1 remarks.

SMR is projected to grow its revenue by 46% this year and 188% next year to $155.5 million. NuScale is still expected to lose money during the next several years. Thankfully, NuScale closed the first quarter with roughly $521.4 million of cash, cash equivalents, and short-term investments vs. zero debt and $89 million in total liabilities.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

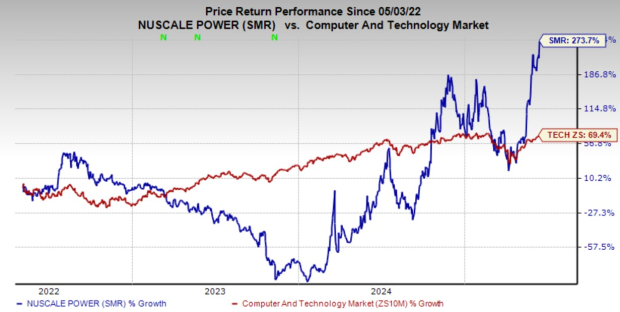

NuScale stock has skyrocketed over 120% in the past month, including a massive one-day surge on Wednesday following the Amazon and Talen nuclear energy deal news. SMR has ripped nearly 300% higher following its May 2022 SPAC IPO. The nuclear energy stock’s recent charge helped it break above its late 2024 and early 2025 highs.

No stock can go straight up forever, and SMR is trading solidly above its 21-day moving average, at overheated RSI levels, and well above its average Zacks price target. NuScale also trades at 99X forward sales. That said, the momentum might continue in the short run if FOMO buying heats up.

Long-term nuclear energy bulls might want to buy NuScale now and then add to their positions when SMR faces selling pressure. Investors might want to utilize pullbacks to NuScale’s previous highs or its 21-day as a chance to buy. Any drop back to its 50-day or 200-day would mark an even better buying opportunity.

Buy Next-Gen Nuclear Energy Stock Oklo and Hold?

Oklo Inc. (OKLO) is a next-generation nuclear fission company that went public in May 2024 via a SPAC, with the help of Sam Altman of OpenAI and ChatGPT fame. Unlike NuScale, Oklo is attempting to advance old-school, proven nuclear energy technology.

Oklo is a fission technology and nuclear fuel recycling firm working to build smaller nuclear power plants at scale. The company’s Aurora nuclear reactors can produce up to 75 MWe of electrical power and can be powered by recycled fuel. Oklo is developing micro nuclear reactors that it will build on site to “deliver cost-effective, reliable power with lower financing risk.”

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company’s goal is to “sell power, not power plants, directly to customers under long-term contracts,” setting up recurring revenues and a more streamlined regulatory pathway. Oklo is targeting its first deployments in 2027 after obtaining its first site use permit from the U.S. Department of Energy in 2019.

Oklo said it has a 14 GW demand pipeline, driven by its scalable technology that’s well-suited to customers across different areas of the economy, including AI data centers.

The next-gen fission company is still pre-revenue and losing money. But the nuclear energy momentum is on its side, as Amazon, Meta, Microsoft, and other AI hyperscalers race to secure as much reliable, always-on, non-fossil fuel power as possible.

Oklo has established itself as one of the few potential big winners in the future of nuclear energy. The stock has nine brokerage recommendations at Zacks vs. five just three months ago, with six at “Strong Buys.”

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

OKLO stock has skyrocketed 550% in the past year, including a 220% YTD run. The stock has been on a wild run since its SPAC IPO, including a massive initial tumble. Oklo, like SMR, soared to new highs on Wednesday as it broke meaningfully above its previous peaks.

Long-term nuclear energy investors could consider buying OKLO now and adding to their position at the next meaningful pullback. A retreat to its 50-day or 200-day moving average would offer an even more attractive opportunity to buy.

— Benjamin Rains

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks