It’s time to sell the banks.

The last time we wrote about the banking sector was in early April. Back then, bank stocks had been selling off hard, along with the broad stock market. But the chart of the KBW Nasdaq Bank Index (BKX) was showing signs of a potential reversal. And with earnings season coming up, we figured bank stocks might be setting up for a rally.

Since then, bank stocks have been on fire. The sector has led the market higher over the past six weeks. BKX is up nearly 25% since early April.

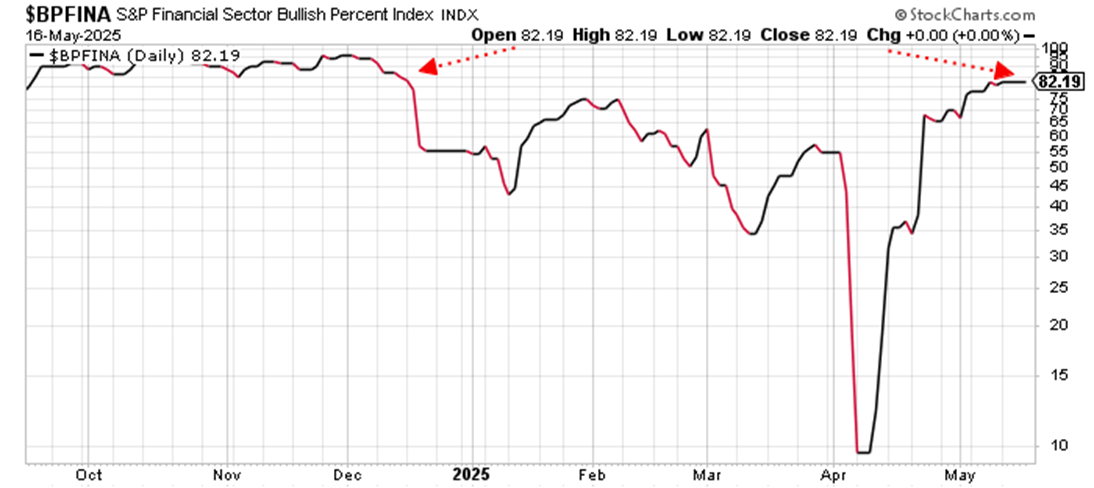

Now, though, the sector is overbought. And the Bullish Percent Index for the Financial Sector (BPFINA) is about to generate its first sell signal of 2025.

Look at this chart of BPFINA…

A bullish percent index (BPI) shows the percentage of stocks in a sector that are trading in bullish technical patterns.

A bullish percent index (BPI) shows the percentage of stocks in a sector that are trading in bullish technical patterns.

It’s an easy way to measure overbought and oversold conditions for a sector. Typically, a reading above 80 – meaning 80% of the stocks are trading in bullish technical patterns – means a sector is overbought. Readings below 30 indicate oversold conditions.

Buy and sell signals occur when a BPI reaches extreme levels and then reverses.

For example, when a BPI rallies above 80 and then turns lower, it generates a sell signal. When a BPI dips below 30 and then turns higher, that’s usually time to buy. At least, those are the general rules.

The last BPFINA sell signal occurred back in December. The KBW Nasdaq Bank Index (BKX) was trading near $135 at the time. Over the next four months, BKX fell all the way to $105 before the BPFINA turned higher from oversold conditions and generated a buy signal.

Today, the banking sector is back to where it was trading last December. And BPFINA is once again in overbought territory and on the verge of generating a sell signal.

Yes, it’s possible for BPFINA to work even higher. Overbought conditions can always get more overbought.

But with the broad stock market looking vulnerable to a pullback, and with the banking sector in overbought territory, it’s probably a good idea to take some profits off the table.

Traders who bought bank stocks on our suggestion in early April should consider selling them now.

Best regards and good trading,

Jeff Clark

I recently visited Mar-a-Lago... And now I'm prepared to put my reputation on the line. Since 1998, my proprietary system would've returned 13,126% in backtests. (That's 13X the S&P and 106X the average investor, according to JP Morgan.) However, one investment I just uncovered could be my biggest winner of all... It involves President Trump, Elon Musk, trillions of dollars, China... And a MAJOR upgrade to the artificial intelligence revolution. See for yourself!

Source: Jeff Clark Trader