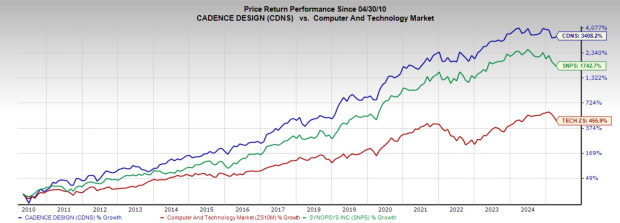

Cadence Design Systems (CDNS) stock has ripped off a 1,300% gain in the past decade, leaving electronic design automation rival Synopsys and Tech firmly in its rearview.

The outperformance is no fluke since Cadence’s modeling and computational software plays an increasingly critical role in driving innovation at the cutting edge of semiconductors and beyond.

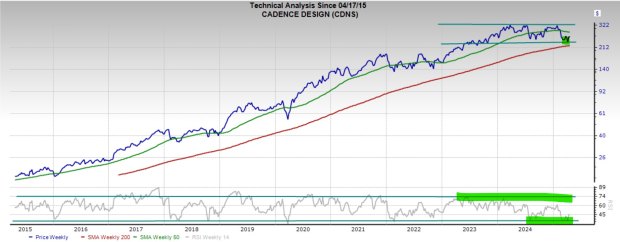

Cadence stock is holding its ground at some key technical levels, and it might be ready to break out of a holding pattern it has been stuck in for the last few years if it impresses Wall Street at the end of the month.

The top tech stock is trading 20% below its all-time highs heading into its first quarter 2025 earnings release on Monday, April 28.

Why This Tech Stock is a Great Long-Term Buy and Hold

Cadence is a pioneer of electronic systems design. The company’s modeling and computational software help tech companies design their semiconductors, complete electromechanical systems, and other vital technologies.

Cadence and its Intelligent System Design strategy aim to “deliver software, hardware and IP that turn design concepts into reality.” Nvidia (NVDA) and other giants depend on Cadence to simulate their cutting-edge semiconductors before they are made.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The growing complexity of semiconductors needed for artificial intelligence, hyperscale computing, aerospace innovation, robotics, and beyond transformed Cadence into an invaluable partner for many technology companies and a vital part of the semiconductor ecosystem.

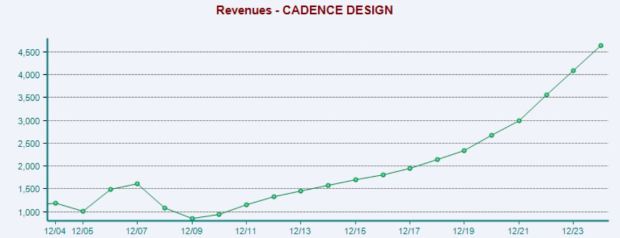

CDNS averaged 15% revenue growth over the past five years, including 14% YoY growth in 2024. Cadence closed the year with a record backlog, and it’s topped our EPS estimates for five years running.

The critical behind-the-scenes tech company is “well positioned to benefit from the various phases of AI, including the current AI infrastructure buildout, applying AI to our own products, and expanding into new markets such as life sciences,” according to Cadence CEO Anirudh Devgan.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Cadence on March 18 announced the next step of its growing partnership with Nvidia. It said it expanded its multi-year collaboration with the AI chip giant to help drive “advancements in accelerated computing and agentic AI.”

Cadence’s Nvidia partnership aims to address “critical global technology challenges, delivering tangible advancements that accelerate innovation across a wide range of industry verticals.”

Cadence’s Other Key Fundamentals

Cadence is projected to grow its revenue by 12% in 2025 and 2026 to reach $5.78 billion, extending its streak of double-digit YoY sales expansion to seven. Meanwhile, it is projected to boost its adjusted earnings by 13% in FY25 and 14% in FY26, following 18% average growth in the past two years.

Cadence’s 2025 and 2026 earnings estimates have faded over the last 12 months, leading to its slide. That said, its FY26 estimate is up slightly during the past several months, and the tech standout has beaten our EPS estimates for five years in a row.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock also slipped after it issued $2.5 billion of senior notes at a weighted average interest rate of 4.44% in September 2024. Wall Street worries that Cadence’s increasing debt load may jeopardize its ability to pursue acquisitions and other growth efforts.

Thankfully, it holds cash and equivalents of $2.64 billion vs. long-term debt of $2.47 billion, with its total assets more than doubling its total liabilities.

Cadence also faces stiff competition from other electronic design automation companies like Synopsys (SNPS) and the tariff fight will certainly impact CDNS. Still, 14 of the 18 brokerage recommendations tracked by Zacks are “Strong Buys” and Cadence stock has crushed the Tech sector and its rival Synopsys across the last 15, 10, and five-year timeframes.

CDNS has climbed 3,400% in the last 15 years, blowing away Tech’s 460% and Synopsys’1,700%. The stock is up 73% in the trailing three years to more than double Tech, with it down -13% YTD vs. Tech’s -18%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

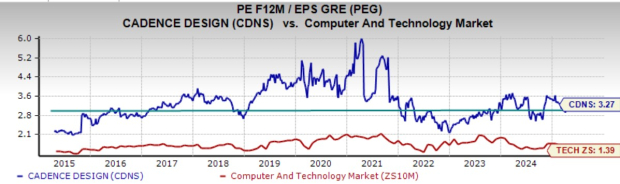

On the valuation front, Wall Street has been willing to pay a premium for Cadence’s consistent growth outlook for a long time. CDNS trades at its 10-year median and at a nearly 40% discount to its highs at 45.9X forward earnings and 45% below its highs when it comes to its PEG ratio—which factors in its long-term earnings growth outlook.

Is Now the Time to Buy This Tech and AI Stock On the Dip?

Cadence trades roughly 20% below its highs and has been stuck in a trading range for over a year. The stock found support near its 200-week moving average and a critical May 2023 breakout level.

It might be time to buy the modeling and computational software giant before it reports its Q1 results on April 28 for investors who can handle the risk. Others might wait for it to report its results and provide insights into how tariffs could impact its business and bottom line.

— Benjamin Rains

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks