Strong cash flows reflect financial stability, enabling companies to eliminate debt, pursue growth opportunities, and distribute dividend payments, among other positive features.

These companies are also better equipped to weather downturns, providing another beneficial advantage for investors from a long-term standpoint.

Three mega-cap giants – Verizon (VZ) , Apple (AAPL) , and NVIDIA (NVDA) – all fit the criteria nicely. Let’s take a closer look at how each currently stacks up.

Apple Remains Cash King

Apple has long been a cash-generating machine, providing many benefits over the years, including higher dividend payouts. In fact, Apple has raised its quarterly payout in 13th consecutive years, now more than halfway to becoming a Dividend Aristocrat.

Shares yield a modest 0.5% annually, though the company’s 4.9% five-year annualized dividend growth helps bridge the gap. The tech titan generated $108.8 billion in free cash flow throughout its FY24, with flows remaining on a steady uptrend over the years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Apple posted adjusted EPS of $2.40 and sales of $124.3 billion in its latest print, reflecting growth rates of 10% and 4%, respectively. Both EPS and sales figures reflected all-time records for the company, with Services revenue also touching an all-time high.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Verizon Keeps Paying Investors

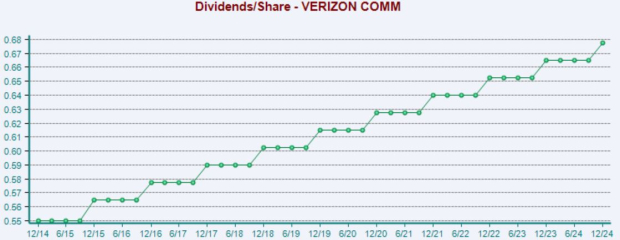

Verizon’s strong cash-generating abilities have positioned it at the top of many income-focused investors’ lists, with the company close to joining the elite Dividend Aristocrats club thanks to years of consistently higher payouts.

Below is a chart illustrating the company’s dividends paid per share on a quarterly basis. FY24 free cash flow of $19.8 billion grew 6% year-over-year. Shares currently yield a steep 6.2% annually, crushing that of the S&P 500.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Its latest set of quarterly results exceeded both Zacks Consensus EPS and Sales estimates modestly. Continued customer growth has been a nice tailwind for the company, with its broadband market share continuing to grow.

NVIDIA Continues to Impress

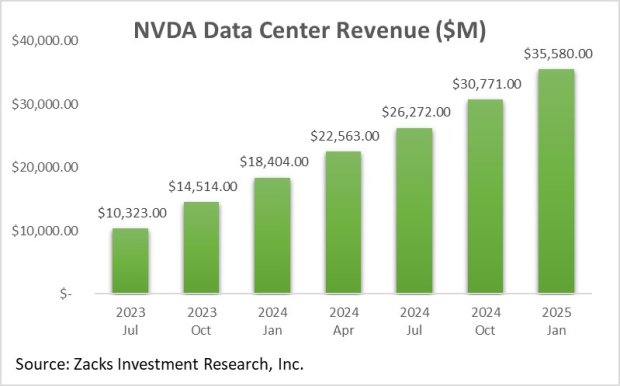

Concerning headline figures in NVIDIA’s latest print, quarterly sales of $39.3 billion shot 78% higher from the year-ago record, also reflecting a new quarterly record. Adjusted EPS of $0.89 reflected 71% growth YoY, also beating our consensus estimate by nearly 6%.

The big growth on headline figures is undoubtedly reflective of a positive demand picture, a trend we’ve become very accustomed to over recent periods. Of course, Data Center results were the highlight of the print, which again were rock-solid and grew 90% year-over-year to $35.6 billion.

Below is a chart illustrating NVDA’s Data Center sales on a quarterly basis.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

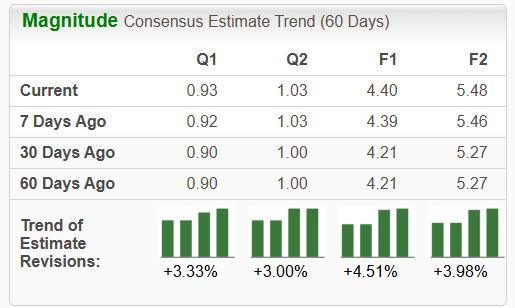

In addition, the AI favorite posted free cash flow of $15.2 billion, up 40% from the year-ago period and fueled by the above-mentioned demand picture. The stock continues to sport a favorable Zacks Rank #2 (Buy), with analysts revising their EPS expectations higher across the board over recent months.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Companies boasting strong cash-generating abilities can be great investments, as they have plenty of cash to fuel growth, pay out dividends, and easily wipe out debt. And as mentioned above, these companies are better equipped to handle an economic downturn, undeniably a positive.

For those seeking cash-generators, all three companies above – Verizon (VZ) , Apple (AAPL) , and NVIDIA (NVDA) – fit the criteria nicely.

— Derek Lewis

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks