Among the Zacks Rank #1 (Strong Buy) list, Allegiant Travel Company (ALGT) is a stock that stands out in terms of growth, value, and momentum.

Operating a low-cost passenger airline, Allegiant’s stock looks poised for more upside after impressively exceeding its Q4 earnings expectations last Tuesday. Landing the Zacks Bull of the Day, Allegiant stock is of interest for short-term gains but appears to be headed for long-term success as well.

Allegiant Overview

Headquartered in Las Vegas, Allegiant Air has become one of the fastest-growing airlines in the United States by creating a niche that centers around strategic expansion into underserved markets. This has propelled the company ahead of other low-budget carriers such as Spirit Airlines (SAVEQ) , which serves markets with more direct competition from the larger carriers and have higher operating costs.

Furthermore, Allegiant is known for its positive customer experience by offering free seat selections and a more straightforward fee structure as opposed to Spirit Airlines. Allegiant also has a reputation for efficient operations, including quick turnaround times and high aircraft utilization rates, which helps maximize revenue.

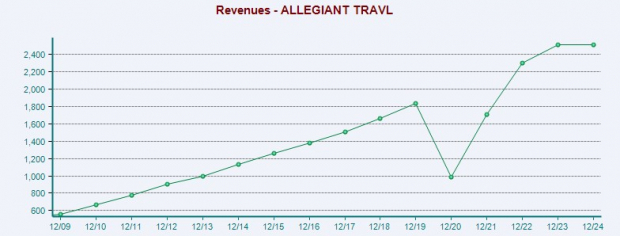

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Allegiant’s Strong Q4 Results

Allegiant posted Q4 adjusted earnings of $2.10 per share, beating the Zacks EPS Consensus of $1.88 and flying from $0.11 a share in the prior-year quarter. On the top line, Q4 sales increased 3% year over year to $627.11 million and edged estimates of $624.8 million.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Allegiant’s Compelling Growth Trajectory

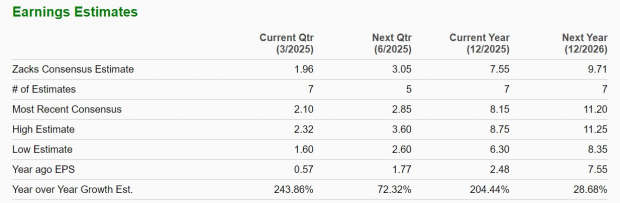

Notably, Allegiant expects Q1 EPS at $1.50-$2.50 with the current Zacks Consensus at $1.96 or 244% growth from $0.57 a share in the comparative period (Current Qtr below). Allegiant’s annual earnings are expected to rebound and soar to new peaks of $7.55 per share compared to EPS of $2.48 last year, with its previous record being $7.31 a share in 2023. Plus, Zacks projections call for Allegiant’s EPS to expand another 28% in FY26.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Sales forecasts call for low-double-digit growth in FY25 and FY26 with projections edging toward $3 billion. However, most intriguing and indicative of more short-term upside in ALGT is that FY25 and FY26 EPS estimates have soared over the last 60 days and are up 16% and 6% in the last week respectively.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

With Allegiant stock trading at a reasonable 11.1X forward earnings multiple, now appears to be an ideal time to get in on the company’s expansion and appealing EPS growth. To that point, it wouldn’t be surprising if ALGT starts to rally based on a very compelling trend of positive earnings estimate revisions.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks