Nuclear energy powerhouse Constellation Energy (CEG) soared 25% on Friday to all-time highs after announcing its acquisition of natural gas and geothermal giant Calpine.

The deal creates the nation’s largest clean energy company and further cements Constellation Energy’s status as one of the best long-term investments in the future of energy and artificial intelligence.

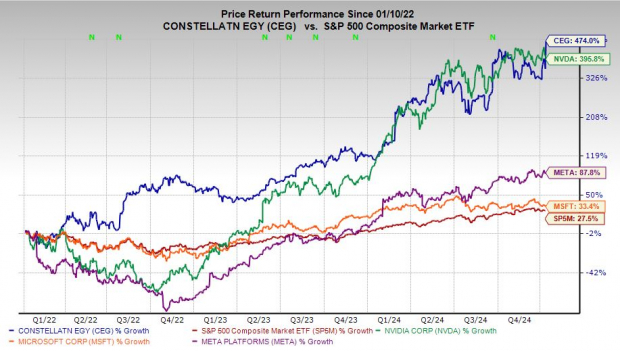

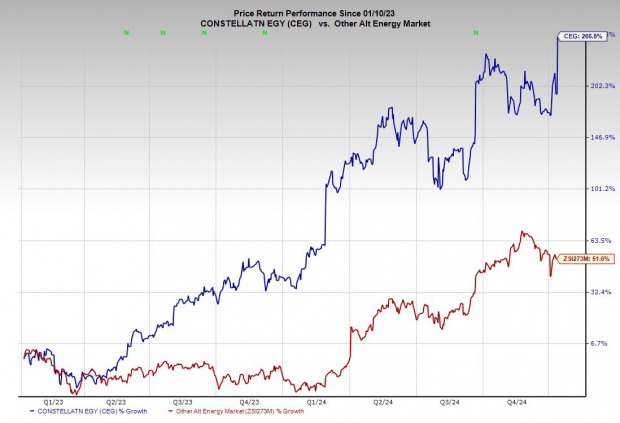

Constellation is a Zacks Rank #2 (Buy). CEG has outclimbed plenty of big tech AI stocks over the past several years including Nvidia, and it looks ready to breakout again to start 2025.

Why Constellation Energy is a Great Buy-and-Hold Stock

Constellation is the largest U.S. nuclear power plant operator, with over 20 reactors at roughly a dozen sites across the Midwest, the Mid-Atlantic, and the Northeast. CEG has been one of the best S&P 500 stocks over the last several years, skyrocketing 475% in the past three years to outpace Nvidia.

Wall Street dove into Constellation because nuclear energy is poised to play a growing role in the economy, powering the energy-hungry AI age as the country attempts to shutter more coal plants.

Constellation benefits from the U.S. government’s newfound support of nuclear power, as the world’s largest economy aims to triple its nuclear energy capacity by 2050. Nuclear energy vaulted to the top of the clean energy mix because it provides baseload power that’s 2.5X to 3.5X times more dependable than wind and solar.

Nuclear was by far the most significant domestic source of clean energy in 2024. Nuclear has also supplied roughly 20% of U.S. electricity every year since 1990. China, India, and others are all-in on nuclear energy to power their growing economies that are also attempting to become more energy independent.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Constellation benefits from the U.S. government’s direct support of nuclear power. CEG boosted its dividend by 25% in 2024, exceeding its 10% annual growth target and Constellation improved its balance sheet.

Constellation is retrofitting its current nuclear power plants to keep them running for longer, reopening decommissioned plans, and exploring next-gen technologies.

The company in November forecasted “visible, double-digit long-term base EPS growth backed by the Nuclear Production Tax Credit.” CEG is projected to grow its earnings by 66% in 2024 and 10% in 2025.

Constellation had also assured investors over the last few years that it would pursue acquisitions and return more value to shareholders.

Calpine and Recent AI-Focused Energy Deals

Generative AI platforms can use 10X the energy vs. a Google search and some artificial intelligence data centers consume the same amount of electricity as midsize cities.

Big tech capex is projected to reach $250 billion in 2025, with Microsoft expected to spend $80 billion on AI data centers this year alone. Speaking of, CEG strengthened its nuclear energy bull case when it landed a 20-year power purchase agreement with Microsoft (MSFT) in September. Alphabet, Amazon, and Meta all made large nuclear power deals in 2024.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Energy utilities capex is projected to hit all-time highs between 2025 and 2027 to help support skyrocketing demand.

Constellation announced on January 2 that it was “awarded more than $1 billion in combined contracts by the U.S. General Services Administration to supply power to more than 13 government agencies and perform energy savings and conservation measures.”

Most recently, Constellation officially announced on Friday its $26.6 billion cash and stock deal to buy natural gas and geothermal titan Calpine, combining two of the country’s largest electricity generators.

Calpine is one of the largest generators of electricity from natural gas and geothermal in the U.S. Calpine’s fleet can generate approximately 27,000 MW of electricity or enough to power around 27 million homes.

Natural gas will, without a doubt, continue to play a critical role as the U.S. attempts to shutter more coal plants and maintain grid reliability.

On top of that, Calpine expands CEG’s geographical footprint into power-hungry and tech-heavy Texas and California.

“Both companies have been at the forefront of America’s transition to cleaner, more reliable and secure energy, and those shared values will guide us as we pursue investments in new and existing clean technologies to meet rising demand,” Constellation CEO Joe Dominguez said in prepared remarks.

Constellation’s Calpine transaction is expected to close within 12 months of signing.

Is CEG Stock Ready to Breakout in 2025?

Constellation stock has soared 475% in the past three years to outpace Nvidia’s (NVDA) 390%, Meta’s (META) 85% and Microsoft’s 33%. CEG ripped 170% higher in the past 12 months, including its 25% jump on Friday.

Constellation gapped above its early October highs. The move appears similar to its September surge following its Microsoft announcement that took it above its May peaks.

Some investors might want to wait for a pullback before buying CEG because it could be overheated following its one-day surge. Still, CEG’s 1.5 price/earnings-to-growth (PEG) ratio marks a discount to the S&P 500 (1.8) and its industry (1.6) even though Constellation stock has crushed them.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Constellation’s upward earnings revisions help it earn a Zacks Rank #2 (Buy). CEG’s deal combines two of the country’s largest electricity generators as Microsoft, Amazon, Meta, and every other big technology company races to secure power to fuel their AI investments that will be measured in trillions.

Constellation is a great dividend-paying investment into the future of energy and the long-term expansion of AI.

— Benjamin Rains

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks