Following Wednesday’s FOMC meeting and press conference from Jerome Powell, it seems 2025 may be shaping up to be a bit more uncertain than investors were expecting. Powell expressed his concern about rising inflation and signaled the central bank was going to be more hawkish moving forward.

Fortunately, investors need not try to predict what is going to happen next year, and would be better served by picking a diverse portfolio of stocks that will benefit from various future outcomes.

While 2024 brought strong economic growth, cooling inflation, exciting advancements in AI, and a surge in technology stocks, 2025 may chart a different course. If the Fed tightens its stance and inflation rises, a defensive, commodities-focused portfolio might outperform a tech-heavy one. However, since the future is uncertain, my approach is to build a balanced portfolio of stocks that complement each other. This way, if one area underperforms, another can help offset the impact.

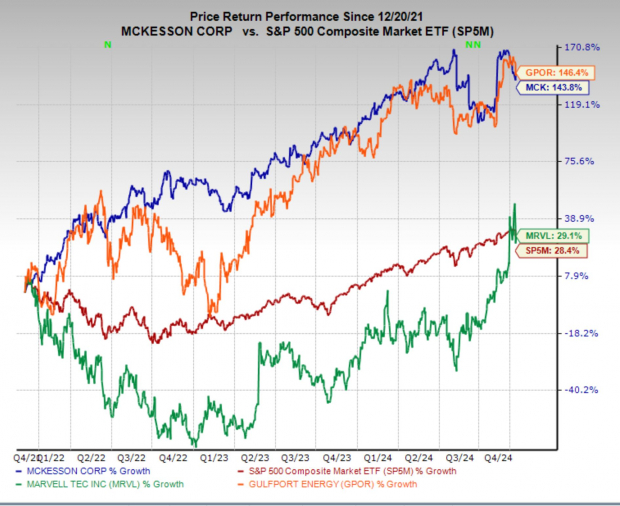

Here, I’ll highlight three stocks with strong fundamentals, each positioned to perform well under different potential scenarios for the coming year. Gulfport Energy (GPOR) should hedge the portfolio in the case of another inflationary period, McKesson (MCK) will perform well in a more challenging economic downturn and Marvell Technology (MRVL) should outperform if we see another strong year led by the AI boom. Additionally, each of these stocks enjoys a top Zacks Rank.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Gulfport Energy: Top Zacks Rank and Inflation Hedge

Gulfport Energy is an independent oil and natural gas exploration and production company based in Oklahoma City, Oklahoma. The company primarily focuses on developing its assets in the Utica Shale in Ohio and the Scoop Stack in Oklahoma. Its portfolio is heavily weighted toward natural gas production, positioning it to benefit from favorable trends in the energy market.

If inflation surges again, commodities-oriented stocks are likely to outperform, as we witnessed in 2022. Energy, being a highly sensitive commodity, is often among the first to see price increases. When this happens, energy producers typically experience a rapid rise in profits, as their production costs remain relatively stable while the prices of the commodities they produce climb.

In addition to the potential macroeconomic shifts, Gulfport energy has several compelling fundamental business catalysts that make it an attractive standalone investment. Not only does Gulfport boast a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions, but also has a very reasonable valuation. GPOR is trading at a one year forward earnings multiple of 11.9x, which is especially interesting when you consider earnings are projected to climb 46% next year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

McKesson: Defensive Stock Position

McKesson is a leading healthcare services and pharmaceutical distribution company, based in the US. It plays a critical role in the healthcare supply chain by delivering medicines, medical supplies, and technology solutions to pharmacies, hospitals, and healthcare providers.

Known for its scale, McKesson supports the healthcare system with incredible operational efficiency and has also expanded into oncology and specialty care, solidifying its position as a key player in the healthcare industry.

Because of how critically important some of the largest healthcare companies in the US are, they have considerable flexibility in pricing. In boom times or recession, the demand for healthcare services stays consistent, giving the sector an upper hand during periods of uncertainty.

Because of this unique dynamic, McKesson has seen its sales and earnings tick monotonously higher for the many years, demonstrating the consistency of the business model. Earnings per share have grown from $2.40 per share to $28.87 per share over the last 20 years.

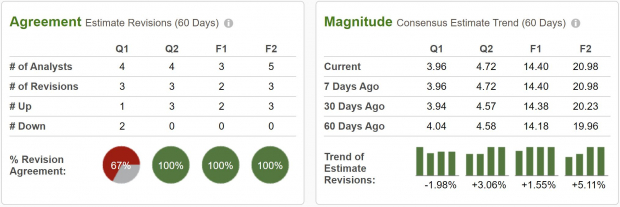

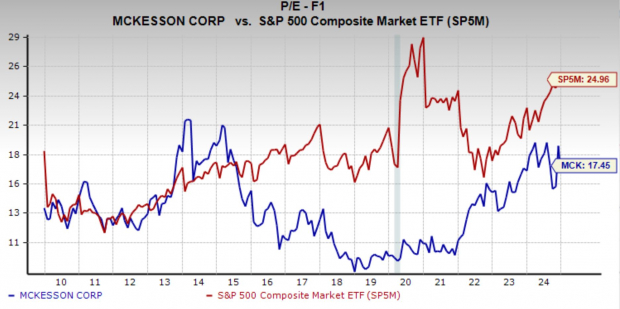

McKesson also has a Zacks Rank #1 (Strong Buy) rating, with analysts nearly all raising earnings estimates in the last two months. MCK also has a reasonable valuation, currently trading at 17.5x forward earnings. This is above its 15-year median of 13.3x but is well below the market average. And you can see that during periods of uncertainty, the earnings multiple has occasionally risen above the market average, which may be the case if we see a rise in volatility next year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Marvell Technology: Winning AI Stock

Marvell Technology is a leading semiconductor company specializing in data infrastructure solutions. Based in the US, it designs and develops cutting-edge chips for applications in cloud computing, artificial intelligence, and networking.

More recently, Marvell has gained prominence for its custom silicon solutions, including Application-Specific Integrated Circuits (ASICs), tailored for AI workloads and high-performance data centers.

MRVL’s entry into the custom AI silicon industry has been a very successful pivot for the company and led to a banner quarterly earnings report earlier this month. While Nvidia is dominating the broad AI infrastructure industry with its GPUs and full stack offerings, hyperscalers have begun to demand custom solutions as their compute needs grow more specific. Last quarter, revenues for Marvell grew 20% quarter-over-quarter, with expectations of another 20% sequential gain next quarter.

Because of this development, analysts have been quick to raise their earnings estimates for the company, and Marvell Technology now has a Zacks Rank #1 (Strong Buy) rating. Not surprisingly, MRVL stock broke out aggressively following the recent quarterly report. Now after gapping higher, the stock price has been forming a bullish consolidation. If the AI boom is to continue, I would expect MRVL stock to continue to consolidate over the next few weeks, and again break higher.

Image Source: TradingView

Image Source: TradingView

Should Investors Buy Shares in GPOR, MCK and MRVL?

Investors looking for a balanced approach in 2025 may find Gulfport Energy, McKesson, and Marvell Technology appealing. This diversified portfolio is well-positioned to benefit from a range of economic scenarios, whether it’s another surge in inflation, an economic downturn, or a technological boom. Each stock offers a unique hedge, ensuring the portfolio is resilient across different market conditions.

— Ethan Feller

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks