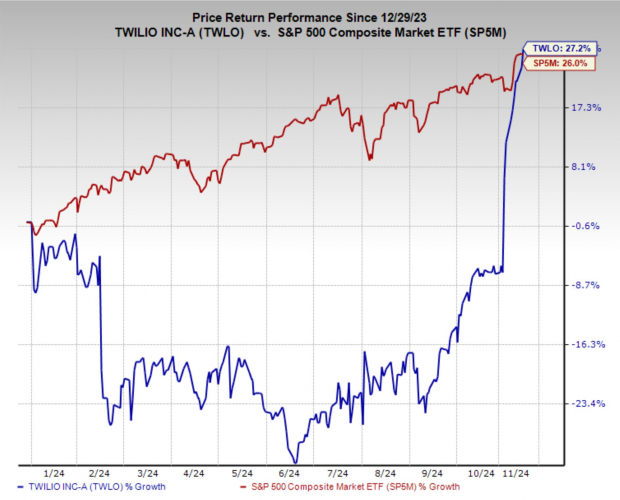

Twilio (TWLO) has made an impressive comeback, shaking off the challenges of the last few years to become one of the most compelling mid cap tech stocks in today’s market. Once a high-flying stock, Twilio experienced a sharp decline as tech valuations reset in 2022. However, strong growth forecasts and a reasonable valuation have renewed investor interest.

Now a Zacks Rank #1 (Strong Buy), Twilio combines strong fundamentals with a powerful technical trading pattern, suggesting the potential for an extended bull run. This momentum, supported by a promising growth outlook and appealing valuation, could drive significant upside as Twilio continues its impressive turnaround.

With its powerful suite of APIs for cloud communications, Twilio enables businesses to seamlessly integrate messaging, voice, and video features into their apps, enhancing customer engagement at scale. This focus on connecting businesses and consumers digitally continues to position Twilio as a key player in the digital business transformation —an area expected to see substantial demand in the years ahead.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

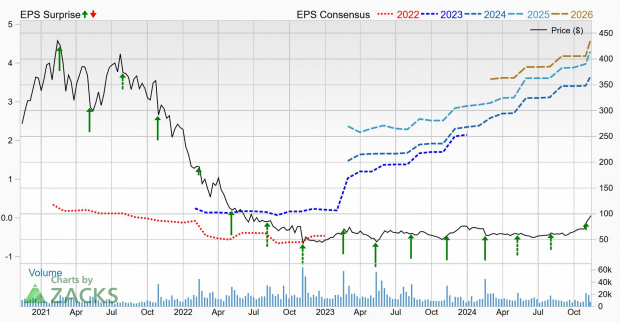

Powerful Earnings Revisions Trend Carries Stock Higher

Twilio’s earnings revisions trend has been accelerating upward since early 2023, even though the stock’s performance didn’t reflect this strength until recently. With sentiment now catching up, investors are taking notice of Twilio’s sharply improving earnings estimates, propelling the stock higher.

In just the last 30 days, earnings estimates for the current quarter have surged 16.3%, and projections for fiscal year 2025 earnings rose 10.5%. These positive revisions indicate confidence in Twilio’s growth trajectory and profitability, bolstered by demand for its communication and customer engagement tools as businesses prioritize digital transformation.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

TWLO Stock Breaks Out from Technical Base

For the past two years, Twilio was largely overlooked as its stock hovered near historic lows. Recently, however, the tide has turned with a notable technical breakout, drawing renewed attention.

The share price surged past the $80 resistance level and has since climbed nearly $20 higher. This momentum suggests there may still be significant upside potential, supported by Twilio’s appealing valuation and promising growth forecasts.

Image Source: TradingView

Image Source: TradingView

Twilio Shares Appear Undervalued

Over the past two years, despite a stagnant stock price, Twilio’s sales and earnings have continued to grow steadily. This resilience has helped bring its valuation to a more reasonable level of 26.5x forward earnings.

The appeal is even greater when considering Twilio’s impressive growth trajectory: with earnings projected to increase at an annual rate of 41.8% over the next three to five years, the company trades at a PEG ratio of just 0.63, signaling a substantial discount based on this metric. This combination of moderate valuation and strong growth potential positions Twilio as an attractive opportunity for long-term investors.

Should Investors Buy TWLO Shares?

Twilio’s recent turnaround has made it a strong contender in the tech sector, showcasing not only robust growth potential but also an appealing valuation. After a challenging period, the company’s fundamentals and favorable earnings revisions have drawn new interest from investors. With a Zacks Rank #1 (Strong Buy) and an attractive PEG ratio, Twilio’s shares appear to offer value alongside growth.

Furthermore, the technical breakout and rapidly rising earnings projections suggest that Twilio may continue its upward momentum. However, as with any investment, potential buyers should carefully monitor price action and broader market conditions. For investors seeking exposure to a company driving digital transformation, Twilio presents a compelling growth opportunity.

— Ethan Feller

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks