Half the country is happy, and half the country is sad, that’s the way democracy goes sometimes. This is a financial publication, so we are going to focus on the economic and market implications of a Trump presidency.

I think Trump is likely to be positive for economic growth in the US, as his prior presidential period was noted by a pickup in economic activity. In the past it was driven primarily by a lowering of corporate and personal taxes and an attempt to decrease broad regulations. It was a simple and fairly effective method to initiate growth, pulling on some of the primary levers moving the economy.

Of course, there are other factors outside of the presidential scope, which can have an equal if not larger impact on the stock market and economic performance. Including but not limited to, Federal Reserve policy, geopolitics and long-term economic cycles such as demographics.

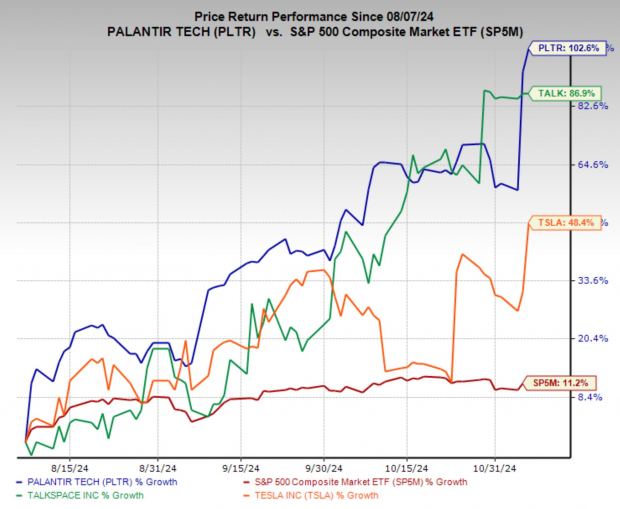

While acknowledging the role the president plays in the performance of the stock market, I have identified three stocks that I believe will benefit from a Trump presidency as well as broader business trends. Palantir Technologies (PLTR), Tesla (TSLA) and Talkspace (TALK) all enjoy specific factors which align with a Trump led economy, but also boast strong price momentum and top Zacks Ranks.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Tesla: Political Relations Bolster Stock Price

Elon Musk played a pretty important role in helping to get Donald Trump elected. With large donations through his Super PAC and plenty of chatter on X.com where he has 200 million followers, he showed a major effort to assist Trump.

This is no small matter and Tesla stock is reflecting this new position Musk now plays in the broader political sphere. TSLA stock is up nearly 14% on the day as of this writing and is now making new year-to-date (YTD) highs.

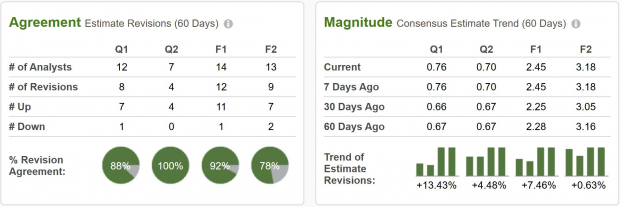

Tesla also has a Zacks Rank #1 (Strong Buy) rating, reflecting some significant revisions higher to its earnings estimates. Current quarter earnings estimates have jumped 13.4% over the last 60 days and FY24 estimates have climbed by 7.5% over the same period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Palantir Technologies: Shares Jump on Expanding Government Contracts

Palantir Technologies stands to benefit significantly from a Trump presidency, given the company’s strong government ties and focus on defense and intelligence solutions. Known for its work with federal agencies, including the Department of Defense and other national security branches, Palantir is well-positioned for potential expansions in government contracts that could follow pro-defense and security spending policies.

The company’s advanced data analytics and AI-driven solutions are particularly valuable for enhancing national security initiatives, making it a likely choice for additional contracts under an administration focused on bolstering the military and intelligence sectors.

Adding to its appeal, Palantir holds a favorable Zacks Rank #2 (Buy) rating, which reflects an upward trend in its earnings outlook. Just take a look at the stock today and you will see how wall street is favoring it. PLTR stock has been on a tear since the summer and is up nearly 6% as of this writing.

Image Source: TradingView

Image Source: TradingView

Talkspace: Metal Health Stocks in Focus

Talkspace, an online therapy platform, is well-positioned to see increased demand as a result of heightened emotions in the current political climate. With the polarizing effect of Trump’s presidency, many people who feel deeply impacted by his policies may increasingly turn to mental health resources to cope.

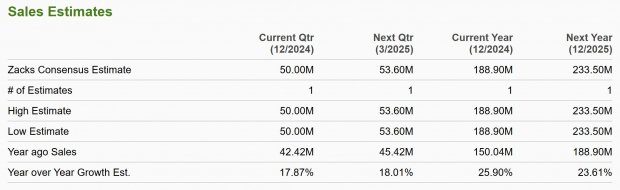

Talkspace is also already showing strong growth forecasts, with annual sales expected to grow more than 20% this year and next. Additionally, Talkspace holds a Zacks Rank #1 (Strong Buy) rating, indicating optimism from analysts about its growth trajectory.

As public awareness and acceptance of mental health services continue to grow, Talkspace is primed to benefit from both increased demand and favorable industry trends.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Should Investors Buy TALK, TSLA and PLTR Shares?

For investors navigating the post-election landscape, focusing on stocks with both promising fundamentals and an edge in a Trump-led economy may be an effective strategy. Tesla, Palantir, and Talkspace each stand out as companies that could benefit from a pro-business environment as well as from specific sectoral trends that align with a Trump presidency.

These stocks are well-positioned for potential growth, both due to political trends and strong underlying business fundamentals. Investing in companies with solid revenue and earnings growth, favorable valuations, and high Zacks Ranks has historically proven more reliable than attempting to predict how any single administration will influence the stock market.

Ultimately, these picks offer a mix of industry resilience and alignment with broader economic trends, making them promising options for a Trump presidency and beyond.

— Ethan Feller

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks