If you’re like me, when you see an outsized dividend yield, you stop for a second and immediately do the mental math. How much would we get back in payouts from, say, a 9.3% payer if we were to invest $10,000? Or $20,000? Or $100,000?

But savvy contrarians we are, we know to push back on this initial reaction and look deeper.

Because (as we contrarians know), those big yields can (and usually are) a danger sign.

Truth is, a rising dividend is only one possible reason for a high payout.

In fact, it’s the least likely one.

More often, a high yield stems from something we want no part of: a plunging share price. Dividend “darling” Verizon Communications (VZ), with a current yield of around 6.5% as I write this, is the poster child here.

With a yield like that, mainstream investors might think VZ holders have been happily pocketing payout hike after payout hike. I mean, they have seen dividend raises, but I’m not sure they’re happy with them! VZ’s “raises” are usually only about a penny a year.

In the last five years, VZ’s dividend has risen, but only about 10%. You and I both know that inflation has been far higher than that—and that measly growth hasn’t been enough to attract new investors to the share price. It’s down 31% in that time.

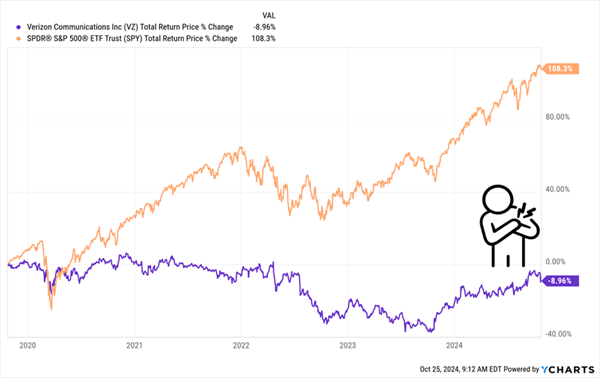

Heck, even when you include dividends, VZ’s total return is still underwater by 9% over that period—in a time when the S&P 500 returned 108%!

High Current Yield Fails to Make Up for “Underwater” Share Price

This is all a (perhaps longwinded!) way of saying we need to look beyond the shiny veneer of a high yield. I’ve got a proven tool for doing just that, which we’ll get into next. We’ll delve into two “authentic” dividend growers for you to consider, too.

This is all a (perhaps longwinded!) way of saying we need to look beyond the shiny veneer of a high yield. I’ve got a proven tool for doing just that, which we’ll get into next. We’ll delve into two “authentic” dividend growers for you to consider, too.

Shareholder Yield Beats Dividend Yield in Every Way

At the end of the day, a dividend stock has three ways to pay us:

- Its current payout: This, of course, is the dividend we get after we buy.

- Dividend growth, which increases the yield on our original buy and acts like a “magnet” on the share price, with the rising payout pulling the share price up.

- Share buybacks, which cut the number of shares outstanding, juicing earnings per share and other per-share metrics.

Buybacks get a bad rap, but they shouldn’t, because when they’re done right (i.e., when the stock is cheap), they can seriously juice our returns. This is another problem with the current yield—it tells us nothing about this buyback effect.

This is where my favorite measure of how much a company is rewarding shareholders comes in. It’s called shareholder yield, and it includes buybacks and dividends.

Lockheed’s Shareholder Yield Flies High

To see it in action, let’s consider Lockheed Martin (LMT), best known for making the F-35 joint-strike fighter, as well as weapon systems and sensors that are mainstays of militaries around the world.

Even though the stock has gained strongly in the last few years, in part (but not fully, as we’ll see in a second) due to higher global instability, the mainstream, current yield–focused crowd would barely give it the time of day, given its low 2.3% dividend yield.

But let’s ignore that for a second and factor in Lockheed’s payout growth, which has been strong: The dividend is up about 38% in just the last five years. That’s definitely had an effect on the share price, pulling it up in unison:

Lockheed’s “Dividend Magnet” in Action

In fact, we could say LMT’s stock has gotten a bit too far ahead of the payout here. This partly explains why the stock has pulled back over the last few days, as its third-quarter revenue came up a bit short of expectations in its recently released earnings report, though LMT beat on the bottom line and boosted full-year guidance.

In fact, we could say LMT’s stock has gotten a bit too far ahead of the payout here. This partly explains why the stock has pulled back over the last few days, as its third-quarter revenue came up a bit short of expectations in its recently released earnings report, though LMT beat on the bottom line and boosted full-year guidance.

And because of that payout growth, folks who bought LMT just five years ago are yielding 3.5% on their original buy now. Sure, that doesn’t exactly knock our socks off, but it is about 50% higher than today’s 2.3% current yield.

Now let’s move on to buybacks: Lockheed has taken 16% of its shares off the market in the last five years, making all those per-share metrics look better. By the way, if you don’t think buybacks matter, check out how LMT’s share price took off starting in 2022, when management really amped up its buyback action:

Share Count Dives, Stock Price Soars

The beautiful thing about shareholder yield is that it combines all three types of shareholder rewards: current dividend, payout growth and buybacks. Let’s look at how to calculate it—then I’ll drop an even better stock, with a higher shareholder yield, for you to buy.

The beautiful thing about shareholder yield is that it combines all three types of shareholder rewards: current dividend, payout growth and buybacks. Let’s look at how to calculate it—then I’ll drop an even better stock, with a higher shareholder yield, for you to buy.

How to Calculate Shareholder Yield

To calculate shareholder yield, take the amount a company spent on share repurchases in the preceding 12 months, deduct any cash brought in through share issuances, then add in the total spent on dividends.

You then take that sum and divide it into the company’s market cap, or the value of all its outstanding shares.

In LMT’s case, that comes out to $3.05 billion spent on dividends and $5.7 billion spent on buybacks, for a total of $8.75 billion in total shareholder returns in the past 12 months. With a $132.9-billion market cap, we can say that Lockheed sports a 6.6% shareholder yield—nearly triple the 2.3% current dividend yield.

Beyond LMT: This Stock Drops an Eye-Popping 14.6% Shareholder Yield

If you read last Tuesday’s article, you know I’m bullish on refiners—the price of their main feedstock, oil, has dropped.

Meanwhile demand for their finished products—gasoline, mainly—stands to rise as the “no-landing” scenario I’m predicting (where the economy keeps growing but inflation returns) plays out.

And lucky for us, refiners offer some of the highest shareholder yields out there! Consider Valero Energy (VLO), the third-biggest refiner by market cap, behind Marathon Petroleum (MPC) and Phillips 66 (PSX).

While VLO’s current yield is just 3.2%, its shareholder yield is a lot higher. In the last 12 months, VLO spent $1.4 billion on dividends and $4.8 billion on buybacks, for a total of $6.2 billion on all shareholder rewards. Divide that by VLO’s $42.6-billion market cap and you get a shareholder yield of 14.6%

Fourteen point six percent!

That shareholder friendliness is one reason to like the stock. Its recent disappointing earnings report doesn’t change the tailwinds it’s poised to ride—and sets up an opportunity to buy.

— Brett Owens

Soft Landing? Hard Landing? Inflation? These Dividends Don’t Care. [sponsor]

Look, we’ve got a contentious (to say the least!) election now days away. Plus, no matter what the Fed says, 10-year Treasury rates are popping higher.

That adds to the evidence that inflation isn’t quite as over as Jay Powell would like.

Truth is, no one knows what things will look like even a couple of weeks from now.

But one thing I do know is that at times like these, the 5 “recession-resistant” dividends I’m urging investors now are smart, pragmatic buys. Thanks to their fast-growing payouts (and powerful Dividend Magnets), I expect these 5 stocks to return 15%+, on average, for years to come.

And if markets do take a short-term tumble, we can take some solace when we own these 5, because their bargain valuations and soaring payouts will help insulate their downside.

These 5 dividend growers are the ideal names to own in worrying times like these. Click here and I’ll tell you more about them and give you a FREE Special Report revealing their names and tickers.

Source: Contrarian Outlook