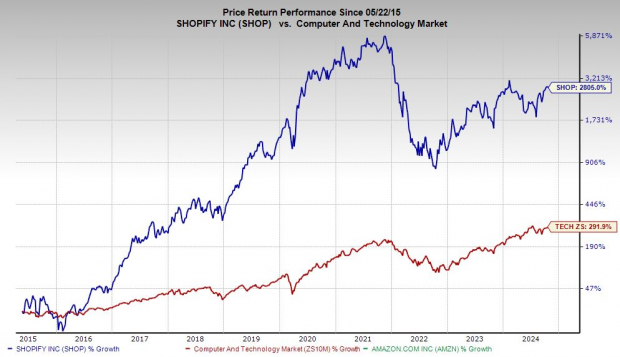

Shopify Inc. (SHOP) stock has doubled the Technology sector over the last two years and blown it away since SHOP’s 2015 IPO.

Shopify stock crushed Amazon during both periods, yet it trades 50% below its all-time highs.

Shopify’s impressive revenue and earnings outlook is driven by its expansion and profit-focused streamlining efforts. Shopify boasts a stellar balance sheet and its offerings become integral to its growing portfolio of diverse clients.

It might be time for investors to buy Shopify stock down 50% from its peaks while tons of other big tech stocks appear overheated and trade near all-time highs.

Why Shopify Continues to Thrive in an E-commerce World Dominated by Amazon

Shopify helps its clients grow online and in person in an e-commerce and retail world dominated by Amazon (AMZN) and Walmart. The company offers solutions across four core phases of business: start, sell, market, and manage.

Shopify’s portfolio includes everything from website creation and design to sales, marketing, payments, automation, inventory, shipping, and much more. Shopify’s customers span entrepreneurs, small and mid-businesses, and large enterprises.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Shopify is thriving in the Amazon-heavy e-commerce industry by catering to sellers and businesses, while Amazon ruthlessly focuses on getting consumers any product as fast as possible at the lowest price.

Shopify expanded from $1.1 billion in revenue in 2018 to $7.1 billion in FY23 by empowering its clients to efficiently sell across digital channels, in-store, wholesale, and beyond.

Shopify’s Growth and Outlook

Shopify makes money from recurring subscription fees and various add-ons. Shopify’s days of 60% revenue growth are over, but it is making up for that with higher prices and a focus on profits.

Shopify raised its prices in 2023 (by roughly 30% for its various plans) for the first time in over a decade.

Shopify posted a strong beat-and-raise second quarter. The company said it “is rapidly strengthening its position as a leading enabler of global commerce and entrepreneurship.”

Shopify’s Gross Merchandise Volume grew by 22% to $67.2 billion. SHOP’s Gross Payments Volume reached $41.1 billion, representing 61% of GMV processed vs. 58% in the year-ago period—GPV is the amount of GMV processed through Shopify Payments.

SHOP grew its quarterly revenue by 21%, or 25% after adjusting for the sale of its logistics businesses. Subscription Solutions revenue increased 27%, “driven by growth in the number of merchants and pricing increases on our subscription plans.”

Meanwhile, Merchant Solutions revenue increased 19% to $1.5 billion. On top of that, Shopify more than doubled its free cash flow margin to 16%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Shopify is projected to grow its sales by 22% in 2024 and 20% in 2025 to surge from $7.1 billion last year to $10.3 billion next year (SHOP did $1.6 billion in sales in pre-Covid 2019).

SHOP is expected to boost its adjusted earnings by 51% in 2024 to $1.12 a share and then boost its bottom line by 19% next year. Shopify’s upbeat earnings revisions help it land a Zacks Rank #1 (Strong Buy).

SHOP’s most accurate/recent EPS estimate for FY25 came in 13% above its already-improved consensus.

Shopify executives earlier this year reaffirmed their commitment to keeping things lean, with the company saying that employee onboarding has been “essentially flat” for the past five quarters.

Time to Buy Shopify Stock on the Dip?

Shopify shares have climbed roughly 2,800% since its 2015 IPO, blowing away Amazon’s 800% and Tech’s 300%. Shopify stock was a Wall Street star long before Covid hyper-charged the stock.

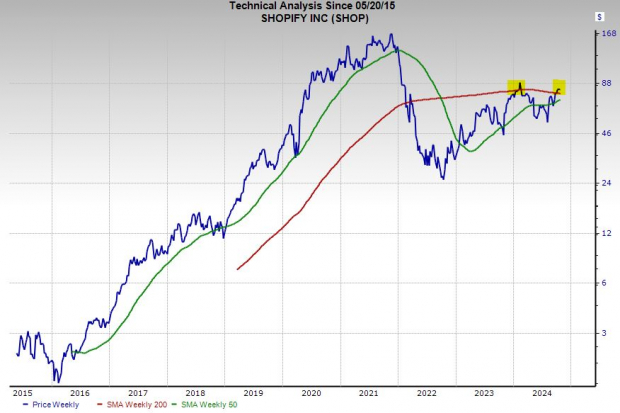

Shopify shares then got hammered by higher rates and slowing growth. Shopify trades roughly 50% below its 2021 peaks despite soaring 185% in the last two years.

Shopify is attempting to hold its ground at its 21-day moving average. SHOP stock is back above its 200-week moving average for the second time since its massive pullback.

SHOP stock could break above its early 2024 levels if it provides solid guidance when it reports its Q3 results.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Shopify’s 10-for-1 stock split in mid-2022 helped make it more attainable to a larger swath of investors (currently trading for around $82 a share).

SHOP’s sky-high valuation is holding the stock back, but its commitment to earnings and streamlined growth is helping.

SHOP’s 2.4 PEG ratio, with factors in its long-term earnings growth outlook, marks an 84% discount to its recent highs and not too large of a premium compared to the Zacks Tech sector (1.6).

Why Shopify is the Bull of the Day Stock

Shopify is growing its reach in a critical area of the economy. SHOP’s robust balance sheet ($5 billion in cash and equivalents $11.3 billion in total assets vs. $2.2 billion in total liabilities) will help Shopify continue to expand and possibly invest in the next critical frontier of commerce.

It might be worth adding exposure to Shopify stock 50% below its peaks while the S&P 500 trades near all-time highs.

— Benjamin Rains

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks