Limbach Holdings, Inc. (LMB) is a rare red-hot small cap company. This Zacks Rank #1 (Strong Buy) is up 85.9% year-to-date.

Limbach is a building systems solutions firm specializing in revitalizing mission-critical electrical, plumbing, and mechanical/HVAC infrastructure within existing buildings.

Headquartered in Pennsylvania, it works with building owners in six markets: healthcare, industrial and manufacturing, data centers, life science, higher education and cultural and entertainment.

Limbach has more than 1200 employees across 19 offices in the eastern United States to provide services essential to the operation of their clients’ business. It’s a small cap company with a market cap of $921.1 million.

Limbach Beat Big in the Second Quarter of 2024

On Aug 6, 2024, Limbach reported its second quarter results and beat on the Zacks Consensus Estimate by 35.1%. Earnings were $0.50 versus the consensus of $0.37.

This was the second big earnings beat in a row.

The company is executing on a strategy to increase its Owner Direct Relationships (“ODR”) business and to lessen its General Contractor Relationships (“GCR”) business.

The ODR business focuses on existing buildings and gets recurring revenue from service and contracts. It’s more stable and resilient against macroeconomic changes.

The GCR business is new construction. It’s more cyclical and can be volatile depending on changes in the economy.

ODR Business Versus the GCR Business

In 2023, the revenue from each business segment had been split 50-50. But the strategy for beyond 2024, is to grow the ODR business into 80% of the revenue versus 20% for the GCR.

Why focus on the ODR business?

The margins are much higher. In 2023, ODR quarterly gross margins ranged from 27.1% to 30.1% but the GCR gross margins only ranged from 15% to 19.3%.

As a result of the focus to growth the ODR business, Limbach saw record gross margins in the second quarter of 2024 of 27.4%.

ODR revenue rose 40.8%, to $82.8 million from $58.8 million a year ago while GCR fell to $39.5 million from $66.1 million the year before.

Total revenue, however, was down 2.1% to $122.2 million from $124.9 million, even as the mix changed.

Limbach believes that while revenue has been flat since 2019, it will improve as the ODR business grows.

The analysts believe that too. While revenue is expected to grow just 1.3% in 2024, the analysts see it jumping 12.8% in 2025.

Analysts are Bullish on Limbach’s Earnings for 2024 and 2025

While revenue is expected to be up only in the single digits, that’s not the case for the earnings.

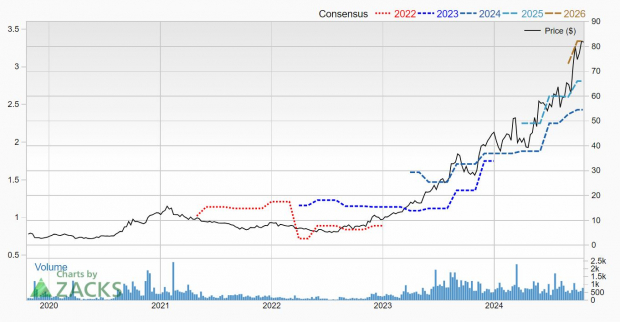

The 2024 Zacks Consensus is calling for $2.43 versus just $1.76 last year. That’s earnings growth of 38.1%.

2025 is also looking bullish with the Zacks Consensus Estimate jumping to $2.81, which is another 15.6% earnings growth.

Here’s what it looks like on the chart. It’s certainly a big turnaround from 2023.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Shares of Limbach Soar in 2024

The Street has caught onto the turn towards the higher margin ODR business. The shares are up big this year, easily beating the performance of the NASDAQ.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Limbach isn’t cheap. It has a forward P/E of 33.6.

It will report third quarter earnings in Nov 2024.

If you’re an investor looking for a red-hot small cap growth stock, then Limbach is one to keep on your short list.

— Tracey Ryniec

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks