The Fed has finally cut interest rates.

By taking the Federal Funds benchmark down 50 basis points (bps) yesterday, it marks the first rate cut in four and a half years.

This shift to easing policy means that the cost of capital is heading lower… and that’s a good thing for business and the economy. So be happy!

Now, I’ll bet that pundits will argue whether we’re heading for a soft or hard landing. Respectfully… I view that as a waste of time.

I’d rather put energy towards uncovering great stocks that can thrive no matter what kind of landing we get.

Just as we showed last November how history can help us find three stocks to buy before the Fed cuts rates, today we’ll showcase stocks that have handsomely rewarded investors as the Fed embarked on its rate-slashing spree.

The bears will have you believe rate cuts are doom and gloom. Just don’t buy into that argument… you’ll miss the big move that’s coming.

But, before we unpack a hard-hitting evidence-rich study, let’s first stroll down history lane and review prior times when the Fed began slashing rates.

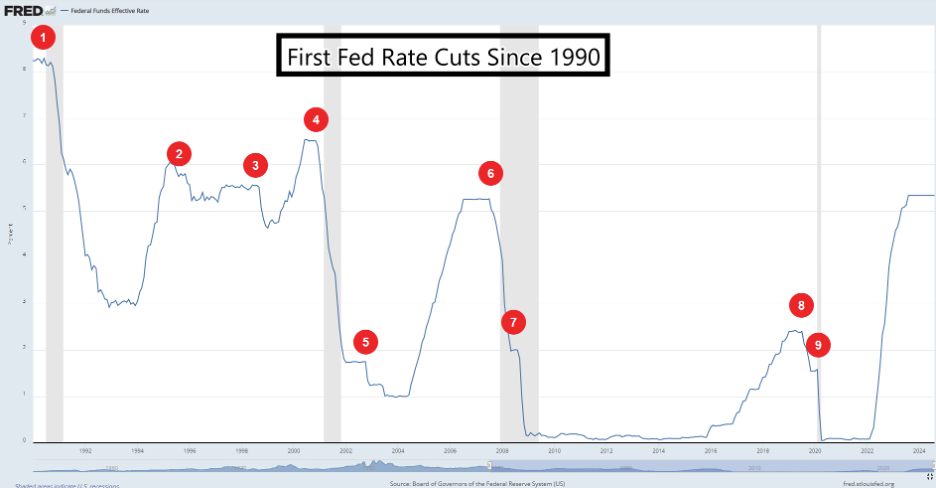

The Last Nine Rate-Cut Regimes

Over the past 34 years, the Fed has started rate-cut regimes nine times previously.

A breakdown of those initial interest-rate cuts are as follows:

- July 1990, during the Gulf War (25 bps cut)

- July 1995 Mid-cycle adjustment (25 bps cut)

- September 1998 Global Currency Crisis (25 bps cut)

- January 2001 Dot-Com Bubble Crisis (50 bps cut)

- November 2002 (50 bps cut)

- September 2007 Housing Crisis (50 bps cut)

- October 2008 Global Financial Crisis (50 bps cut)

- August 2019 Mid-cycle adjustment (25 bps cut)

- March 2020 COVID-19 Pandemic (50 bps cut)

These notable periods are illustrated below on the Federal Reserve Economic Data (FRED) chart back to 1990. You’ll also see the four recessions shaded in gray:

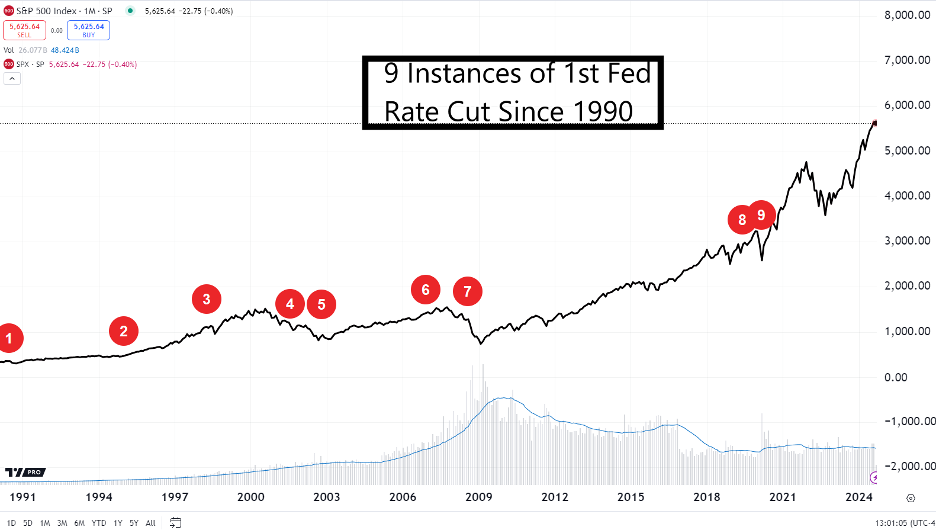

By using the same framework, let’s now overlay these nine events on the S&P 500.

By using the same framework, let’s now overlay these nine events on the S&P 500.

It may be hard to tell from the image, but 2002 (number 5 on the chart below), 2007 (number 6), and 2008 (number 7) saw markets fall hard once the Fed began cutting rates:

Sadly, many bearish pundits only focus on these big global panics to stir investors’ emotions.

Sadly, many bearish pundits only focus on these big global panics to stir investors’ emotions.

The reality is that, on average, after all nine of these instances… the S&P 500 has gained 7.7% in the following 12 months, with a 78% win rate.

In other words, the odds are strong that the stock market will be higher this time next year…

So, this is no reason to abandon stocks. In fact, you should focus on the companies that have shown an ability to thrive whether we see a “hard landing” (recession) after rates got so high for so long…or a “soft landing” (no recession).

Three Stocks to Buy As the Fed Starts Cutting Rates

While equity markets may have ho-hum returns after the Fed initially cuts rates, there are a few stocks that absolutely thrive under rate-cut regimes… crushing the benchmarks.

And for good measure, we’ve discussed two of these names before in TradeSmith Daily.

The first stock that you should consider owning during a Fed rate-cut cycleis bulk discount retailer Costco (COST). (Disclosure, I’ve owned COST for many years.)

Costco might sound like a boring old staples stock. But when you look at their numbers, you’d realize you’re 100% wrong.

You see, this business is a staple to consumers all over the nation. In 2023, sales for this retail giant stood at $242.3 billion and they’re expected to eclipse $273.8 billion in 2025.

Net income in 2023 stood at $6.3 billion and is estimated to reach $7.9 billion in 2025.

Sales and earnings growth is always a great sign for a company. But what makes Costco a good bet for 2025 is simply its market history.

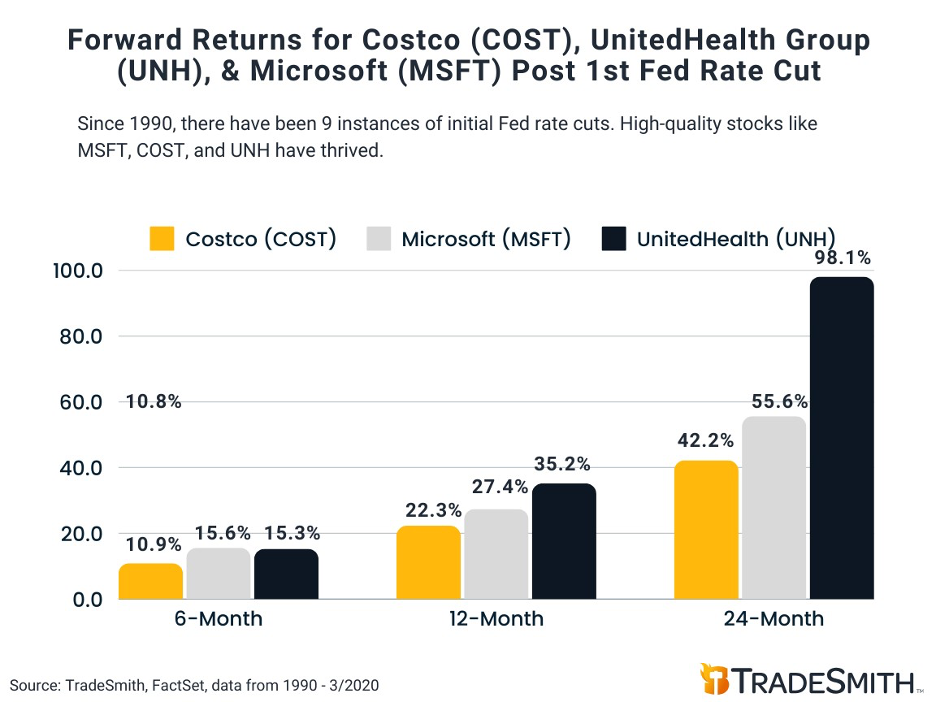

During the previous nine initial Fed interest-rate cuts, COST has managed to gain:

- 10.9% six months later,

- 22.3% 12 months later,

- And 42.2% 24 months later.

What will 2025 bring for COST shares? No one knows for sure, but odds suggest upside!

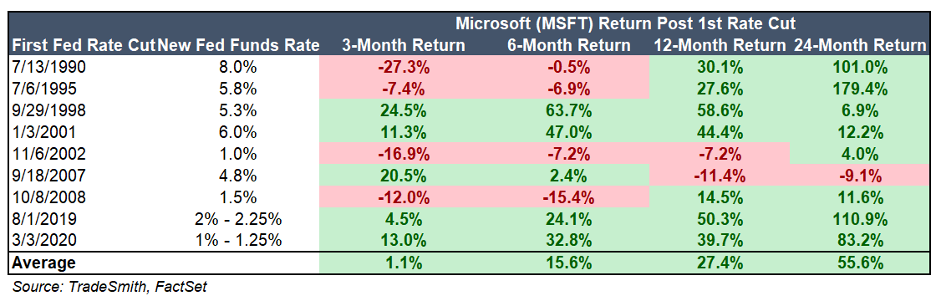

The second stock to hold as the Fed begins cutting rates is software behemoth Microsoft Corp. (MSFT). (Disclosure, I’ve owned MSFT for years.)

At last measure, Microsoft is the second largest stock in the world, at a $3.2 trillion market cap. Given revenues came in at $198.3 billion in 2022, $211.9 billion in 2023, and are estimated to reach $319.4 billion in 2026… it’s no question this company is an all-star.

And the profits keep piling up, too. In the fiscal year 2024, MSFT had a staggering net income of $88.1 billion.

With numbers like that, it’s no surprise this is a rare superstar outlier.

But here’s where the rubber meets the road for today’s environment.

Since 1990 when the Fed has initially cut interest rates previously, MSFT shares have soared with:

- Six-month gains of 15.6%,

- 12-month jumps of 27.4%,

- And 24-month rips of 55.6%.

Don’t fear rate cuts… just buy best-of-breed companies. Let’s keep going!

Don’t fear rate cuts… just buy best-of-breed companies. Let’s keep going!

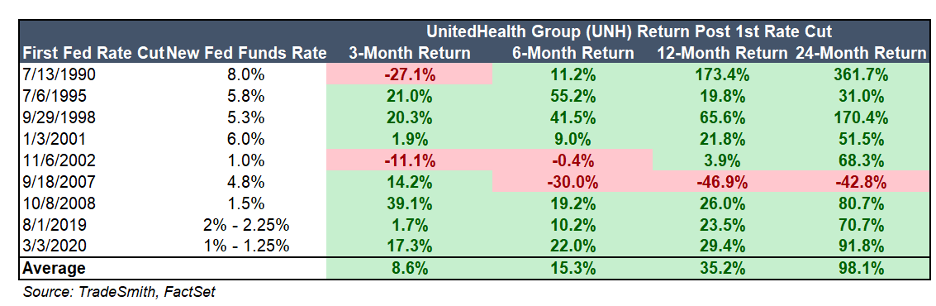

The third stock set to thrive as the Fed begins easing rates is UnitedHealth Group (UNH).

Let’s face it; we all need health care. Yet costs have been going only one way the last few years: up.

So, the cure to rising health-care costs is to bet alongside the insurers like UNH.

Profits keep climbing for UnitedHealth. In 2021, its net income clocked in at $17.3 billion, and by 2023 that number grew to $22.4 billion.

Healthy gains on the bottom line tend to help stock prices… and, apparently, after the Fed begins cutting rates.

Here we can see how since 1990 after the first Fed rate cut, UNH has soared, with:

- Six-month gains of 15.3%,

- 12-month ramps of 35.2%,

- And 24-month rips of 98.1%.

With numbers like this, I say have guts… and buy into the cuts!

With numbers like this, I say have guts… and buy into the cuts!

Here’s a compact graphic highlighting the truth about initial Fed rate cuts… Pick the right stocks, and you’ll be rewarded:

If you want even more TradeSmith analysis on how we found these three names, you can watch my video deep dive right here.)

If you want even more TradeSmith analysis on how we found these three names, you can watch my video deep dive right here.)

The bottom line is this: Don’t spend a lot of time worrying about the economy or interest rates.

It’s hard to predict and, frankly, it’s a waste of time.

You’ll be better served by focusing on quality businesses with simple, inarguable factors: easy to understand, loved by consumers, and excitingly profitable.

Limit your investment search to these three criteria, and odds are you’ll outperform the masses.

Costco, Microsoft, and UnitedHealth Group check off all three attributes. As it turns out, these stocks tend to surge when the Fed starts chopping rates… you can do the math.

Some key stocks are going to rip in 2025.

Have guts and buy into the cuts!

Regards,

Lucas Downey

Contributing Editor, TradeSmith Daily

Source: TradeSmith