Now that August is in the books, which sector will climb to the top for the remainder of 2024?

In today’s signal study, we’ll be looking back through history to learn which group thrives the most in the last four months of the year.

And no, it’s not Tech.

Even though Tech does have strong September – December historical returns, one less-covered group takes the top spot.

Let’s set the scene by seeing where each sector ranks for the year-to-date, then we’ll dive into the top groups poised to thrive in the final innings of the year.

Most importantly, I’ll then offer up a top-ranking stock with a wonderful end-of-year batting average beginning in September.

Stocks are Off to a Huge Start Through August

The train keeps on chugging along. Through the first eight months of the year, the S&P 500 has managed to return a market-beating 18.42%.

To put that into perspective, it’s the second best January – August return going back to 1997. The only recent year where the large-cap index climbed further was 2021, with a chunky 20.41% gain.

When we dive below the surface, we find four groups that surpassed the S&P’s performance:

- Information Technology, which gained 26.53%;

- Communication Services, with a 22.34% jump;

- Financials, posting a 21.21% jolt;

- And Utilities, with a healthy 19.75% rally.

The chart below details all YTD sector returns through August. It’s not just those four that are doing well – seven out of 11 groups have posted double-digit gains:

The great news here is that big momentum starts to the year often signal a greenlight into year-end.

The great news here is that big momentum starts to the year often signal a greenlight into year-end.

When the S&P 500 gains at least 10% through August, the index averages a gain of 4.94% through the balance of the year.

So, keep this in mind. Don’t fade this strength…prepare for more upside.

As for which groups to lean into right now, we’ll turn to today’s historical study.

The Top S&P 500 Sector to Bet On Into Year-End

They say that history never repeats, but it often rhymes.

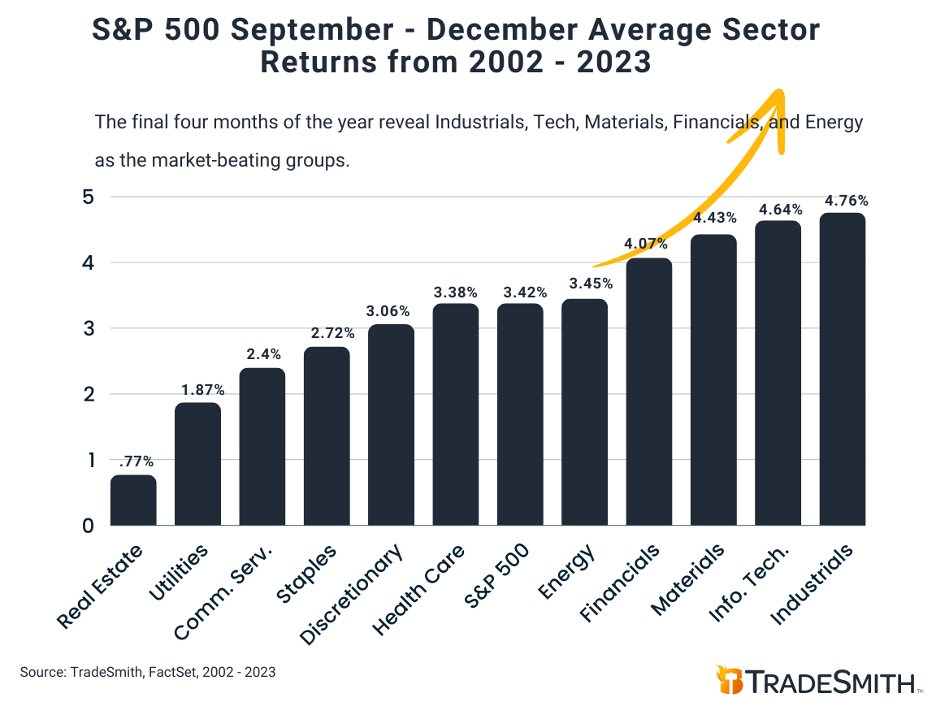

So, I went back and pulled returns of each of the S&P 500 sectors for September through December.

Turns out, since 2002 the S&P 500 has managed to gain an average of 3.42% in the final four months. Even more interesting are the five sectors that have outperformed the major index during that period:

- Industrials, with a gain of 4.76%;

- Information Technology, with a 4.64% performance;

- Materials, clocking a 4.43% gain;

- Financials, jumping 4.07%;

- And Energy, boasting a solid 3.45% return.

So, while Tech is still very much on the board, it’s been taken down a peg: supplanted by Industrials.

So, while Tech is still very much on the board, it’s been taken down a peg: supplanted by Industrials.

Now that we’re armed with some data-driven analysis based on 22 years of history, let’s use it to our advantage…

A Top Industrial Stock Approaching a Rare Unbeaten Window

Nothing is more of a joy to discuss with you here than a truly outstanding stock…except, of course, when that stock has two lift-off signals converging at once.

That’s what we have here with Trane Technologies (TT).

You may have seen Trane’s logo emblazoned on its residential heating, ventilation and air conditioning (HVAC) units, but it’s a rarely discussed stock. Nonetheless, TT has had a stunning start to 2024. Its one-year gain of 75.6% easily trumps the S&P 500’s 25.1% thrust:

Now, to give you reasons to own this stock, I could go on and on about Trane’s fundamental achievements, like its net income growth (from $1.34 billion in 2018 to $2.02 billion in 2023) or the earnings per share growth (from $5.35 in 2018 to $8.77 in 2023).

Now, to give you reasons to own this stock, I could go on and on about Trane’s fundamental achievements, like its net income growth (from $1.34 billion in 2018 to $2.02 billion in 2023) or the earnings per share growth (from $5.35 in 2018 to $8.77 in 2023).

But what you really need to know is: There are two market dynamics suggesting a timely gain could be headed Trane’s way.

The first is a strong seasonal tailwind between Sept. 4 and Dec. 3.

By checking the TradeSmith Seasonality tool, we find that TT has a 100% batting average of rising during this window in the last 15 years, with a powerful average return of 10.68%, as you see in the below snapshot of the seasonality data going back to 2009:

Looks like this Trane is ready to leave the station!

Looks like this Trane is ready to leave the station!

Let’s take stock of what we have discovered so far:

- Markets are primed for more gains into year-end, with Industrials having the best track record during this period.

- We’ve isolated a high-quality stock in that group, Trane Technologies, with an especially strong seasonal buy signal at the moment.

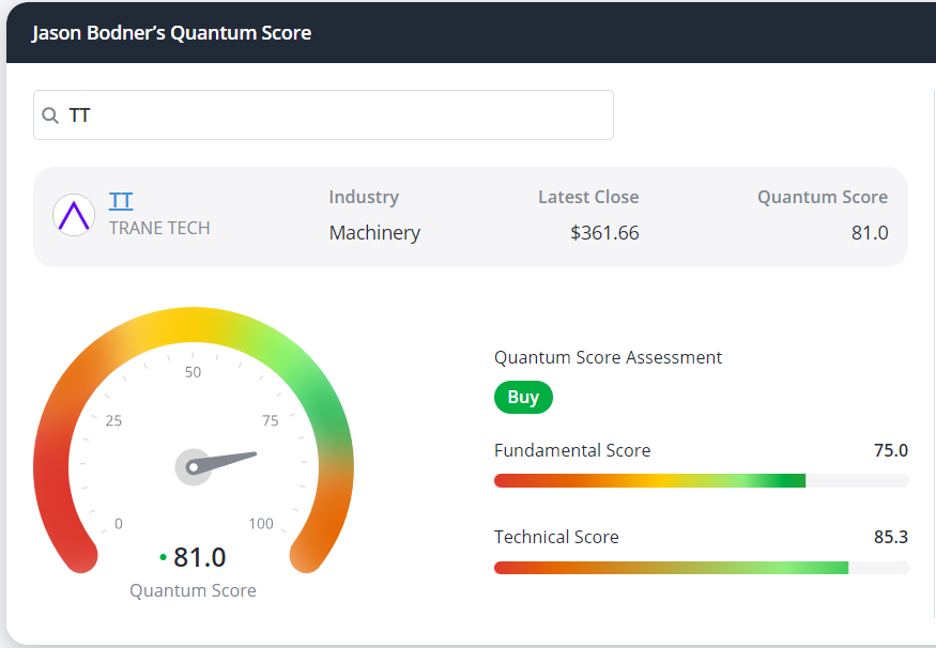

We could just end the research here and call it a day. But to really make sure we’re making this “bet” at the right time…we can also reference my favorite TradeSmith indicator: the Quantum Score.

This all-in-one scoring mechanism instantly sizes up a company based on fundamental and technical criteria. The best time to buy is when a company scores 70 – 85. (Anything above that, and you figure the stock has gotten “overheated,” so the buy window has closed for now.)

Below we can see how Trane has a Quantum Score of 81, highlighting positive fundamental and technical attributes:

Folks, this one data point seals the deal for me when it comes to stocks ready for blast-off.

Folks, this one data point seals the deal for me when it comes to stocks ready for blast-off.

If you’re not using the all-so-common September volatility as an opportunity to buy great stocks like this, I humbly believe you’re missing out.

We’ve got momentum on our side and a bullish case for Industrial stocks into December…

Throw in the evidence that Trane Technologies tends to soar in September – December, and the fact that it’s one of the best-ranking names out there…

And I’m all aboard this train!

From where I’m sitting, the best part of evidence-rich studies like these is how they highlight the power in having a process…especially during these trying times.

Regards,

Lucas Downey

Contributing Editor, TradeSmith Daily

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Trade Smith