When Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett buys or sells shares of a company, professional and everyday investors pay close attention. That’s because the aptly dubbed “Oracle of Omaha” has nearly doubled-up the annualized total return of the benchmark S&P 500 since becoming CEO in 1965. This near-doubling in annualized total return spanning almost six decades works out to an aggregate increase in Berkshire’s Class A shares of 5,347,200%, as of the closing bell on Aug. 15.

Even though Buffett is just as fallible as any other investor, he’s demonstrated a knack for finding amazing deals hiding in plain sight. Thus, riding his coattails has been a fruitful investment strategy for decades.

But it’s just as important to know when to sell as it is to understand what stocks to buy.

Last week, Form 13Fs were filed by institutional investors with at least $100 million in assets under management. A 13F provides a concise snapshot of what Wall Street’s brightest and most-successful money managers have been buying and selling.

Berkshire Hathaway’s 13F revealed record selling activity for the Oracle of Omaha and his top investment aides, Todd Combs and Ted Weschler. This trio has overseen seven consecutive quarters of net-equity security sales, with more than $75 billion in net-equity sales during the June-ended quarter.

What follows are the 10 stocks Warren Buffett was a seller of during the second quarter.

1. Apple: Sold 389,368,450 shares (reduced stake by 49.33%)

The jaw-dropper of Berkshire Hathaway’s 13F, which was technically given away earlier this month by the release of the company’s second-quarter operating results, was the nearly 50% reduction in top holding Apple (AAPL).

Although Buffett has been unwavering in his love for Apple as a business, and absolutely appreciates its historic capital-return program, he opined during his company’s annual shareholder meeting in May that corporate tax rates were liable to climb in the future. With Berkshire Hathaway sitting on enormous unrealized gains from its stake in Apple, Buffett hinted that investors would, in hindsight, appreciate his company locking in these gains at a relatively lower tax rate.

Even after selling more than 389 million shares of Apple, it still accounts for about 29% of Berkshire’s invested assets.

2. Paramount Global: Sold entire stake (7,531,765 shares)

2. Paramount Global: Sold entire stake (7,531,765 shares)

Completely exiting Berkshire’s stake in media stock Paramount Global (PARA) comes as no surprise. During the same annual shareholder meeting where Buffett ventured a guess that corporate tax rates would climb, he noted that he (and he alone) had disposed of the remaining 7.5 million shares of Paramount that had been held, as of March 31 — and at a sizable loss!

Like most legacy media companies, Paramount has had to shift its focus to streaming options as cable cord-cutting accelerates. Unfortunately, building out a streaming content library has proved challenging and weighed down the company’s operating results.

Paramount is one of those rare misses for the Oracle of Omaha.

3. Snowflake: Sold entire stake (6,125,376 shares)

One of the biggest surprises from 13F season is the complete disposition of Berkshire’s stake in cloud data-warehousing company Snowflake (SNOW).

Let’s be crystal clear: This was not a Buffett buy. I’d venture a guess that Buffett doesn’t understand the first thing about cloud data-warehousing. Rather, it was likely Todd Combs and/or Ted Weschler making the call to exit this stake, which was entered at Snowflake’s initial public offering (IPO) price four years ago.

Although Snowflake possesses clear-cut competitive advantages, its growth rate has slowed meaningfully since its IPO, and its valuation has remained lofty. With the stock market historically pricey, Snowflake is a candidate to get clobbered if the Nasdaq Composite rolls over.

Macro factors, such as tight global oil supply, have helped to lift the spot price of crude oil. WTI Crude Oil Spot Price data by YCharts.

Macro factors, such as tight global oil supply, have helped to lift the spot price of crude oil. WTI Crude Oil Spot Price data by YCharts.

4. Chevron: Sold 4,369,673 shares (reduced stake by 3.55%)

For a second consecutive quarter, Buffett and his crew modestly reduced their company’s stake in oil and gas goliath Chevron (CVX).

Since this century began, energy stocks have often played a minimal role for Berkshire’s investment portfolio. But with Buffett and his crew steadily building up Berkshire’s stake in Occidental Petroleum, which was described as an “indefinite” holding in Buffett’s latest annual letter to shareholders, we may be witnessing corresponding reductions in the Chevron stake. In other words, Berkshire’s brightest investment minds may not want any additional oil and gas exposure as they increase their stake in Occidental.

However, with macro factors generally supportive of a higher spot price for crude oil, it would be surprising to see Buffett substantially reduce his company’s stake in Chevron.

5. Capital One Financial: Sold 2,651,978 shares (reduced stake by 21.27%)

Perhaps the most head-scratching move of all from Berkshire’s 13F is the sale of 2.65 million shares of credit-services company Capital One Financial (COF).

Buffett is generally a huge fan of brand-name value stocks in the financial sector. Capital One shares can currently be scooped up for less than book value, and sport a forward price-to-earnings (P/E) ratio of 8.6. It’s a company that’s taken advantage of the steepest rate-hiking cycle in four decades.

The best guess I can offer as to why Buffett & Co. pared down their stake in Capital One is consumer credit card delinquency trends. According to the Federal Reserve Bank of New York, 7.18% of credit card debt was seriously delinquent (90 or more days) in the second quarter, up from 5.08% in the comparable quarter last year.

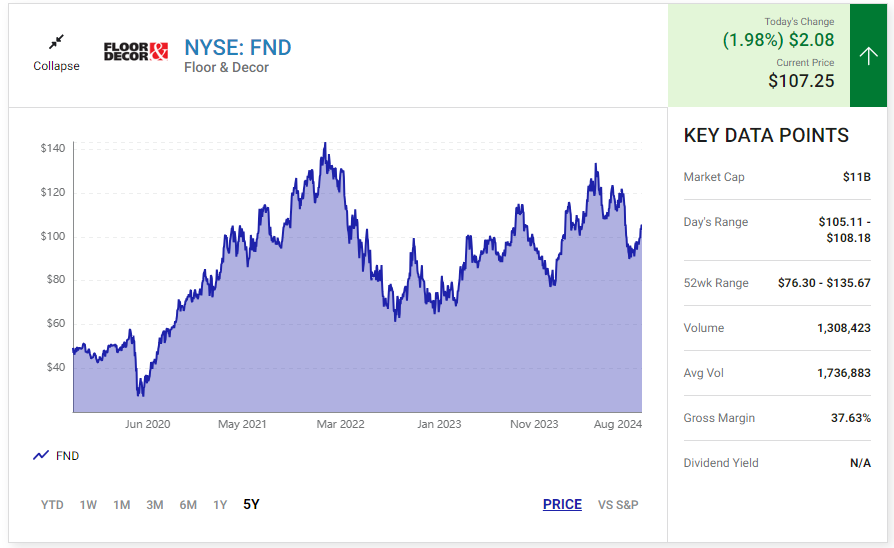

6. Floor & Décor: Sold 802,130 shares (reduced stake by 16.78%)

6. Floor & Décor: Sold 802,130 shares (reduced stake by 16.78%)

The roughly 802,100-share reduction in Floor & Décor (FND) has a similar feel to Snowflake in that it’s probably more Combs’ and Weschler’s doing than Buffett’s.

Floor & Décor is a company that initially benefited from a rapid rise in interest rates. As mortgage rates soared, it set the stage for the company to reap the rewards of people choosing to stay in their existing homes and remodel.

Unfortunately, the luster of this higher-rate environment has worn off. CEO Tom Taylor has cautioned that higher rates are negatively impacting discretionary spending on hard surface flooring, which has brought topline growth for Floor & Décor to a near-standstill. While management has levers it can pull to potentially boost its margins, its forward P/E of 51 can’t be swept under the rug.

7. Louisiana-Pacific: Sold 633,154 shares (reduced stake by 9.6%)

7. Louisiana-Pacific: Sold 633,154 shares (reduced stake by 9.6%)

With the exception of Apple, Paramount, and Chevron, where Berkshire’s operating results and/or comments from Buffett gave away that selling activity had occurred, I’d argue the easiest-to-predict reduction was siding solutions provider Louisiana-Pacific (LPX).

Last week, I postulated that Buffett and his investment aides would completely exit this stake given the expectation of a Fed rate-easing cycle beginning in September.

When mortgage rates soared, it effectively froze the market for existing-home sales and opened the barn door for suppliers of homebuilders, like Louisiana-Pacific, to thrive. As mortgage rates decline, the sheen for homebuilders and their supplier will likely fade.

8. T-Mobile: Sold 570,000 shares (reduced stake by 10.87%)

The eighth stock Warren Buffett was a seller of in the June-ended quarter is telecom titan T-Mobile (TMUS).

The Oracle of Omaha has a bit of a checkered past with telecom companies and doesn’t tend to hold onto them for extended periods. T-Mobile’s once scorching-hot sales growth rate has certainly slowed in recent years, while its long-term debt has risen modestly since the pandemic.

Yet in spite of slowing topline growth, T-Mobile’s earnings per share and adjusted free cash flow (FCF) are expanding considerably faster than other telecom companies. An all-time record $4.4 billion in second-quarter FCF might be enough to entice Buffet, Combs, and Weschler to stick around.

9. and 10. Liberty Live Group: Sold 214,929 shares Series C (LLYV.K)(reduced stake by 1.93%) and sold 65,330 shares Series A (LLYV.A)(reduced stake by 1.29%)

9. and 10. Liberty Live Group: Sold 214,929 shares Series C (LLYV.K)(reduced stake by 1.93%) and sold 65,330 shares Series A (LLYV.A)(reduced stake by 1.29%)

Last but not least, Warren Buffett and his investment team were sellers of Liberty Live Group (LLYV) (LLYV.A) during the second quarter. The reductions in both the Series A and C shares were minimal (below 2%), with Todd Combs or Ted Weschler probably behind this selling.

Liberty Live Group is owned by Liberty Media and is effectively a tracking stock for Liberty Media’s sizable stake in Live Nation Entertainment, the parent company of Ticketmaster. Since Berkshire received its stake in Liberty Live Group via spinoff, and neither Buffett, Combs, or Weschler initially purchased shares of this tracking stock, occasional selling and/or profit-taking isn’t too surprising.

— Sean Williams

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: The Motley Fool