I don’t want to be the messenger of bearish news to kick off the new year. But, as a card-carrying contrarian, I can’t help it either.

We should sell our dicey dividends now. While the market is high.

The best time to buy was October, when vanilla investors were fearful. We discussed “backing up the truck” to buy anything and everything week after week after week.

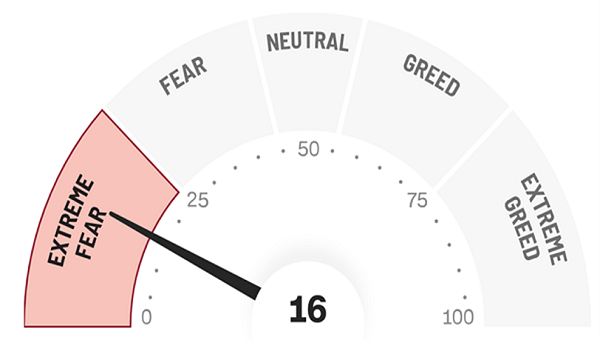

CNN’s Fear and Greed Index (FGI) had bottomed out at 16 out of 100, an Extreme Fear reading only seen during stock market panics:

1 Rally and 3 Months Ago: Extreme Fear

Meanwhile the bastion of basic financial thinking, MarketWatch.com, reported that “extreme fear” had indeed returned to the stock market.

Meanwhile the bastion of basic financial thinking, MarketWatch.com, reported that “extreme fear” had indeed returned to the stock market.

Thanks for the heads up. That was a great time to buy.

Thanks for the heads up. That was a great time to buy.

Meanwhile I and you, my fellow financial maverick, eyed Gabelli Dividend & Income Trust (GDV) as a 6.8% payer that should bounce as the panic subsided. Boy did it—GDV has returned 14.2% including dividends since that discussion. (We’re talking 60% annualized gains!)

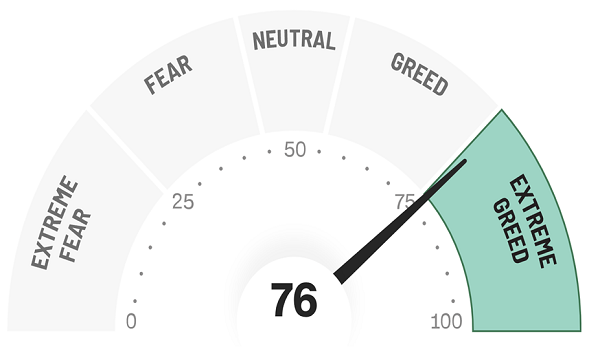

That’s the good news, which unfortunately for our 2024 outlook is already in the rear-view mirror. As I write to you today, CNN’s FGI has cycled the entire emotional field from Extreme Fear to Extreme Greed:

1 Rally and 3 Months Later: Extreme Greed

Other measures of sentiment are equally jubilant. Which tells us this is a time to sell rather than buy.

Other measures of sentiment are equally jubilant. Which tells us this is a time to sell rather than buy.

Buzzkill? Maybe. Though I’d argue it’s a gift. For those of us with dividend dogs on our books, this is a nice time to sell high.

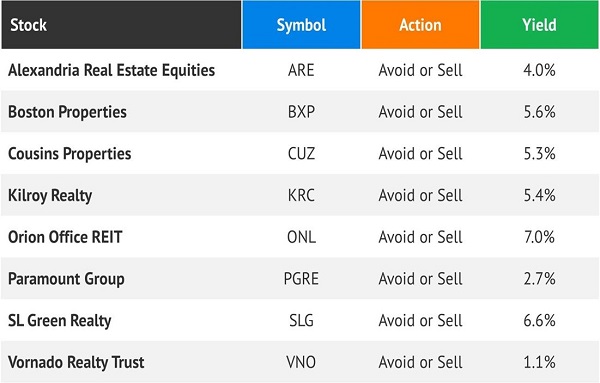

We’ll begin with retro landlord plays, the office REITs (real estate investment trusts). We’re nearly four years removed from the initial “work from home” surge of 2020, and information workers remain allergic to their commute.

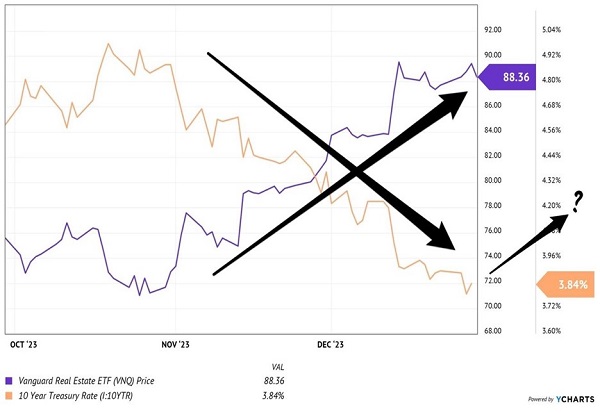

These stocks have rallied furiously of late, but their fundamentals haven’t improved. The catalyst for the rally was the falling 10-year Treasury yield, which has plummeted more than 100bps since October’s “inflation forever” fear narrative!

We figured the panic was overdone. It was, and the rising greed tide has lifted all REIT boats. Anyone left at the office party should consider jumping ship here:

Office REITs to Avoid or Sell

Careful Contrarian Income Report readers will note that I did not include Net Lease Office Properties (NLOP) on the hit list. NLOP was spun off from W.P. Carey (WPC) on November 2 and, as a rule, we are slow to sell spinoffs. They are usually attractively priced because, well, what parent wants to be embarrassed by a child’s poor public performance?

Careful Contrarian Income Report readers will note that I did not include Net Lease Office Properties (NLOP) on the hit list. NLOP was spun off from W.P. Carey (WPC) on November 2 and, as a rule, we are slow to sell spinoffs. They are usually attractively priced because, well, what parent wants to be embarrassed by a child’s poor public performance?

There are no bad stocks, only bad prices. NLOP may be attractively priced in a challenging industry.

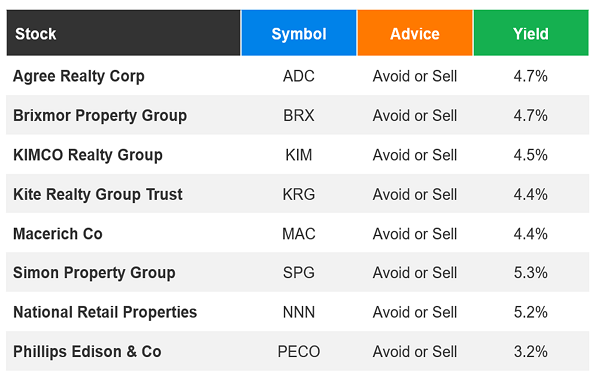

We will not be recommending any retail REITs in CIR anytime soon. Their businesses are permanently impaired by the convenience of e-commerce. (How much of your holiday shopping did you do in person versus online? Exactly.)

The bond rally lifted these dinosaur retail landlords. Take the gift:

“Dinosaur” Retail REITs

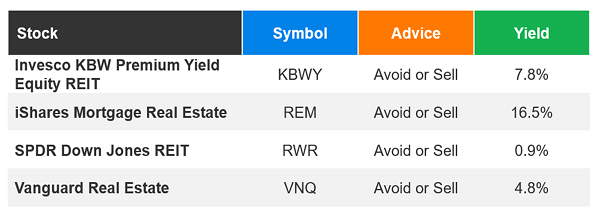

With these overpriced landmines in the REIT sector, this is no time to own an ETF. Well-known Vanguard Real Estate (VNQ) owns 163 stocks. Good luck with that game of Russian roulette.

With these overpriced landmines in the REIT sector, this is no time to own an ETF. Well-known Vanguard Real Estate (VNQ) owns 163 stocks. Good luck with that game of Russian roulette.

Three months ago, it was OK to hold our nose and buy VNQ. Or close our eyes and throw a dart at its 163 holdings—and buy the target! The ETF was due to bounce because rates were ready to decline:

VNQ Rallied as Rates Dropped

Fast-forward to today, pedestrian investors all believe that rates will continue to fall in 2024. Which gives me pause. These ETFs will give back some of their recent gains if rates rise again, a move that will “surprise” garden-variety investors:

Fast-forward to today, pedestrian investors all believe that rates will continue to fall in 2024. Which gives me pause. These ETFs will give back some of their recent gains if rates rise again, a move that will “surprise” garden-variety investors:

The financial world has a knack for surprising the run-of-the-mill crowd. As we begin the new year, everyone is convinced that lower rates and higher stock prices will continue. Be careful—and don’t be afraid to sell high.

The financial world has a knack for surprising the run-of-the-mill crowd. As we begin the new year, everyone is convinced that lower rates and higher stock prices will continue. Be careful—and don’t be afraid to sell high.

— Brett Owens

Sponsored Link: Remember, we’re living in a post-COVID world—which requires a post-COVID portfolio!

Many traditionally “safe” dividends are now quite dicey. In 2024, we can no longer see a great headline yield and buy. Beneath the surface, there could be serious trouble. This is a different economy, which requires a proper post-Covid dividend portfolio strategy.

Source: Contrarian Outlook