Growth investing has made a big comeback this year among investors, with many high-flying names enjoying positive price action throughout the period. Still, it’s critical to note that growth investing is commonly volatile by nature, perhaps steering away those with a more conservative approach.

The style is centered around targeting companies expected to grow their earnings and revenues at an above-average level, a development that commonly follows through to share outperformance.

And with sentiment remaining positive following last week’s FOMC announcement, the recent rally we’ve seen in the market could just be getting started.

For those interested in the growth investing style, three stocks – NVIDIA (NVDA), Pinterest (PINS), and Spotify Technology (SPOT) – could all be considered.

On top of strong projected growth, all three sport a favorable Zacks Rank. Let’s take a closer look at each.

NVIDIA

We’re all familiar with the artificial intelligence excitement surrounding NVIDIA in 2023, with shares up more than 200%. The company undoubtedly boasts one of the brightest growth trajectories thanks to scorching demand, with estimates calling for 220% EPS growth on 100% higher sales in its current year (FY23).

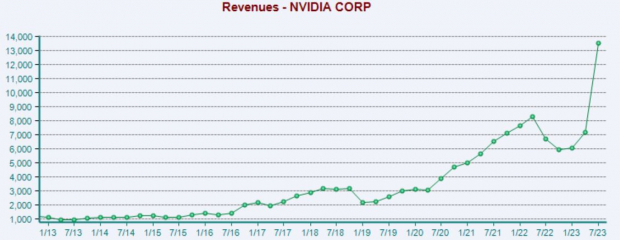

Peeking ahead, current estimates for its FY24 imply 50% EPS growth paired with a 50% sales increase. The company reported record quarterly sales of $13.5 billion in its latest release, improving 88% sequentially and 101% year-over-year.

As we can see below, the company’s top line has benefited massively from Data Center demand. In fact, Data Center revenue totaled $10.3 billion throughout the mentioned quarter, up 141% sequentially and 171% on a year-over-year basis.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

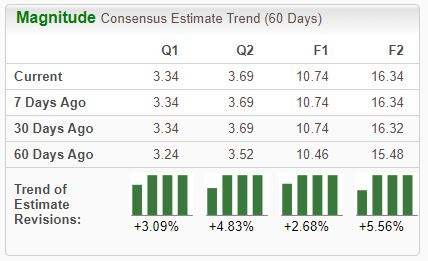

Analysts have been rapidly revising their expectations higher throughout the year, reflecting optimism surrounding the company’s Data Center results. The stock is currently a Zacks Rank #1 (Strong Buy).

Zacks Investment Research

Zacks Investment Research

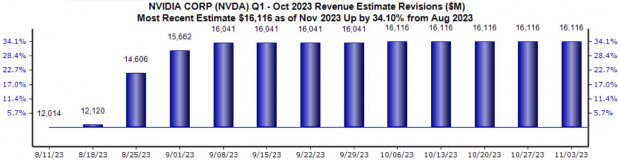

All eyes will be focused on the company’s next quarterly release scheduled for November 21st. Currently, the $3.34 Zacks Consensus EPS Estimate suggests 480% growth year-over-year, with our $16.1 billion consensus revenue estimate implying an improvement of 170% from the same period last year.

Top line revisions have also hit the tape, with the current $16.1 billion consensus revenue estimate 34% higher since mid-August.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Pinterest provides a platform to show its users visual recommendations based on their personal tastes and interests, generating revenues by delivering ads on its website and mobile application.

The company’s latest quarterly results have helped shares find positive momentum, with PINS delivering a 33% EPS beat and reporting sales 3% ahead of expectations. In addition, monthly active users totaled 482 million, improving 8% year-over-year and reflecting continued platform expansion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

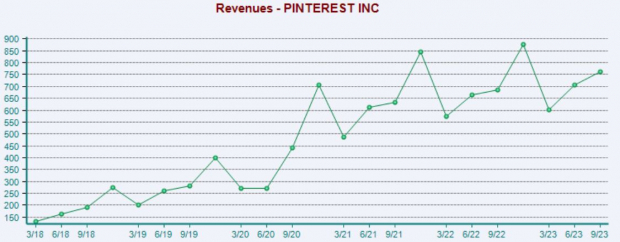

PINS revenue continues to maintain its upward trajectory, with Q3 revenue of $763 million up 11% from the same period last year. Regarding expectations, the company’s earnings are forecasted to climb 70% in its current year on 9% higher revenues, with estimates for its next year (FY24) suggesting an additional 20% earnings growth paired with a 16% sales increase.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

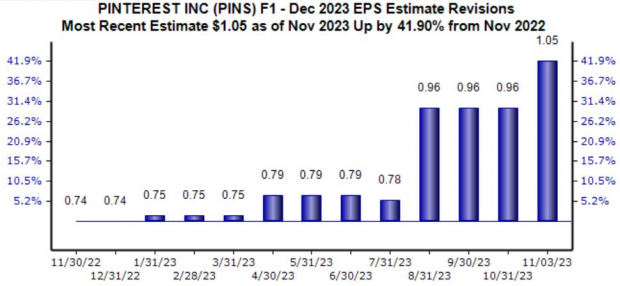

The stock is currently a Zacks Rank #1 (Strong Buy), with the revisions trend particularly bullish for its current year, up 41% to $1.05 per share since last November.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Spotify Technology

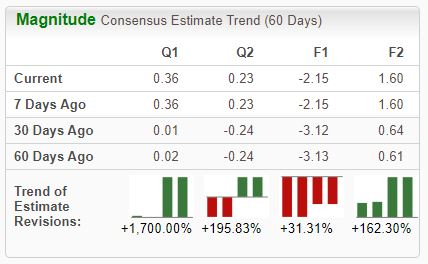

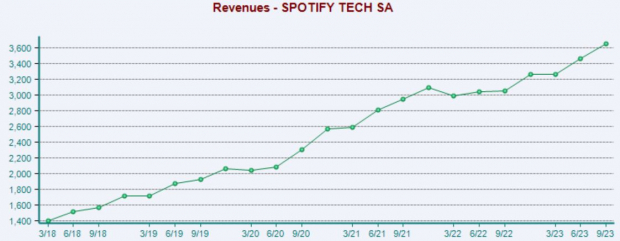

Spotify offers a platform for users to stream music, providing both commercial-free music and ad-supported plans to subscribers. The stock is a Zacks Rank #1 (Strong Buy), with analysts revising their expectations higher across the board in a big way.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company’s Q3 results (reported in late October) came in better than expected, with the company returning to profitability and key indicators exceeding prior guidance. Monthly active users grew 26% year-over-year, and Subscribers improved 16%, with the former nearly reflecting a Q3 record.

Regarding headline figures, the company posted a 271% beat relative to the Zacks Consensus EPS Estimate and reported revenue modestly above the consensus. Both items were well higher than the year-ago figures.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Concerning estimates for its current year (FY23), earnings are forecasted to climb 30% on 14% higher sales, with FY24 estimates suggesting 174% earnings growth paired with a 17% sales climb. The stock carries a Style Score of “A” for Growth.

Bottom Line

Growth investing has jumped back into style in 2023, with many growth-oriented names popping and delivering market-beating gains.

And with sentiment remaining positive, all three stocks above – NVIDIA (NVDA), Pinterest (PINS), and Spotify Technology (SPOT) – could be great considerations for those with a growth-focused approach.

In addition to high-growth characteristics, all three sport a favorable Zacks Rank, providing the fuel needed to continue climbing.

— Derek Lewis

Want the latest recommendations from Zacks Investment Research? [sponsor]

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks