The market often reacts erratically to quarterly earnings. Companies that deliver solid returns can see their stock prices soar, while those that fail to impress investors often swiftly move in the opposite direction.

But quarterly updates rarely have prospect-altering news in them, and that’s why post-earnings moves can create opportunities for long-term investors to acquire shares of excellent companies on any dip. With that in mind, let’s look at one solid growth stock that has been southbound since it released its first-quarter earnings earlier on May 9: Airbnb (ABNB).

Here’s why the company’s shares are worth buying.

Why the post-earnings dip?

Why the post-earnings dip?

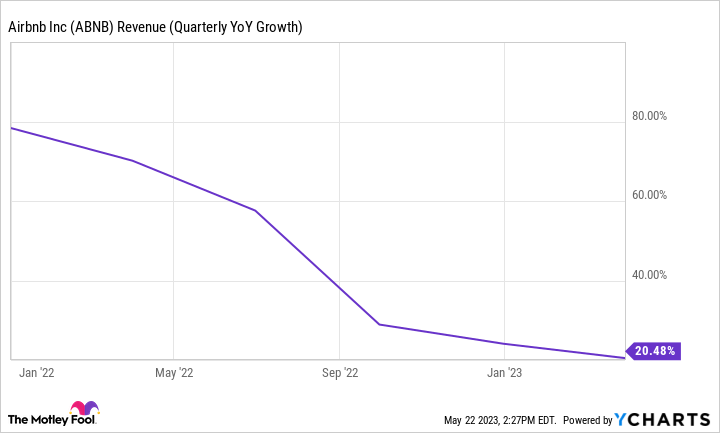

Were Airbnb’s results in the first quarter terrible enough to justify its shares falling on the heels of its earnings report? Hardly. The company’s progress has indeed slowed on some fronts. For instance, revenue of $1.8 billion increased by 20% year over year, a slower top-line rate than investors saw for all of last year.

But it is also the case that Airbnb turned in a net profit of $117 million, compared to a net loss of $19 million in the year-ago period. And free cash flow of $1.6 billion jumped by 32% year over year.

But it is also the case that Airbnb turned in a net profit of $117 million, compared to a net loss of $19 million in the year-ago period. And free cash flow of $1.6 billion jumped by 32% year over year.

There were other bright spots, with its gross booking value and nights and experiences booked all moving in the right direction. Still, the slowing revenue growth likely played an important role in the post-earnings sell-off, especially given Airbnb’s second-quarter guidance.

The company expects revenue between $2.35 billion and $2.45 billion, which would be an increase between 12% and 16% year over year. Travel activity rebounded significantly once pandemic-related lockdowns ended in most countries. Airbnb benefited from that.

But investors are likely worried that the company’s slower growth indicates that this tailwind is ending. And with a possible recession on the way, things could get even worse for Airbnb.

But let’s consider why that’s not nearly a good enough reason to avoid the stock, at least for those investors with a time horizon of five years or more.

Focus on what matters

Focus on what matters

It’s easy to get sidetracked by the current economy. While Airbnb might suffer if we fall into a recession, as some Federal Reserve staff members recently predicted, the more important question is whether the company has the tools to survive and continue to thrive after it.

There are good reasons to believe that Airbnb does indeed have the means to do that. The company is profitable and cash-flow positive, even more so than the year before the pandemic started. In 2019, Airbnb reported a net loss of $674 million, along with a positive free cash flow of just $97 million.

Yet, the company was able to navigate the challenging days of the pandemic, during which its operations suffered with business closures and a substantial drop in travel volume. Airbnb emerged from that ordeal a stronger business, as evidenced by the financial results it has been able to deliver since.

The next recession is unlikely to be as hard on the company as the early days of the pandemic were, so investors have reason to think that a now financially stronger Airbnb will successfully navigate it.

Meanwhile, the company should continue to attract hosts and guests to its platform. Hosts see it as a convenient way to make some money on the side, while travelers benefit from the massive and increasing library of vacation rentals from which to choose — creating a flywheel effect.

Airbnb still sees vast white space in some international markets, especially Asia, where it is looking to replicate the success it has had elsewhere. Management recently said that the Asian market is severely underpenetrated. Even in regions where Airbnb is already well established, expect growth to come from long-term stays of 28 days or more, especially with the continued popularity of remote work.

Airbnb is arguably much better than hotels for these kinds of stays since it provides privacy and amenities traditional hotels don’t. In short, multiple dynamics are working in its favor, and even a recession should merely slow down, but not stop, the company’s momentum.

That’s why investors should strongly consider taking advantage of the post-earnings dip to initiate a position in this excellent growth stock.

— Prosper Junior Bakiny

Source: The Motley Fool