It may be hard to believe. But back in May 2019, a ton of Wall Street analysts were calling Tesla (TSLA) stock dead money.

But while Morgan Stanley (MS) and Citi (C) were offering doomsday price targets for the EV stock thanks to the choppy Model 3 production ramp, we were calling it a generational buying opportunity.

Fast forward 3 1/2 years. Tesla stock has soared nearly 1,000%, turning every $10,000 investment into a $100,000 payday. Over that same stretch, the S&P 500 is up just 45%.

A lot of folks have since asked me: Luke, how did you see so early on that Tesla stock would be a winner?

A lot of folks have since asked me: Luke, how did you see so early on that Tesla stock would be a winner?

There are several reasons. But perhaps the funniest – and most unique – is that I simply kept an ear to the ground.

I watched the world around me change rapidly. In 2019, I started to notice a plethora of Tesla Model 3 vehicles. Folks were driving them through suburban San Diego neighborhoods. I saw them parked in front of shopping malls, grocery stores, and gyms. All my friends were talking about Tesla cars. Many were considering buying one.

The buzz was all about Tesla. I knew, eventually, that buzz would feed into the income statement, power huge delivery and revenue growth, and lead to an enormous run in the stock price.

Indeed, that’s exactly what happened.

Now, believe it or not, I’m seeing history repeat.

This same dynamic is happening all over again. But not with Tesla cars – with Rivian (RIVN) vehicles.

The Quick Rundown on Rivian

Now, let me be clear on where I stand on Rivian stock. I’m bullish, and that’s before my ear to the ground told me to be.

For those unaware, Rivian is an EV startup that’s designing, manufacturing, and selling high-end electric SUVs and pick-up trucks. The company is widely considered one of the most technologically advanced and promising pure EV makers in the world today.

Rivian just started delivering units of its first model – the R1T – in 2021.

It’s an electric pick-up truck that seats five, has a 54×50-inch bed and gets roughly 300 miles per charge. It can tow up to 11,000 pounds and has a 0-to-60 mph time as quick as three seconds. The interior is comprised of vegan leather, with a panoramic all-glass roof and a custom enhanced audio system.

It’s a very high-quality electric pick-up truck. It currently starts at $73,000. Rivian delivered almost 1,000 of these trucks in 2021 and is on track to deliver more than 20,000 this year.

Rivian’s second model is an electric SUV dubbed the R1S.

Rivian’s second model is an electric SUV dubbed the R1S.

Rivian’s second model is an electric SUV dubbed the R1S. It’s a large-format SUV that can comfortably seat up to seven passengers and their gear. It, too, gets roughly 300 miles of driving range on a single charge and can accelerate from 0-to-60 mph as quick as three seconds. It has all-wheel-drive capability and is outfitted with the same interior fittings as the R1T: vegan leather interior, all-glass panoramic roof, and a custom enhanced sound system.

R1S deliveries have just barely begun, but we are starting to see a few out in the wild. Significant ramp is expected in the coming months. Starting price is $78,000.

Rivian went public in a highly-anticipated and briefly super-successful initial public offering (IPO) last year. The stock has since struggled after a brief hot run. Today, the company is worth $32 billion – and that’s a valuation that I think is an absolute steal for this stock.

The Long-Term Bull Thesis on Rivian Stock

Long-term, I strongly believe that high-quality EV stocks are great multi-year investments. Indeed, EVs are set to grow from ~10% of car sales today, to 50%-plus by 2030. As the whole industry grows 5X, the companies at the forefront of this disruption will sell a lot of cars. They’ll generate lots of profits and unlock lots of shareholder value.

Over the next five to 10 years, some of the stock market’s biggest winners will be high-quality EV stocks.

In that realm, Rivian stock is one of my favorites.

Why? There are, in my opinion, five big sticking points of the bull thesis:

- Leader in a strong demand niche of the burgeoning EV industry. We know that the trucking niche of the automotive market is very large with very durable and strong demand drivers. Presumably, as that portion of the auto market gets electrified, there will emerge an equally large electric truck market. Presently, there is no clear leader in that market. But Rivian has a promising early start with a fantastic first-to-market truck that has among the best specs in the industry. This electric trucking market will support multiple winners, and we’re confident Rivian will be one of them.

- Great brand equity, with strong technology and a fantastic first product. Rivian has established exceptional luxury branding and has developed leading EV battery and torque technology. These are two things that are very important for creating a great electric truck. Indeed, the R1T is probably the highest-performing electric pick-up truck in market today. And it should remain so for the foreseeable future.

- Strong early demand signals. Rivian has more than 90,000 net preorders in the U.S. and Canada for the R1S and R1T, illustrating that consumers want these cars.

- Big support and partnerships. Aside from its recently-announced collaboration with Mercedes-Benz, Rivian also has a very unique and promising partnership with Amazon (AMZN). The retail giant will buy at least 100,000 electric delivery vehicles from Rivian. The extent of this partnership broadly implies that Amazon has basically picked Rivian as its “horse” in the EV race. And at scale, it will convert its entire delivery fleet into Rivian cars. That represents a huge long-term opportunity.

- A mammoth-sized balance sheet. The best thing about Rivian is that it has almost $20 billion in cash on the balance sheet. And that grants the company an almost unfair advantage over peers. Rivian plans to use basically every penny of that cash balance over the next two to three years to develop market-leading tech, secure market-leading supply deals, and establish market-leading production capacity. Rivian’s $20 billion should enable it to create an electric vehicle empire by 2025.

For those five reasons, I believe Rivian projects as one of the largest producers of EV cars by 2030, rendering it one of the most valuable auto companies in the world by then.

My “back-of-the-napkin” math indicates that Rivian could hit the million-deliveries-per-year milestone by the late 2020s. At a $70,000 average sales price, that implies total revenues of $70 billion. Assuming a similar margin profile as Tesla (30% gross margins/20% operating margins), that would lead to $14 billion in operating profits – or about $10 billion in net profits after taxes.

A simple 20X price-to-earnings multiple on that implies a potential late 2020s valuation target for Rivian of $200 BILLION. That’s nearly 10X the current market cap, meaning I see Rivian stock as a potential ten-bagger.

Powerful Short-Term Drivers

OK… now that we’ve run through the long-term bull thesis, let me tell you why I’m so excited about Rivian stock right now.

To me, it feels like Rivian in 2022 is going through what Tesla did in 2019.

You can call it a “moment” or an “awakening.” Call it what you want, but what’s happening is that – like Tesla in 2019 – Rivian is rapidly ramping production of its vehicles in 2022. Those vehicles are appearing all over, and everyone in the prospective car buyer world is talking about the R1T and R1S.

Here in San Diego, the Rivian was an ultra-rare sighting just two months ago. But on Halloween weekend alone, I saw four driving on surface streets, three on the highway, and three parked in the same parking lot for a Spirit Halloween store. (We’re big Halloween fans at the Lango household).

And I’ve been receiving text messages from friends that all read something like: “Just saw another Rivian! They look so cool!”

In conversation, no one is talking about buying a Tesla Model 3, X, Y, or S anymore. They’re all talking about Rivian.

Of course, anecdotes are not evidence. But a series of nearly identical anecdotes three years ago did correctly predict the boom in TSLA stock, so I wouldn’t discount them entirely.

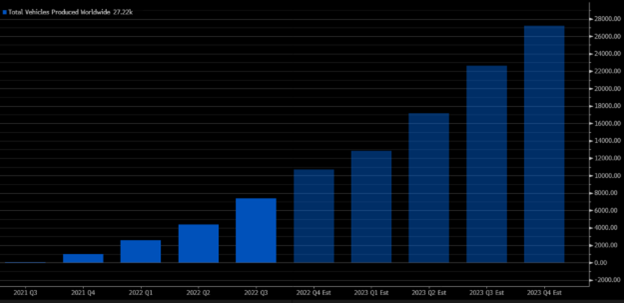

They also line up with the data that Rivian just reported. The company produced 7,400 vehicles last quarter, up 67% from the previous quarter!

It seems clear to us that Rivian is gaining significant traction in the EV Race these days.

It seems clear to us that Rivian is gaining significant traction in the EV Race these days.

Granted, the company just announced its canceled deal with Mercedes-Benz (MBGAF). That news spooked many, and it sent RIVN stock lower.

But we actually view this as a positive development. It shows that Rivian is being more conservative with its cash and is prioritizing internal investments and projects. And that only bolsters the bull thesis here.

— Luke Lango

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place