This hasn’t been a particularly good year for stocks. But June was particularly violent starting on June 8. Markets just collapsed out of panic regarding the U.S. Federal Reserve’s strict monetary policy. Yesterday, the indices pretty much recovered all of it but two daily candles. Among the recovery, steel stocks were up more than 3%. The best steel stocks to buy now have made good progress against the June drop. But they did not recover with equal force.

Yesterday, the market-wide rally was likely in relief that the Fed event had passed. Chairman Powell did not signal easing stances against his intention to destroy the economy. It doesn’t sound like he is tracking the private sector’s hiring and firing data. If he did, he would have noticed that all mega-tech companies (and others) have pretty much stopped hiring. Some have even started firing.

The news wasn’t good from chairman Powell, but the market didn’t care. The best steel stocks on the market spiked in jubilation, which is proof positive that we’re not trading on news but on sentiment. This means we shouldn’t overthink things and rely only on the data in the charts to make timing decisions. If the Fed is out to crimp growth, the steel business should suffer. We will find out more from their upcoming earnings reports.

Ultimately, the main parameter used to determine the best steel stocks to buy today is finding picks that are at or near support. With that in mind, let’s take a closer look at my top three picks in the space.

United States Steel Corp (X)

Source: Charts by e-Trade

Source: Charts by e-Trade

I’ve tracked the performance of United States Steel Corp (NYSE:X) stock, and I expected fans to defend it. Indeed they have, as there was support into $16. Consequently, X stock has bounced 30% so far, but it’s still one of the best steel stocks to consider today. Just like I expected support to show up, I now see potential resistance lurking near $22 per share. If I bought the bottom, I would trim some of my winnings.

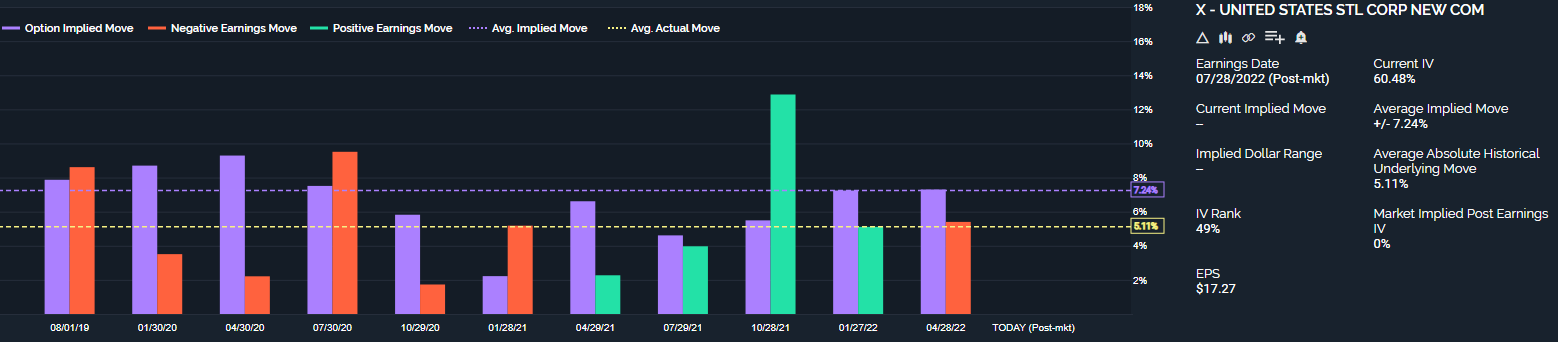

U.S. Steel reports earnings tonight. The reaction could be bumpy, and it’s definitely a coin flip. But according to e-trade, the bulls had more pops since April of 2021, with one red reaction versus four green. While this doesn’t guarantee another earnings pop, it at least indicates a good habit of performance.

The pandemic was good for X’s revenues, as they are now double those from 2015. Net income is almost $5 billion, so now the expectations may be too high going forward. Once the commodity crisis abates, these financials will disappoint investors. Therefore, I would be delicate with my trades and how long I hold them.

Steel Dynamics (STLD)

Source: Charts by TradingView

Source: Charts by TradingView

Steel Dynamics (NASDAQ:STLD) is in similar technical shape as X stock. It has recovered about half of the early June crash, and it could now face some resistance. I bet there will be buyers on dips into the $69.50 zone, and more into $67 below that. Those looking to enter this stock should consider adding some to their portfolio now.

There will also be buyers waiting to bid above STLD stock up at the $75 and $76 zones. That’s where it failed on June 21. It’s also the halfway mark of the June crash. Traders like to be active there, so there will be resistance waiting on the first revisit.

Although Steel Dynamics is on my list of stocks to buy, there will be a reaction to United States Steel Corp earnings this week that will also impact STLD stock. The move in United States Steel Corp tomorrow morning will influence a sympathetic move in STLD. So, again, this is a bit of a coin flip. However, the reaction is tradeable for smart money.

Luckily, like X, Steel Dynamics’ financials are impressive. The company sports a $22 billion revenue line, but it is not as efficient with cash from operations. Nevertheless, sales have more than doubled since 2019.

Nucor (NUE)

Source: Charts by TradingView

Source: Charts by TradingView

Out of the three best steel stocks to buy now, Nucor (NYSE:NUE) is my favorite. My reason for this is technical, so this is where the steel sector experts could disagree with me. NUE stock has recovered 80% of the June crash and has another potential bullish trigger lurking. If the bulls can take out $131 with emphasis, they can take NUE stock to $145 per share.

So investors can nibble a bit here, then add more on better entry signs. Those can be dips to $115, or rips from $131. I don’t like to buy all-in and anticipate a move. That’s how “fear of missing out” hurts investors, especially those trading NUE stock with options.

Fundamentally, from a price-to-earnings ratio perspective, X is the cheapest. But overall, between size and price action, NUE has acted better on charts. So my reason for favoring NUE stock the most boils down to technical aspects. So far, the clues from the charts have been near perfect.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place