The technology beatdown in 2022 is showing no mercy to Intel (NASDAQ:INTC). Neither its dividend, which yields close to 4% nor its single-digit price-earnings multiple spared INTC stock from falling to multi-year lows, even as it continues to have a reliable and growing business.

On the supply side, Intel may cut back and delay its Ohio expansion. Even worse is demand: Intel actually had to cut prices of its latest desktop processor chip.

With all that negative news, why might investors consider buying INTC stock? The company has several potential catalysts in the second half of the year.

Manufacturing Plant Expansion Delay

Recently, Intel shareholders faced multiple negative headlines. The company stated that it might delay or shrink its $20 billion plant expansion in Ohio. Intel blamed Congress for not passing the CHIPS Act. Without government assistance, Intel is not eager to expand.

The government delays created severe uncertainties for Intel’s growth plans. The U.S. would have benefited from the company diversifying its supply chain away from China, since the majority of chip production is in Asia. Only 12% of the world’s chips are made in the U.S. Politicians would also have benefited from creating jobs as a result of the expansion.

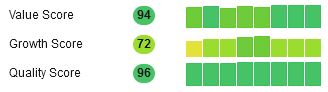

Source: Data from Stock Rover

Source: Data from Stock Rover

As seen in the chart above, Intel consistently scored well on value and growth in the last eight quarters.

According to Stock Rover, growth is less consistent but is still a 72/100 score.

The market’s expectations of the expansion easing supply issues contradict Micron’s (NASDAQ:MU) quarterly outlook. In its report posted on June 30, 2022, Micron forecasted Q4 2022 revenue of around $7.2 billion and EPS around $1.52 a share. Micron blamed the lowered outlook on weaker PC demand. Still, it has company-specific challenges. The industry is slow in taking DDR5 memory.

The consumer PC market is also facing major upgrade delays. As a result, cheaper DDR4 memory sales will continue to outpace the newer DDR5 demand.

Alder Lake CPU Price Cut

Weak PC demand forced Intel to cut the prices of its Alder Lake CPUs. The modest price cut is not entirely bad news for Intel shareholders. Lower prices this early in the product cycle could spur PC demand.

The PC gaming market struggled with sales when graphics card prices rose. High cryptocurrency prices in the last two years led to excessive demand. In 2022, crypto prices plunged. Today, GPU prices are at or below MSRP. PC gaming systems are affordable again. Consumers who delayed the purchase of a PC might take advantage of the lower prices.

Intel’s Alder Lake is a compelling product. It supports faster PCIe lanes. Customers may choose motherboards that run on either DDR4 or DDR5.

Arc GPU a Catalyst for INTC Stock?

Without much fanfare, Intel launched its delayed Arc A380 GPU in China. The card will retail for $595. It has excellent specifications — “8 Xe cores, or 1024 shader units clocked at up to 2,450MHz, 6GB of GDDR6 memory” according to PC Gamer. Best of all, it will only need 92 watts of power.

The entry-level card is not too late in attracting consumers. Graphics card prices are still expensive. Intel’s competitors are about to refresh their product line. This will keep card prices high.

Buy Intel Stock

Intel is at multi-year lows. At these prices, investors may sit on the stock and collect the annualized $1.46 a share dividend. The semiconductor sector is cyclical. It is in a slowdown phase, due entirely to poor macroeconomic conditions.

The economic slowdown, exacerbated by inflation, will eventually end. When that happens, Intel’s chip sales will recover.

— Chris Lau

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place