Amazon (NASDAQ:AMZN) stock has not been a leader for a while. This is an unusual situation, but so is the entire setup on Wall Street. Today we are suggesting that this shall pass. AMZN stock will once again be a profit center for retail investors. But first we must address the situation with the lack of any positive sentiment.

Investing in the past year has become an extremely challenging proposition. Even the experts are at a loss, because these circumstances are unique and without precedent. Last week the bulls ended strongly, but they came into a deep red situation on Tuesday. The market open after the July 4 holiday was somber and left a big gap.

But somehow it pulled off another incredible rally back to close it in its entirety. It even managed to close with mixed market score board. The Nasdaq actually soared 1.7% and the small-caps were about half as strong. Tiny glimmers of hope that markets are finally gathering courage.

Meanwhile, investors are suffering through severe peaks and valleys, but in a descending channel. Here we evaluate the opportunity from the AMZN stock for the rest of this year. It is no longer a part of the famous FANG acronym, since they have disbanded the posse. The FANG components are no longer traveling together.

AMZN Stock Is Leaner Than Most Giga-Caps

Source: Charts by TradingView

Source: Charts by TradingView

Amazon stock has already retraced its entire distance back to the pre-pandemic breakouts. Whereas Alphabet (NASDAQ:GOOGL,NASDAQ:GOOG), for example, has not. Therefore we must address their opportunities differently from here. There is no reason for AMZN to fall further on its own. But GOOG has about 32% altitude it can quickly shed.

For the last two months, AMZN has consolidated strongly above $101 per share. The weakest weekly close happened mid-June and above $106 per share. I bet that this base will hold through the next two weeks. This could just be enough time for the bulls to take back some control. I don’t expect a moonshot straight up, but at least stringing a few wins together.

Fundamentally AMZN is beyond reproach and it has the financials metrics to prove it. The company almost tripled revenues and net income since 2019. Profitability may stumble a bit with the higher gas prices, but they can adjust. With metrics this strong, by definition dips remain buying opportunities. The experts were wrong about it for a decade, because they spent too much money. It turns out they were busy changing the world.

Now the company is the second largest private employer on the planet. These two things are not coincidences, and we have plenty of proof to have confidence in the management team. They know what they’re doing, and shorting AMZN stock equates with shorting the whole market. Besides, at this point, there’s more downside risk in Apple (NASDAQ:AAPL), Tesla (NASDAQ:TSLA), Microsoft (NASDAQ:MSFT) and GOOGL.

Hold Some

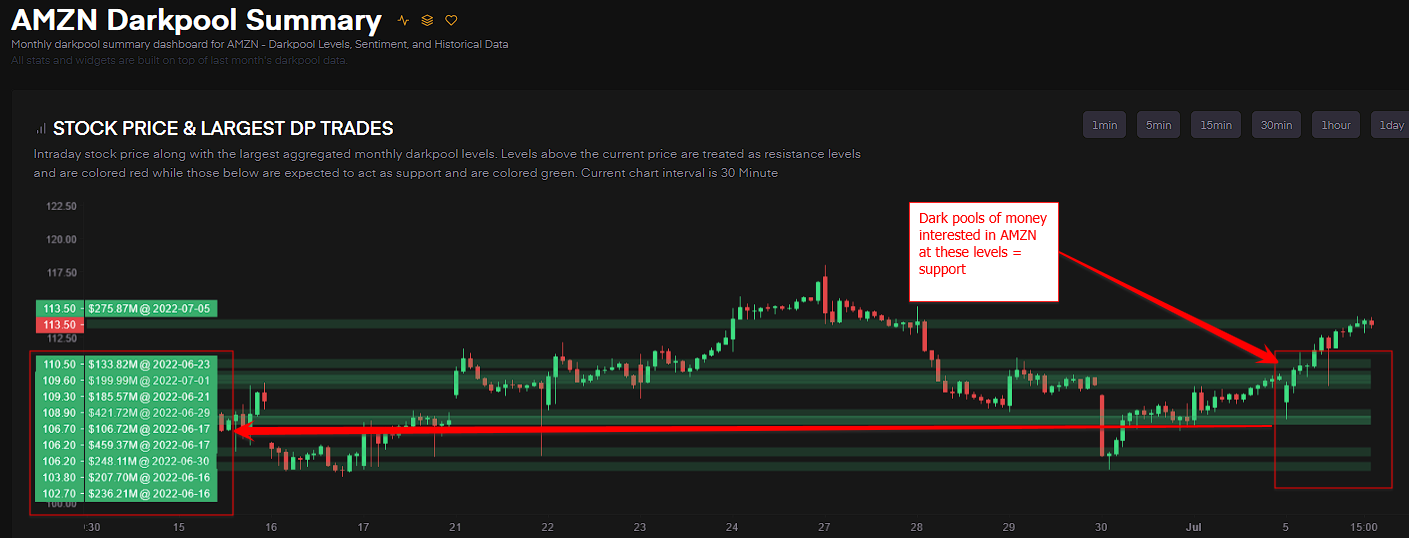

Source: Charts by Tradytics

Source: Charts by Tradytics

Also, according to Tradytics, big dark pools of money will defend the AMZN price. They have been active at levels scattered below current price. So if it falls again they are likely to be active with it, which provides support.

It is appropriate to engage with AMZN stock – especially with starter positions. The strategy is to leave room to add later to spread the risk across time. Or even better, use the options markets to create income out of the fear that other investors have. These credit put spreads strategies are slick and work well in a choppy market like this.

— Nicolas Chahine

Millionaire Investor Says Second Boom in AI Begins Now [sponsor]Louis Navellier has been ahead of the AI market at every turn. He picked Nvidia way back in May 2019. It's up 2,011% since. He made 372% on Cadence Design and 1,810% on Super Microcomputer. Now he says a second boom in AI is about to begin.

Source: Investor Place