Equity buyers won the battle over the sellers last week. They did this in spite of lingering high levels of fears not abating. We must remain cautious while being this optimistic. When we find stocks to buy, we should stick to very basic rules of not chasing junk.

This is an important nuance today because our stocks can carry strong momentum.

In the short term, all investors have to become part-time traders. Even though the goal is to hold stocks for a while, we should avoid short-term pitfalls. I point this out because the indices have had two strong weeks in a row. While this is constructive, it also brings prices back in line with the last two dips. This is where the upside potential becomes harder to accomplish — in theory.

Finding stocks to buy may feel like buying a bottom because of the trepidation at hand. However we must realize that we are merely 6% from an all-time high in the S&P 500. One can argue that the correction hasn’t even started. The price action has been violently choppy in a wide range. This may create the impression of blight. There is no evidence yet of material correction.

But there are several problems in the small-cap sector. The Russell 2000 is now firmly in the hands of the sellers and in a descending channel. Investors who are finding stocks to buy must not be too comfortable that the correction is over. This weekend we learned that China is locking down cities again.

I am optimistic about the future, but I’m also looking out for temporary reversals. The two main current risks are the invasion of Ukraine and the Fed’s war on inflation. Food and energy inflation reports are exploding. Price stability is at the top of the Fed’s lists of worries.

This could have a severe negative impact on U.S. consumer consumption. This high inflation scenario could quickly turn into stagflation. And consumer spending counts for about two-thirds of the U.S. economy. What happens in the next two months is extremely important for how the macro changes.

Meanwhile, here are today’s three stocks to buy on dips:

- DraftKings (NASDAQ:DKNG)

- Penn National Gaming (NASDAQ:PENN)

- Upstart (NASDAQ:UPST)

Stocks to Buy: DraftKings (DKNG)

Source: Charts by TradingView

Source: Charts by TradingView

My first two picks have very similar setups. The fundamentals differ a bit, but generally speaking their stocks trend together. Sadly, they are both in a long-term downward spiral.

My argument for DKNG is that the bulls are showing an effort to establish a base. But most importantly it will also need the indices to cooperate. The February earnings report spurred a 50% rally, but it died going into $25 per share. This was the second time this happened this year. Moreover this new resistance was also the last line of defense in early January. We can assume that sellers are lurking there on this latest bullish effort to reclaim it.

These are short-term comments that represent the opportunity for the next two months. However longer term, the outlook for DKNG stock is bullish. Although it is not dirt cheap now, the opportunity is promising. Sadly, there is very little appetite on Wall Street for high growth stocks that are overspending. My biggest concern now is with its half a billion negative cash flow from operations.

In a rate-hike environment, this could crimp management’s execution style. If so, growth might become harder to achieve. So, I would consider this a better swing trade opportunity than investment. Longer outlook investors should restrict their positions to partial ones. Leaving room to add at lower makes for better risk management strategies. Meanwhile, taking out the $25 mark would spur another 30% rally.

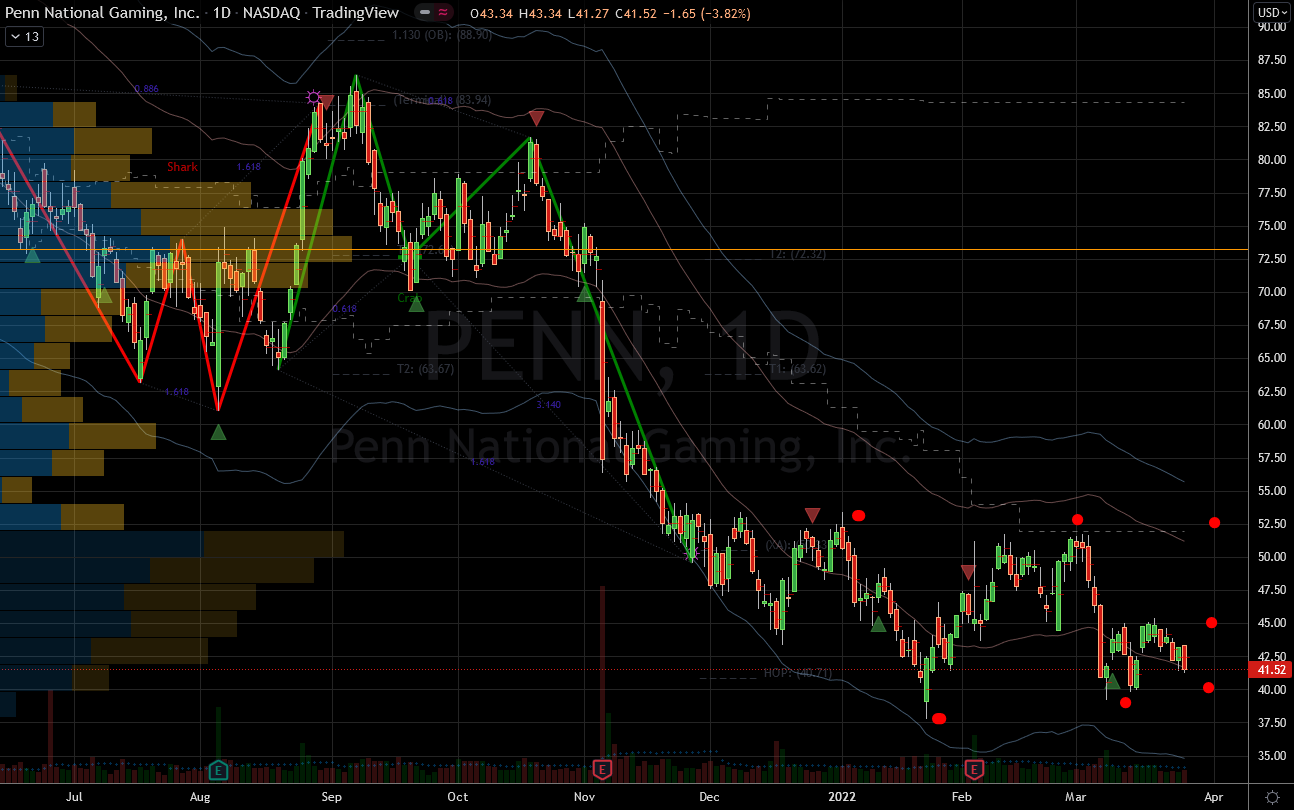

Penn National Gaming (PENN)

Source: Charts by TradingView

Source: Charts by TradingView

My second pick today has a similar price action to DKNG. PENN stock has also suffered for months, and the bears are in charge. Buyers failed to sustain rallies. The most recent ones fizzled when it failed to break out from $50. This has happened since last December, therefore be realistic with the expectations on the next effort.

The first step in bottoming is to stop making lower lows. PENN stock may have accomplished that after the Jan. 24 flash. It established a short stint of higher lows. This will soon go head to head against the ongoing lower high bearish trend. It is imperative for the bulls to not regress on that front.

The next hurdle this week would be near $46 per share. But the bigger one still remains when the bulls finally beat the $52 per share. When that happens, the sellers would give way for a bullish rush past it. The goal then could even extend to $65 per share.

This also qualifies as a swing trade opportunity. However unlike the prior one, PENN has a better financial situation. Management creates about a $1 billion in cash from operations. In addition, they have been profitable for a while except for 2020. This is a better blend of growth and a healthy ongoing business. The 2021 revenues were almost twice bigger than just five years ago.

Statistically, the stock is still cheap with a price to earnings ratio of 18. Investors should be relatively confident owning these shares for the long term. Meanwhile, there’s also the added benefit of shorter term swing profits. Between the first two stocks to buy, this one has the more conservative risk profile.

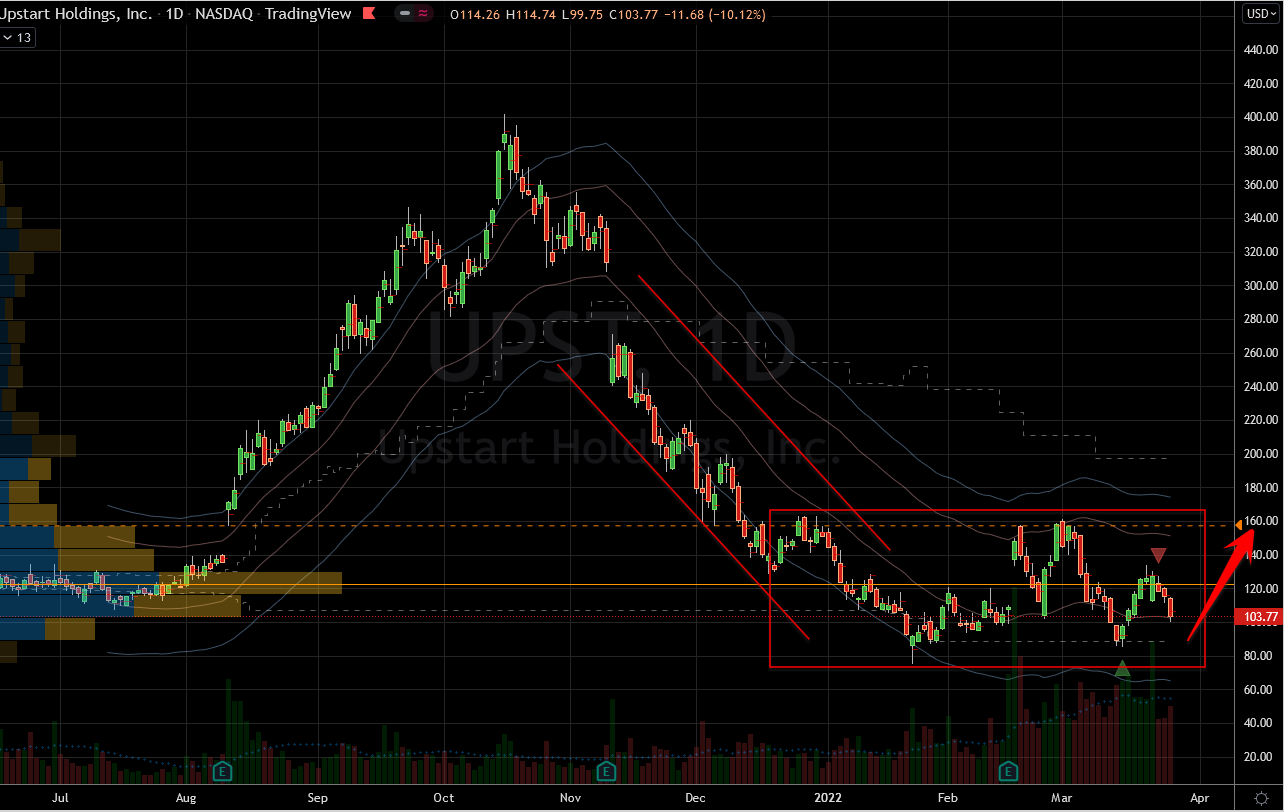

Upstart (UPST)

Source: Charts by TradingView

Source: Charts by TradingView

Upstart has demonstrated the ability to rally and fall extremely fast. This puts it in a special category of stocks that are tough to trade. Investors must remain vigilant because they rarely allow for easy entry or exit. Patience is the better course of action even at the expense of missing out on potential swings. That was the case when it rallied from $40 per share to $400 last year.

After crashing 80%, it stabilized and bounced with a strong 100% rally off $75 per share. That also crashed 50%. The pendulum continues to swing but support has held since January. Therefore, I assume this could hold for another few weeks while the bulls regain more control.

I’ve had success using options to slow the action down a bit. There investors can use alternate strategies that don’t require surgical precision. I could sell puts instead of buying shares, and create temporary downside protection.

The financial reports are encouraging judging by the amount of growth UPST delivers. Revenues are now 7.5 times larger than just four years ago. Moreover, management delivered a profit in 2021, with a positive cash from operations. This is a game changer because it’s important to not depend on borrowing in a rate-hike cycle.

UPST stock is not cheap, but with a 13 price-to-sales it’s not the exorbitantly expensive either. For now, the team should focus on growth, and profitability will come later. Technically, UPST bulls hold the Jan. 24 and March 15 supports. If they fail, the sellers may start another bearish swing lower. Long-term investors can initiate starter positions but definitely not all in.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place