Today’s picks are momentum stocks to buy for their short term pop potential. They are near potential technical contention zones that could become catalysts on bursts. This is not necessarily an investment comment, but it could turn out to be one. The fundamentals of each are relatively solid, but they share nothing specific in common.

Last week was the strongest performance for all the indices since the fall of the pandemic year. That’s quite an achievement, especially since we had just found out the Federal Reserve was no longer our friend. On Wednesday, Chairman Jerome Powell was very specific conveying the committee’s intention to prioritize price stabilization. This week, Powell will speak twice, with about 13 more Fed head speeches to follow. They’ve been under a gag order going into the event, so this is their week to vent.

The Fed threat is no longer a mystery. This makes last week’s test on that fear a major win for the bulls. They passed an extremely stressful challenge with flying colors. And that sets a rule: The dips this week will have strong support below. That’s an assumption that I will need for my three ideas to work. The three momentum stocks to buy are close to breakout lines above current prices. Having strong footing is essential.

Pay Attention to the Algos

Most retail investors don’t think like machines and they should. The bears have been in “sell-the-rip” mode for a while. Wall Street gets too comfortable repeating an easy trade past its usable shelf life. This week, there is a chance that some bears won’t realize a shift may have happened. I bet that the “buy-the-dip” mode will sneak up on sellers when it returns.

We are still in headline mode, especially from the geopolitical threats with Russia. The situation seems far from over and the participants are not bending. Meanwhile, investors can live with it as long as it doesn’t change. A stall there is fine for short term price action, but realize it could flare up in an instant. On the other hand, the macroeconomic conditions are healthy to warrant higher prices.

Headlines aside, the indices could make new highs and fast. Sounds ridiculous? Last week the S&P rallied about 7% from the low. At the close, they were about 7% from the all time highs. Not enough experts are contemplating that scenario yet. Yes, I am optimistic but but not blindingly so. Therefore I also realize that we are too close to the 2/24 low.

If the indices lose the February lows, we would be at risk of having a 10% correction from there. This is where I remind readers that this is a note about “momentum stocks.” This automatically makes the suggestions within it tactical setups. That’s why it would be necessary to know the bullish and bearish trigger so to help manage stops.

Here are the three momentum stocks to buy on impending breakouts.

- Broadcom (NASDAQ:AVGO)

- Enphase (NASDAQ:ENPH)

- Macy’s (NYSE:M)

Momentum Stocks to Buy: Broadcom (AVGO)

Source: Charts by TradingView

Source: Charts by TradingView

This is a consistent performer that thrived after the pandemic crash. AVGO stock is still almost 300% above that March’s lows. So management has earned the benefit of the doubt for a while. The recent 25% correction bounced hard off the $515 support zone. The rally from that is now just above the 50% Fibonacci retracement. What follows next is the tough part.

The opportunity these coming weeks won’t be easy because the bulls need to face tough resistance lines. The $615 zone has been a failure since early February, and in contention since December. It is likely that the bears will fight for it again now. But if AVGO stock rises above it, then the bulls can overshoot to the highs.

At these altitudes, I consider this a tactical setup so there are rules to apply. Since my reason for this comes from the chart, I must label this a trade, not an investment — meaning traders need to set proper stop losses to manage the risk. The fundamental metrics are solid, but up here they don’t inspire an investment opportunity in my eye. Therefore I do not wish to turn this trade into an investment. That’s why it’s important to emphasize this nuance because it applies to all three momentum stocks to buy this week.

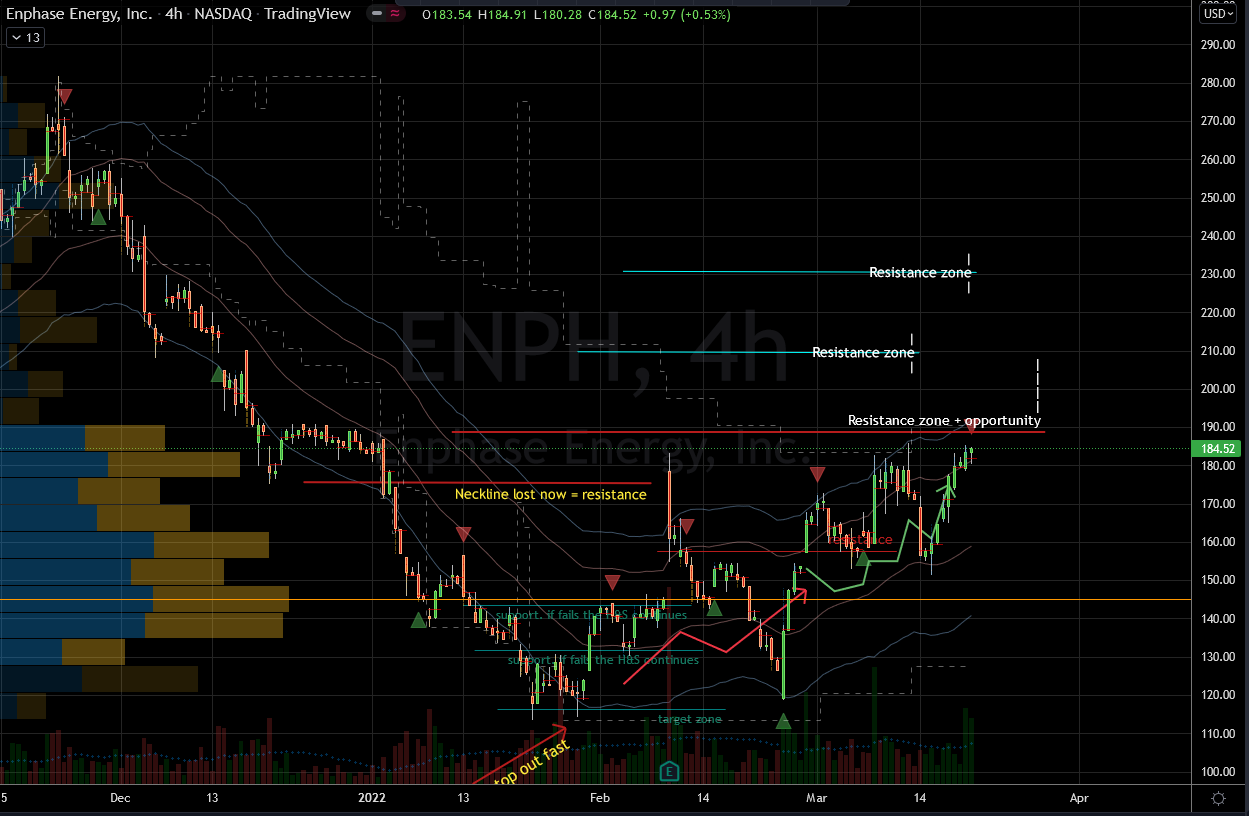

Enphase (ENPH)

Source: Charts by TradingView

Source: Charts by TradingView

The green trade is alive and well. The concept of ESG investing is finally mainstream. Governments are now writing laws to implement it globally. Corporations are also falling in line voluntarily. The best example of this is the commitment of all major car manufacturers. They have all agreed to stop making combustion propulsion vehicles.

Part of this movement is the proliferation of solar energy, and that’s where ENPH stock can benefit. The company has excellent technology especially from their micro inverters in the panels. This gives them an advantage against the competition, even the great ones like Tesla (NASDAQ:TSLA). Eventually the world will need to be on solar power much more heavily than this. There will be enough business for all suppliers to prosper.

But today’s opportunity is more short term. ENPH stock is just below a long term fail point at $191 per share. It is likely that if the bulls can push past $188 with force, they could finally take that out. If and when that happens, ENPH stock could rally 15% from there. This is a tactical trade, so I would not suggest investing all into the breakout. There will be short term sellers lurking near $220 per share.

Fundamentally, ENPH has an impressive profit and loss statement. They nearly doubled their revenues since 2019, and with a positive net income. They also generate enough cash from operations to feed their own growth. This is important in a rate hike cycle. Statistically, ENPH is not cheap, sporting a three digit price-to-earnings (P/E) and price-to-sales (P/S) of around 18.

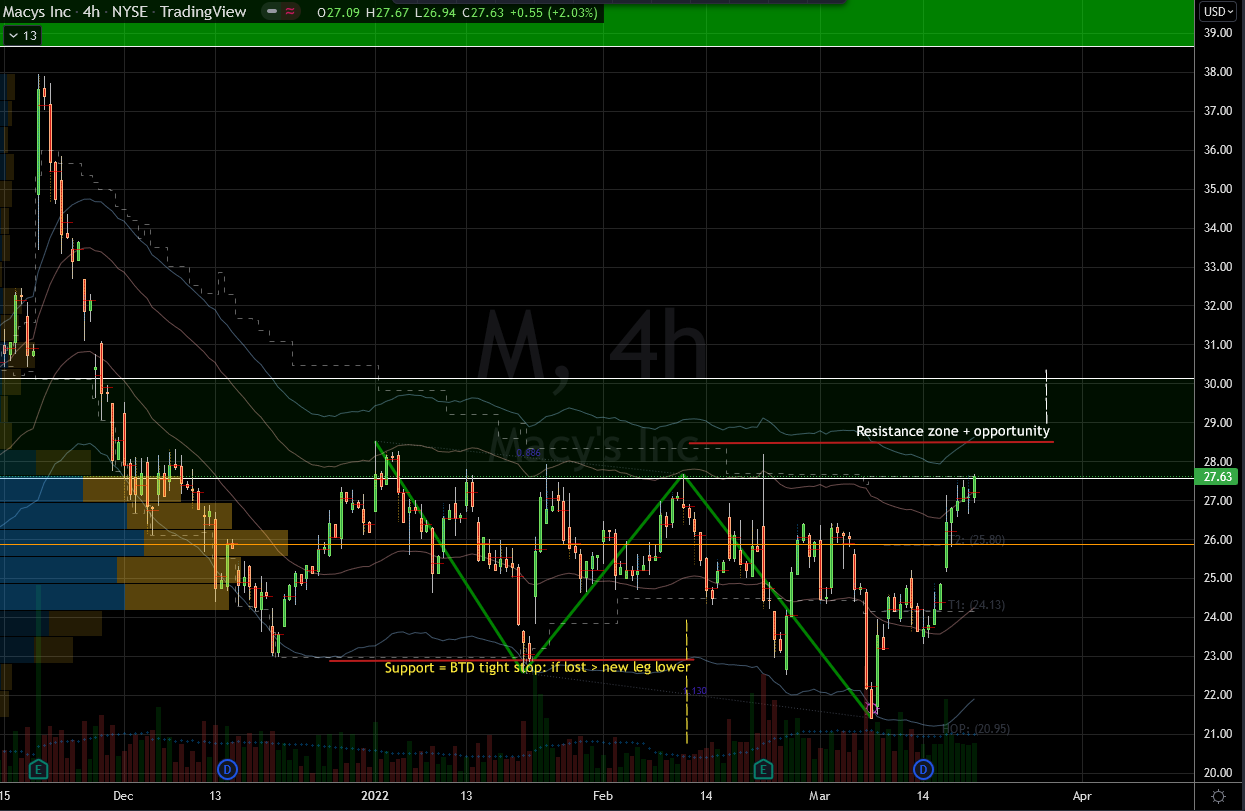

Macy’s (M)

Source: Charts by TradingView

Source: Charts by TradingView

Macy’s is the least attractive one to me from a fundamental perspective. It took management too long to realize the severity of the e-commerce threat. Amazon (NASDAQ:AMZN) absolutely crushed this stock. And finally, after a decade, Macy’s got back on track to adapt to it. Their hesitation may have dug them into a hole from which they’ve yet to emerge.

The opportunity today is technical, so the fundamentals are not that important to it. If M stock can rise above $28.60 then it could explode 10% from there. Above $32 will be difficult, so it would be a quick scalp, not an investment idea. Valuation is not a problem to the bullish thesis since its P/E is 5.7. It’s the growth factor that should worry investors and that’s a fact, not an opinion.

According to TradingView, M stock sales are now 6% below 2015. That’s a terribly stagnant situation well before the pandemic. I can find dozens of better and faster growing businesses to invest. Luckily today’s thesis is for finding momentum stocks to buy, not necessarily investments.

— Nicolas Chahine

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place