Wall Street is struggling with extremely serious headlines. Politicians are playing with fire in the matter of the Russian and Ukraine struggles. Moreover, economic politicians are also reeking havoc with equity prices making it difficult to find stocks to buy on dips.

Investors’ fundamental homework is meaningless if we enter into a world war. I bet it is an unlikely scenario since we are still busy with a virus as a common enemy. Nevertheless, I am not a political expert — and no one ever accused politicians of being reasonable. These matters are serious and investors need to stay vigilant.

I am still optimistic that cooler heads will prevail. Hopefully these are negotiating tactics for strategic and economic goals. In the U.S., investors are also dealing with inflammatory headlines about monetary policy. Last month, the Federal Reserve told us they will end the quantitative easing program in March. Also Fed Chair Jerome Powell unofficially suggested the first rate hike then, too.

But last week, James Bullard from the St. Louis Fed made news by suggesting that it could be a full point by July. That was a shock to investors, and they reacted violently lower. At that time, the bulls had mounted a solid recovery effort off the Jan. 24 low. Now we are back to watching for necklines that could be trap doors to further corrections. This even caused pros like Goldman Sachs (NYSE:GS) to change their forecast. They now expect a hike at every meeting this year. Although that would be nuts, I have to respect the possibility.

Here is the good news about that: A hike every month is likely the worst-case scenario. If that’s the case then expectations are as bad as they get, so the surprise is to the upside. Headline relief will bring pops in the indices. If the Fed goes ballistic with the hikes, they would then owe us a comprehensive explanation. I wonder how they go from “transitory” to all-out panic in one month.

Meanwhile, I continue to assume better scenarios and seek opportunities in stocks to buy. Today’s bunch have good businesses, but their stocks have fallen onto extremely hard times. In fact that’s the thesis that they hit strong support levels where buyers are likely to show up. But as long as the headlines are this serious, I would suggest moderation and partial entries at most. By definition and by design, my conviction is medium because of these wild macro conditions.

The three stocks to buy are:

- Upstart (NASDAQ:UPST)

- First Solar (NASDAQ:FSLR)

- StoneCo (NASDAQ:STNE)

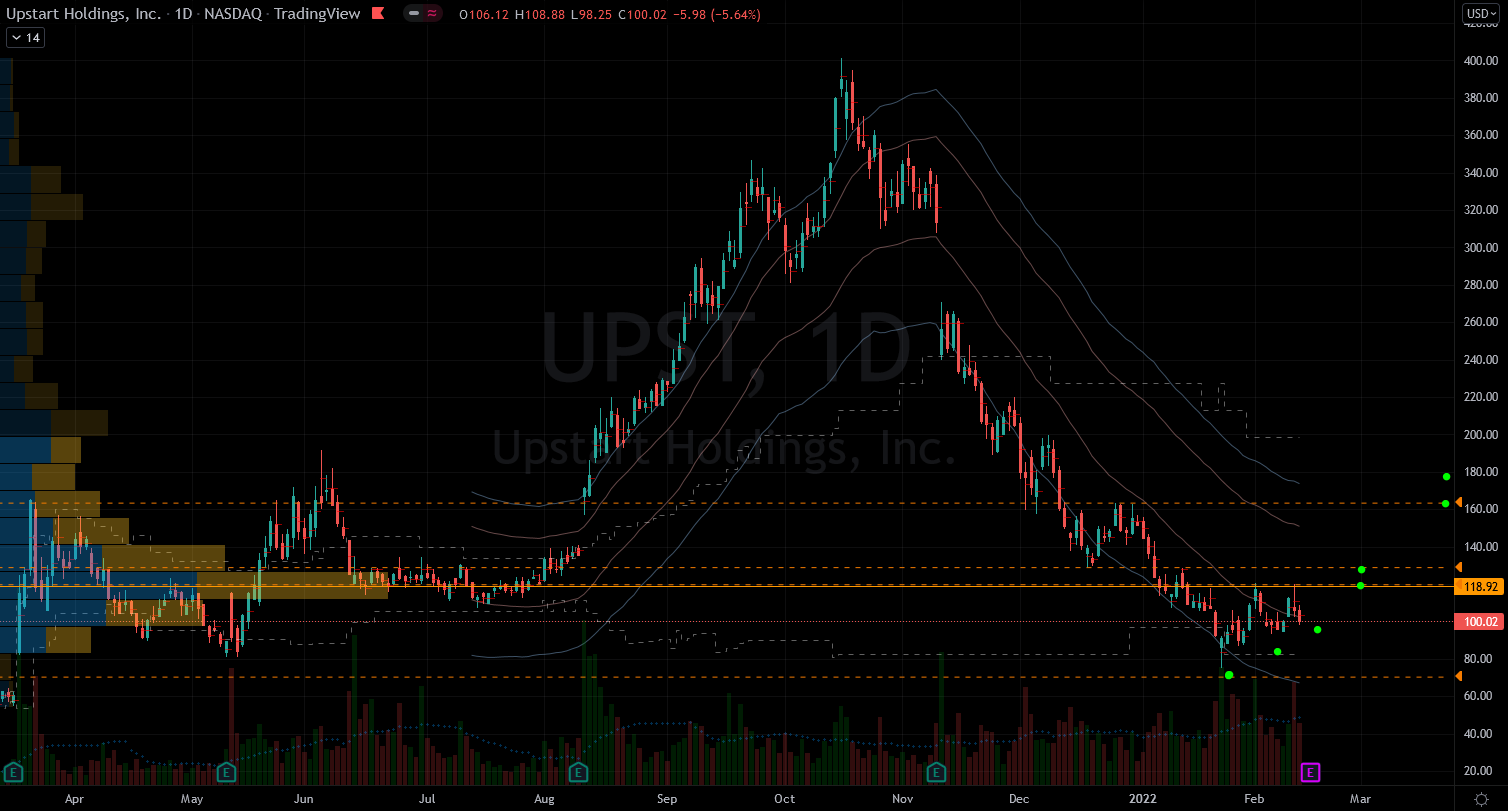

Stocks to Buy: Upstart (UPST)

Source: Charts by TradingView

Source: Charts by TradingView

Over the years I’ve covered fast-moving stocks like Roku (NASDAQ:ROKU) and Shopify (NYSE:SHOP). But UPST takes the cake when it comes to spring in its step. The speed and distance it can cover in both directions is mind blowing. Case in point how it broke out last summer from about $105 to more than $400 per share fast. Then just as quickly, the 250% rally disappeared and turned into a crash to $76 per share.

From high to low, UPST stock fell 81% leaving many investors who chased it late in ruins. It’s going to take a long time to recover the path, or is it? That’s the point with this stock, anything is possible. Fundamentally, the profit-and-loss statement tells a good story, where sales have almost doubled year-over-year. But it is too new to Wall Street, so it lacks the benefit of the doubt. Also it is part of the sell the small caps meme currently happening. And it may also have a bit of the Ark Invest curse working against it.

Luckily, there is good news from the UPST charts. The crash from the highs brought it back into its strongest support zone. So those who didn’t capitulate out of it yet can wait a bit. Investors engaging with it long now are doing the opposite of “chasing” a rally. I’ve traded it twice perfectly already and I would repeat it again from these lows. Remember that this is the mother of all momentum stocks, so moderation is extremely important. If the politicians cause a problem this week then floor turns into a trap door on the charts.

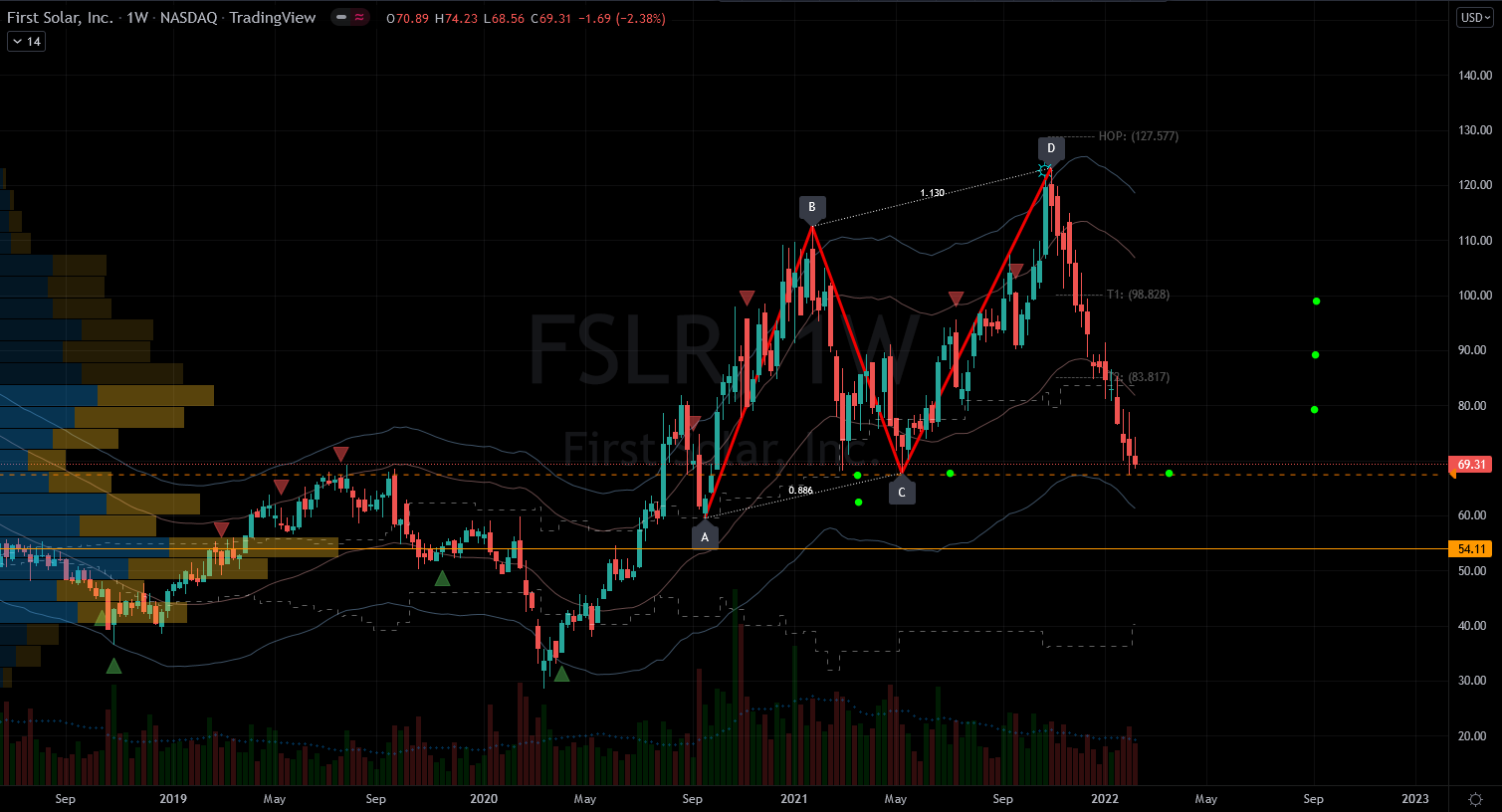

First Solar (FSLR)

Source: Charts by TradingView

Source: Charts by TradingView

Going green has long been a global goal in theory. But over the last few years, that movement grew much more serious. Nations are instituting laws that make the commitment a must. ESG investing as a result has become a real thing. Case in point the massive increase in interest in electric vehicle stocks. Solar stocks should also benefit from that, but of late FSLR is merely struggling to hold a support level.

Therein lies the opportunity, and it’s to own it against a recent bottom. I would consider this a partial entry in case the floor gives way, even if from extrinsic reasons. The slide that started last November doesn’t raise fundamental concerns. This is merely the other side of the pendulum that hasn’t yet stabilized. This stock whirlwind may have started a couple of years ago, and made worse by the global shut down.

From the depth of the pandemic the rally was illogical. Then came the Biden election, which also added fuel to the fire. The enthusiasm was at its peak when the bulls fell in the trap at $120 per share. An easy trick to avoid such a trap is to look left on the chart before going long. That’s the level of a major accident scene on the FSLR stock chart from 2011. The buyers last November bailed out the ones in it from 2011.

This 50% harsh correction brings it back to the pre-pan range from 2019 and below 2018. The easy losses have already happened, so there should be investor interest below.

Sadly, the earnings event is coming up and that’s a temporary coin flip. The reaction overnight to the headline is pure gambling, because it is all about expectations. Regardless of the quality, there is no way to guess how people will feel about them. They loved the Robinhood (NASDAQ:HOOD) report as bad as it was. The last four FSLR earnings reactions are at 50-50 odds.

StoneCo (STNE)

Source: Charts by TradingView

Source: Charts by TradingView

If we judge StoneCo by its report card, we should add it to a list of stocks to buy now. Their profit-and-loss statement shows it grew on average 55% since 2016. Clearly management is doing a fine job with their startup strategy. It operates in an exciting arena and like SHOP, its future should be bright.

However, and also like many other successful young companies, STNE stock has collapsed. It peaked about a year ago and it’s been downhill since. From high to low, the stock lost 80% of its value and it broke into new lows. The bulls no longer have any support zones to target. The bears are completely in charge and they are selling rallies.

Job one for the STNE stock is to establish a trough. The bottom is a process, not an event, and it starts by a flattening effort. Then the bulls can chip away side ways to eventually exit from the lower-high trend. To say that STNE is at this stage would be a stretch. If I squint, I guess I could say there was a bottom on Feb. 4. But it is so close and so delicate that it’s not likely concrete. Nevertheless, this is all that the bulls have for now.

Also, since the stock price descent was so drastic, it built up value. The STNE price-to-sales (P/S) is now in single digits. That is humble even in absolute terms, let alone for a growth company. While a low P/S alone is not a reason to pile in long, it no longer is a negative drag.

Last week, the small-cap sector was the only green index. So maybe there is a new rotation trade bringing interest in the likes of STNE and Palantir (NYSE:PLTR) stocks. I caution investors from thinking they can safely pile into it. If STNE loses $12.5, it would be another trap door to much lower prices.

Eventually, sanity will come back into the markets and investors will care about dollars and cents. For now sentiment is the prime motivator — and that is a powerful human emotion superseding logic.

— Nicolas Chahine

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place