Investors on Wall Street have lost their confidence of late. This makes it more difficult to have confidence finding stocks to buy.

Perhaps the jitters started with the beginning of unwinding the quantitative easing (QE) program. The Federal Reserve has officially announced that the efforts will end next March. Fed Chair Jerome Powell also suggested that they would also start the quantitative tightening (QT) process. Therefore, we should expect them to hike rates as early as March as well.

Nevertheless, today we’re going all out to find three that have big potential rebound rallies. The caveat is that they belong to a group that has lost all love on Wall Street. The small-caps have lost their mojo and led the indices down. From their highs they have more than completed a recession by Wall Street definition.

The problem really started with the size of the rally out of the pandemic. Investors bid them up irrationally, and sadly the pendulum must swing the other way before it stabilizes. In the meantime, we have to suffer through extremes on both ends. Among the loser bunch there are some gems that are falling for no internal reasons. For example, Palantir (NYSE:PLTR) has an excellent business and it still cannot find support.

It’s as if all of Wall Street now trades like a Reddit ape. At some point, homework and fundamentals will matter. This silliness will end, but for now assume a defensive attitude for caution. To adapt, I have accepted the fact that I cannot trust logic. Therefore, I would not make emphatic investments in full size. We should by design infuse a lot of doubt in our bullish assumptions.

The positive reaction to Apple’s (NASDAQ:AAPL) earnings is a sign of sanity returning. On the other hand, the 9% rally after Robinhood’s (NASDAQ:HOOD) terrible headline says stay vigilant. Let’s just resolve to expect the unexpected.

The three stocks to buy today have strong fundamentals and they are falling into support. I am eliminating as many question marks as possible, so not to invest in proverbial crap. Catching falling knives is hard enough, so we should avoid stocks with questionable fundamentals. The three small-cap stocks to buy this week are:

- Beyond Meat (NASDAQ:BYND)

- Etsy (NASDAQ:ETSY)

- Enphase (NASDAQ:ENPH)

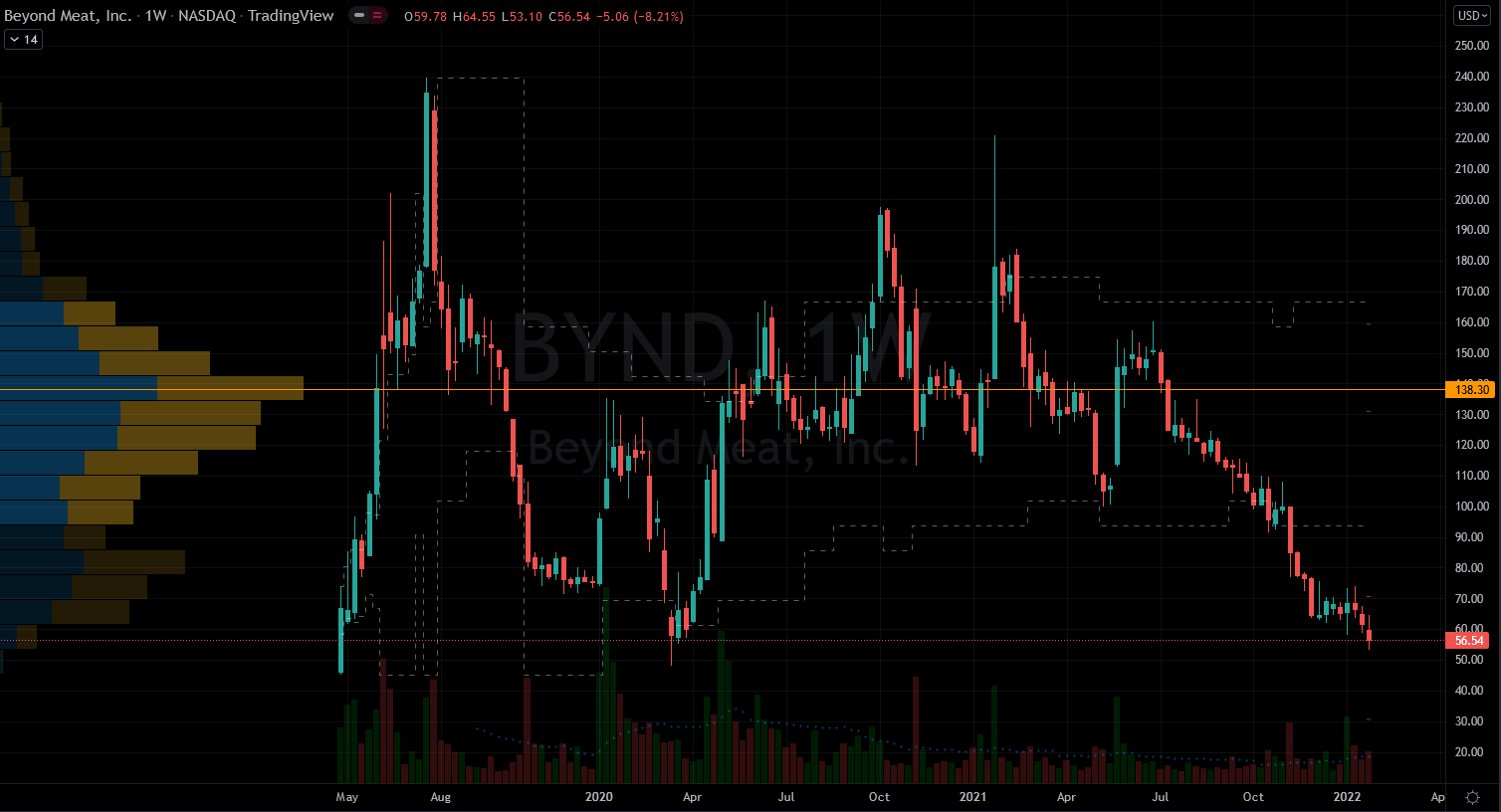

Stocks to Buy: Beyond Meat (BYND)

Source: Charts by TradingView

Source: Charts by TradingView

Although I am not a fan of the Beyond Meat food product, BYND stock looks yummy. Under normal circumstances, a similar chart would cause me to engage with a sizable bet to the upside. But I must consider the fact now the bears are in control of Wall Street.

My assumption is that investors will regain confidence in the next few weeks. Therefore owning BYND stock now for a snap-back rally makes sense. However, I must leave room for error somehow. One way to do this is to use the options. There I can limit my out-of-pocket expense and maximize my return. Another way would be to only take partial positions leaving room to add more later.

The market for alternative meats has a lot of room to grow. Competition is building, but there’s enough for all of them to thrive. Beyond Meat is an early mover, so it should retain an advantage there unless management completely fumbles that. There’s no evidence of major hiccups in their financials.

The revenues are growing at a consistent fast clip. While they still lose money, that is acceptable at this stage of their cycle. There’s no evidence of bloat in value because its price-to-sales (P/S) is under 10. Investors in it now are much more realistic than prior periods. Furthermore, their cash flow from operations is positive, which means they are not hemorrhaging to exist.

Profit margins are improving so there are no flags to raise. Management simply needs to focus investor attention on what matters going forward. They did a good job during the pandemic pivoting toward the consumer segments. They need to do more of it for the next few months. Investor confidence will come back into this one, and the rally could be substantial. If that ensues, there will be plenty of resistance areas along the way. But first thing is to stop the lower-low trend by not falling below $50 per share.

Etsy (ETSY)

Source: Charts by TradingView

Source: Charts by TradingView

During the pandemic, Etsy was a great place for home-bound people to go. When the world confined itself to house-arrest they needed cyber outlets. ETSY provided one for temporary income and for fun. During the unemployment explosion of 2020, the platform provided new potential source of income for entrepreneurs. Just for that service alone, it has earned the right to be in the list of stocks to buy for a while.

Etsy has a unique position between social media platform and online retail business. I doubt it will have any problem staying relevant for the future. Management seems well versed in its ways if we were to judge from their financial metrics. Revenues last year grew 29%, and the year before that it did 111%. The longer-term trend is equally as impressive, so they know what they’re doing. Etsy now generates $1.6 billion in gross profits, and half a billion in net income.

Statistically, the stock is not expensive with a 40 price-to-earnings (P/E) ratio and a 9 P/S. While it continues to grow this fast, investors should not be so picky with profitability metrics. The P/E seems high but not for as long as they are ballooning in size. This correction in ETSY stock seems like a good opportunity to engage long for the future.

It will need the equity markets in general to stabilize, but I bet there’s a nice rally brewing in it. Management now generates $680 million in cash from their own operations. That’s a strong position to pursue whatever strategies they need. There are no apparent hiccups in the way except investor sentiment.

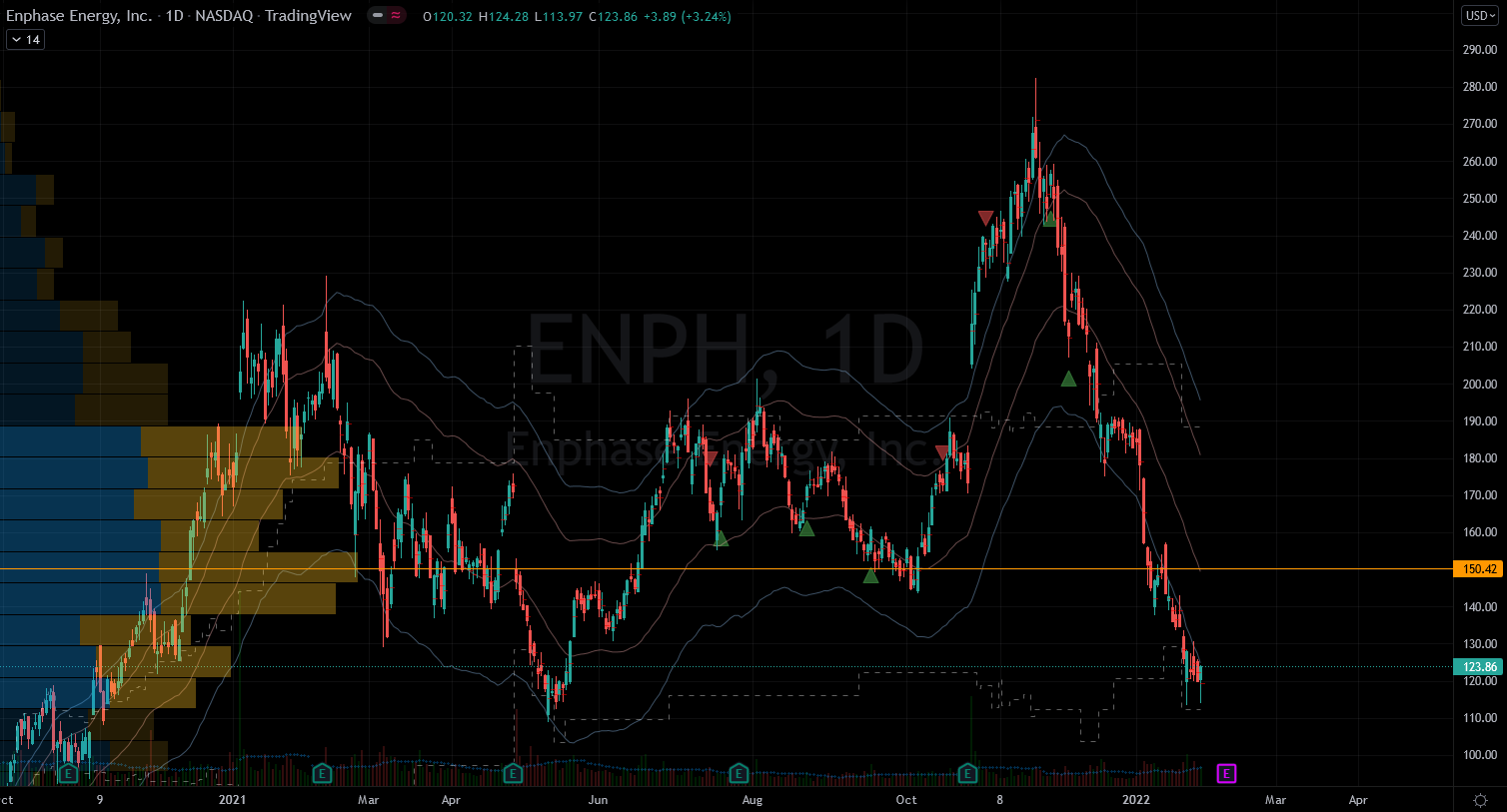

Enphase (ENPH)

Source: Charts by TradingView

Source: Charts by TradingView

In the last few years, the world finally committed to a few pie-in-the-sky concepts. One of those is “going green” with ESG investing. Now all major countries have deployed rules and regulations that force the issue. Two major aspects of that are solar power and abolishing the fossil-fuel vehicle.

Those two trends play well into Enphase’s business. They have great technologies to serve the solar power industry. Their smart panels give the technical edge, and they already have an early mover advantage. The competition is tough, but so far they look up for it.

The best way to judge a company is by reviewing its scorecard. The Enphase financials are solid showing consistent sales growth. Last year’s revenues were double those from 2019. Gross profit was nearly double the sales from 2018. Clearly the team is executing well enough to earn some benefit of the doubt.

The P/E is a bit high but that’s fine for this growth stage of the game. The P/S is still reasonable at 13.7, besides they now have a net income of $165 million. After a 60% correction in two months, I bet that there will be buyers lurking into support. These levels have been pivotal since October of 2020.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place