Before the Federal Reserve shifted its monetary policy stance, Block (NYSE:SQ) stock enamored investors.

The company formerly known as Square appeared ready to head to $300. Instead, the impending rate hike spooked investors. Even financial firms like Wells Fargo (NYSE:WFC) and Bank of America (NYSE:BAC) pulled back.

What happened? How does the drop in financials relate to the decline in a fintech firm like Block?

Markets expected the Fed to raise interest rates by only 25 basis points. Instead, the Fed alarmed the market by suggesting three rate hikes this year, more in 2023, and still more hikes in 2024.

The higher rates widen rate spreads, which would benefit banks. Conversely, the Fed policy may slow the economy. This would hurt banks and Block.

Block transaction volumes would weaken if the economy slowed. As business deteriorates, shareholders cannot justify the stock’s valuations. SQ stock trades at premium valuations.

For example, its price-to-earnings to growth ratio is around 3.6 times. BAC stock trades at a 0.55 times PEG multiple. Block has no room to disappoint investors with weak quarterly results.

Markets apparently are selling SQ stock ahead of time and asking questions later.

A Closer Look at SQ Stock

Block is acquiring Afterpay. The acquisition will strengthen and enable more integration between sellers and Block’s Cash App ecosystem. Block will issue stock to pay for the $29 billion (valuation at the time of the announcement on Aug. 1).

Afterpay served over 16 million customers and around 100,000 merchants worldwide, as of June 30, 2021. The service lets customers control their spending habits. Afterpay will benefit Block by driving repeat business rates. The bigger the average transaction size and count, the more revenue Afterpay will get.

Customers will benefit from the acquisition. They will get better financial products and services. Merchants, regardless of their size, will also benefit as the deal adds incrementally to their revenue.

Last month, Afterpay shareholders could not vote on the deal during a stockholder meeting. Block disclosed that it did not receive a non-opposition from the Bank of Spain. Expect the firms to get regulatory approval in mid-January. While the delay is not a big deal, the markets reacted negatively to the news.

Another possible explanation is that selling momentum accelerated at the end of 2021, mostly due to tax-loss selling.

Block Has Some Risks

Daily infection rates of omicron worldwide are a concern. Governments are imposing lockdowns and restrictions. Markets expect those measures will hurt spending behavior. Credit card companies may face lower transaction volumes.

As companies compete to grow market share in the payments segment, the most efficient firms will thrive.

For example, Visa (NYSE:V) has low quarterly operating expenses. It will post strong operating margins despite falling payment transaction volumes. Conversely, Block is working through costs associated with its Afterpay acquisition. V stock looks safer than SQ stock at times of economic uncertainty.

The under-performance in fintech may persist for longer. Visa and Mastercard (NYSE:MA) rebounded while Amazon.com (NASDAQ:AMZN), Block and PayPal (NYSE:PYPL) underperformed.

Investors may take advantage of the unexpected and sudden dip to buy PYPL, SQ, and AMZN shares. Visa and Mastercard are also good investments that trade at reasonable valuations.

Fair Value

Block received a few (of just six) new analyst ratings in the last month. Readers may need to ignore analyst price targets older than a month.

Block received a few (of just six) new analyst ratings in the last month. Readers may need to ignore analyst price targets older than a month.

They may issue updated reports with a less bullish tone, in light of the stock’s drop. According to Tipranks, the average price target is $285.00.

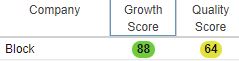

In the table above, Block has a strong growth score of 88/100. Investors should expect Square payment volumes to grow, regardless of the pandemic.

More merchants are transitioning to digital payments. They are offering Square as an option and replacing Mastercard or Visa. Merchants save on transaction fees. This lets them pass the cost savings to customers through lower product pricing.

Fintechs may increase the market share in the years ahead but they will not replace credit card companies entirely. Marketplaces need all options. Growth investors may take advantage of the stock market’s panic by holding SQ stock after the dip.

Your Takeaway

Square’s growth will not slow. Its name change to Block signals a bigger business transformation that will lift its payments business and the Bitcoin market.

The company proved that it knows how to grow Cash App. The downside of adding a BLOCK chain or cryptocurrency to its name is higher volatility. The stock may swing whenever Bitcoin prices rise and fall.

Experienced investors may appreciate Block’s core business will continue growing. As it adds support for Bitcoin in facilitating transactions, Block will appeal to more people. That will lift its customer base and help its business thrive.

— Chris Lau

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place