The S&P 500 broke records last week and again early this morning. This is in spite of a wall of worry that investors keep climbing. It’s almost like there are no bears, which makes it easy to find opportunities for stocks to buy on weakness. Investors are stepping in to buy every dip.

Even though we did break records in some indices, there are others that are struggling. So there are plenty of stocks that have been selling off for weeks. Today we highlight three such stocks to buy but for completely different reasons. They do share a common theme, which is relative weakness on their charts. However, their fundamentals are not related in any way shape or form.

We first have to acknowledge that the altitude raises the likelihood of a correction. We cannot be bearish within this is relentless bullish market that refuses to quit. But we can merely point out potential potholes along the way. Therefore, these opportunities are tactical in nature for now.

The bulls have been buying dips for years and it won’t change until the market conditions also change. The Federal Reserve’s tapering won’t be a hindrance to the stock price action for a while. Successful companies now will not be less so in March or April after the taper ends. Nevertheless this is step one of many that they will take in order to cool down the economy. They tried this in 2018 and failed, so I bet they won’t be aggressive this time.

We are going into the year end with positive momentum. Last week investors shrugged off bad sentiment to pull off a good win. Experts have warned against the potential of year in tax selling. But we have not seen it affect the S&P 500 ramp. We are still in headline mode. The Covid-19 mutation is making waves, but so far the reports have been milder than its predecessor.

While deciding on stocks to buy I ignore the headlines not pertinent to earnings power. Today, I focus on successful fundamentals, and conducive chart technicals. Here are the three stocks to buy ideas:

- Solana (CCC:SOL-USD)

- Generac (NYSE:GNRC)

- ChargePoint (NYSE:CHPT)

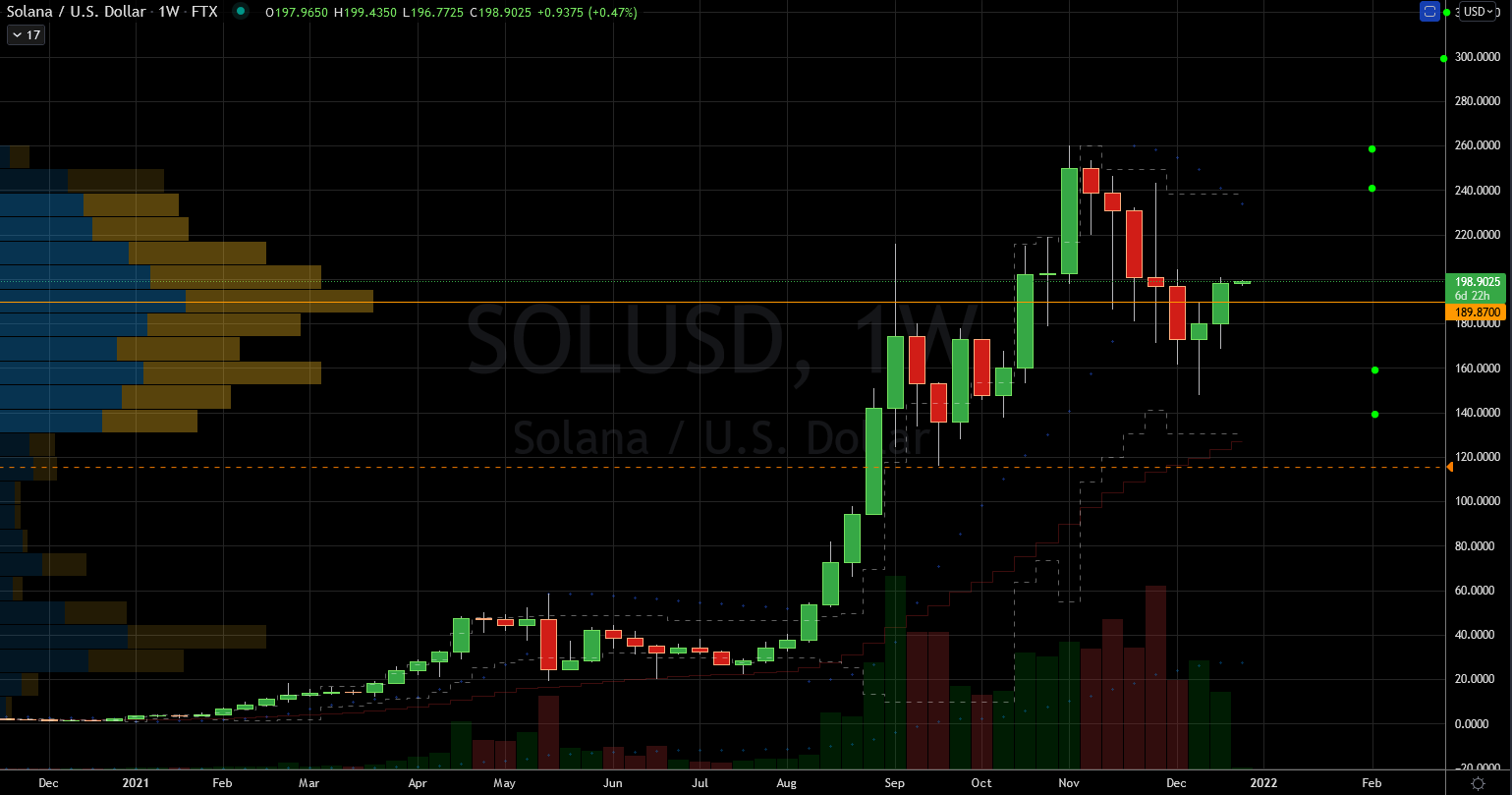

Stocks to Buy: Solana (SOL-USD)

Source: Charts by TradingView

Source: Charts by TradingView

The first one on the list is not even a company but rather a crypto coin. Notice I didn’t say “currency” because it isn’t, nor does it need to be. All crypto transactions happen on networks and there are companies that own the freeways. They charge tolls for doing the proof of stake, so they have native coins to support them.

Ethereum (CCC:ETH-USD) is the leader, and Solana is one of the rising challengers. Therefore SOL-USD, which is its coin, will also have a rosy future for as long as this continues. So far it looks like it’s faster and cheaper, therefore there is no reason why it should fail.

The people behind it have the benefit of the doubt. Cardano (CCC:ADA-USD) is another competitor and they would both actually make good opportunities to buy, especially on the dips from last week. Those who are looking for a quick buck in crypto probably already have it by now. But the more exciting part is owning it for the long term.

It is very tempting to book 30% profits in a few hours and I have done it before. But at some point we would need to accumulate them for a long while. We do have an incentive through a process called staking, and Solana does participate in that. Think of it like dividends on a stock, or a certificate of deposit account with a high interest rate. Currently there is no fixed income anywhere, so it is definitely an attractive bonus to hold.

The fundamentals are easy because electronic payments will likely replace cash in the future. Whatever is going on in the crypto world now is laying down the foundation for that system. I suggest getting up to speed now, so you don’t have a very steep ramp to climb later.

Generac (GNRC)

Source: Charts by TradingView

Source: Charts by TradingView

The 2020 crisis was a wake-up call to many people, and I admit that I was not ready. Therefore I became a bit of a prepper of late for the next time. Owning a generator even though I don’t need one in my area sounds like a great idea.

I think more people will do it if as solar solutions become more ubiquitous. Currently I have solar but I’m still on the grid. Generac could help me morph that into a more off-grid solution on demand. They offer great products and they are a leader in their segment.

Their profit-and-loss statement speaks well for their success. In four years, revenues doubled and net income tripled. This suggests that they are doing a good job already. Conversely, GNRC stock is 30% below its highs, albeit 300% above 2019 levels. There is a dip here but it’s not a bargain relative to its pre-pandemic days.

The price tag face value for GNRC is high. Therefore it is conducive to using options like a buy-write strategy to mitigate some risk. Savvy investors who own shares for a long time can benefit from selling covered calls against them. This would essentially create synthetic dividends as long as the they can part with them higher.

The GNRC stock chart suggests that it has fallen into a prior base. It had launched a massive rally in June. When stocks do that, they tend to find buyers lurking there to repeat the process. This is not foolproof and GNRC could fall closer to $300 per share. As long as they can hold $335, a tranche here would make sense for the long-term investor. I would consider this a 10% swing trade opportunity.

ChargePoint (CHPT)

Source: Charts by TradingView

Source: Charts by TradingView

It is concerning that in spite of the success of the EV concept, CHPT stock keeps reverting to lows. But therein lies the opportunity, which is to buy the dip again. I wrote about this in October and it yielded more than 20% of upside. This is an even clearer and similar opportunity.

The long-term concept and fundamentals are still as viable as they have been. Timing seems to the variable in swing. Consequently, this makes today’s opportunity fit traders and investors alike. Neither should be all in because of extrinsic factors.

The dip here has nothing to do with internal problems. The whole cohort is struggling on Wall Street. Blink Charging (NASDAQ:BLNK) and EVgo (NYSE:EVGO) stock charts can overlay perfectly over CHPT. The whole world committed to making EVs alt-fuel vehicles more ubiquitous. Therefore, demand won’t be an issue.

All that CHPT stock needs is more report cards from the companies. Investors need proof of results before they can give the stock benefit of the doubt. Meanwhile, investors can take advantage of sentiment pockets of weakness to profit.

— Nicolas Chahine

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place