While investors work through their nervousness this week, there are plenty of stocks to buy. The reasons for doing so range from finding fixed income to overzealous bearishness creating value. The fact is that the S&P 500 chart suggests that the buyers are still in charge. Until this changes, there is no need to short markets. The default action is to buy dips still.

My assumption for this year is that we will likely set new highs before we correct 20%. Within that thesis, there are valuable stocks to buy. Today we will share three that vary from highly speculative to sure things. Of course, there’s no such thing as a risk-free trade, but some come close. Wall Street is on edge perhaps because of rhetoric rather than facts.

There are a multitude of scary topics circulating the headlines. None of which change the three basic price drivers. First, there’s nothing wrong with the structure of the system. Second, there is plenty of money floating in the economy. This is in large part thanks to the aggressive White House and Federal Reserve. They are both still in the dovish camp for as long as we need it. So, this leaves us only with sentiment as what’s ailing markets.

This is a fickle variable because it involves human emotions. We’ve seen how quickly they can change their mind. If you doubt that, revisit how wildly the stock prices acted yesterday over the release of the Fed minutes. Remember that these were accounts of past events. The Fed had already told us what happened two weeks ago. Then Fed Chair Jerome Powell answered questions. Yet, when they released the minutes yesterday, investors went hog wild trading up and down.

In the end, Wednesday turned out to be a green day going into an important options expiration. This brings me to another scary meme that’s been floating around for a few months. Consensus on Wall Street is that having a monthly expiry makes for a bearish week. I challenge that notion, but I do acknowledge that it brings volatility.

This means that there is equal opportunity to go up or down and it’s not an automatic red week. Hopefully closing out a flat to green week tomorrow will put that mean to bed.

I’m going to borrow from a cliche that I am cautiously optimistic. Because I am confident that the data supports higher prices. However, I also acknowledge that sentiment can be a powerful motivator, and I don’t know how long it will last. We’ve already overcome the taper headline unofficially. Other than that, going into the holiday season, I expect more bullishness to creep into the headlines.

We still have global hurdles to overcome from the pandemic. The shutdown last year triggered a chain of events that is causing some supply issues now. This is extremely visible in the technology sector, specifically in chip stocks. Sadly, and as we digitize, the impact from this has come to have a wide reach. For example, the auto industry is struggling because cars are mobile computers. If there are no chips, there will be no cars.

Inflation reports are no longer that important for stock price action. They mattered before because we feared they would hasten the taper decision. Wall Street looks forward and focuses on the next potential problem.

We should have clear sailing into 2022 from the macroeconomic headline perspective. Of course, we can always have a black swan, but we can’t plan around it because it’s ever present. Therefore, if you believe in my bullish outlook, then you will find these three stocks to buy interesting:

- Verizon (NYSE:VZ)

- Lemonade (NYSE:LMND)

- Apple (NASDAQ:AAPL)

Stocks to Buy: Verizon (VZ)

Source: Charts by TradingView

Source: Charts by TradingView

Our first pick of the day was a complete surprise to see collapse. Verizon is as steady a company as they get, with a fortress financials. Yet, it has fallen off a cliff like it was a tech stock that disappointed on earnings. I read something about a downgrade from some expert, but therein lies the opportunity. I never let someone else’s opinion of a stock’s quality affect mine.

VZ stock’s financial statements and its technicals are solid. Verizon delivers $42 billion per year in cash from its own operations. I admit that its revenue line is boring and flattish for six years. However, the testament to management’s ability to be efficient is their net income doubling. In other words, they are doing twice more with what they have and that’s smart!

The bottom line is “the bottom line” and that’s the thesis today. There’s nothing wrong with the fundamentals except someone’s opinion of them. The current rapid descent scares investors away, but smart money evaluates the opportunity. This is a quality company stock that is on sale. VZ stock is falling into the pandemic lows. Back then the world was completely at a standstill. This cannot be the same situation now.

Therefore, my assumption is that there will be buyers lurking into $50 per share. And that this would make for an excellent starting point for short and long-term swings. The cherry on top is the 5% dividend rewards while investors wait. This is eight times the amount my bank offers me on high-yield accounts. This is also three times larger than a 10-year bond yield.

Lemonade (LMND)

Source: Charts by TradingView

Source: Charts by TradingView

Our second ticker today doesn’t have as strong a fundamental statement as the first. Therefore, it’s not first in mind for a list of stocks to buy on dips. Nevertheless, LMND stock still shows a pretty strong trend in the profit and loss statement. It is still new to Wall Street, so it needs to earn its street cred. That can only happen over time.

Judging by the hideous price action that has transpired since January, I would say they’re still far from it. LMND has fallen 66% from its all-time highs. What is encouraging now is that it is close to the May base that served for a 100% rally. Moreover, this was the same base from which it exploded in November of last year into a 200% rally. Any way you slice it, LMND stock falling back into such a pivotal zone becomes an opportunity.

The income statement supports optimism but with reservations. The revenues are still tiny but they show fast growth. There’s no sense of looking at profits yet because they are still so young. This is not a cheap stock even after this huge drop. The bulk of its stock price is from hope of future successes. Meaning there’s nothing intrinsic now from the company statistics to stave off the selloff.

To make matters worse, the overall sour sentiment on Wall Street sentiment is not helping LMND. I would consider this a blend between a trade and an investment. Regardless, investors would do well to take small bites just in case we do have a correction coming. If Lemonade loses its May floor, there’s no telling where the next support lies. In theory they should be near $50 per share, but it wouldn’t be a guarantee they would stop there.

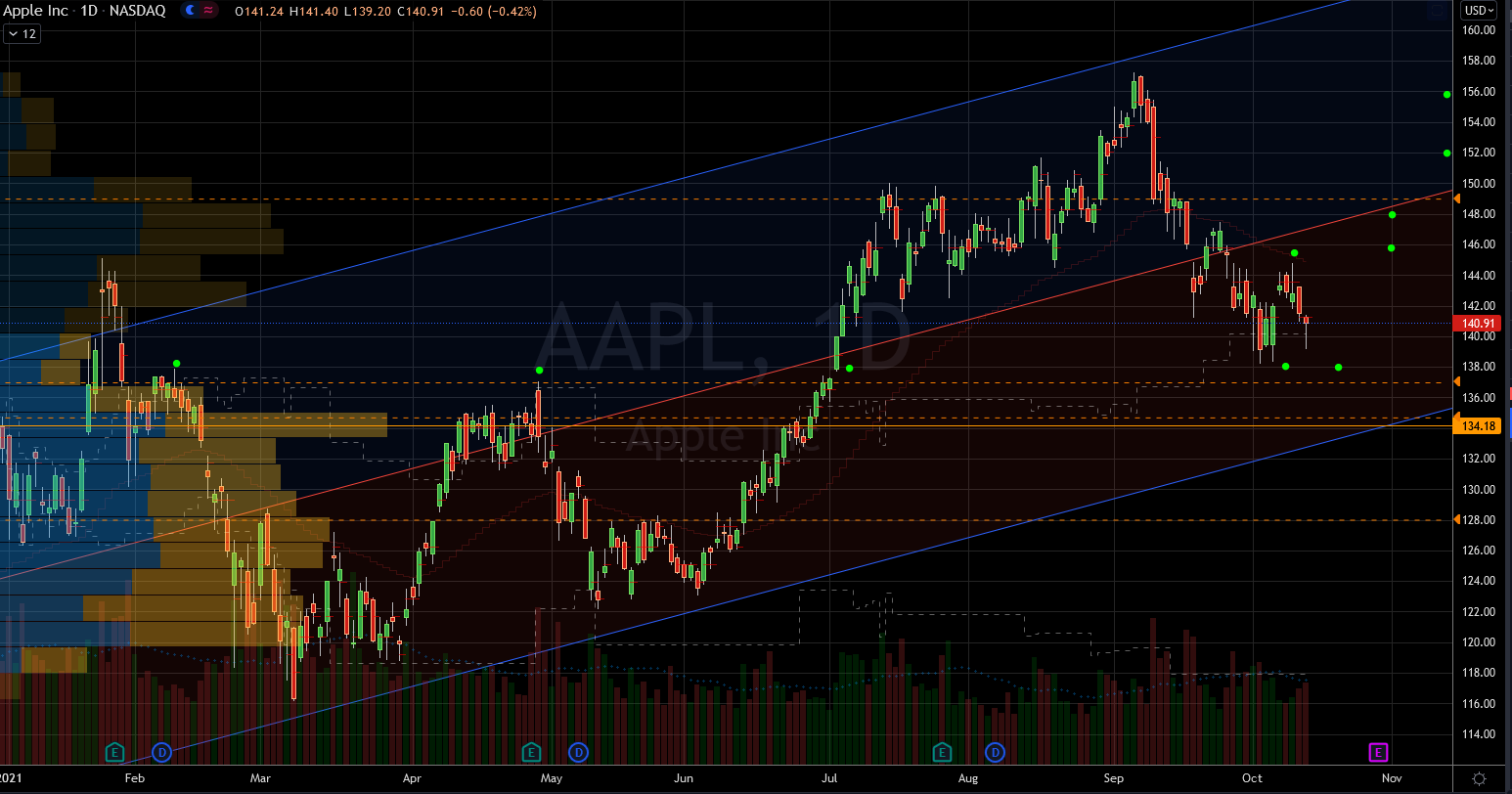

Apple (AAPL)

Source: Charts by TradingView

Source: Charts by TradingView

This leads us to our “sure thing” of the day. Arguably Apple stock is the cream of the crop on Wall Street. This is an extremely successful company that makes an insane amount of money. Its clientele gladly overpays for their product, and they always sell out of every widget they make. It is utopia for a management team to have such a machine beneath them.

This, however, did not stop AAPL stock from falling 12% in September. I can’t remember the last time this company delivered a bad earnings report. Yet, the stock keeps having tizzies like this. Since it persistently breaks records then these dips are buying opportunities.

The financial statements are top notch and borderline boring. It’s not an exciting grower like say Amazon (NASDAQ:AMZN), so it is relatively expensive. This is not a statement of absolute terms, but versus its usual self. We could look the other way for now since they also drastically changed their sales mix. Revenues now include a big chunk from services.

The critic in me wants to warn about bloat versus growth. AMZN grew its revenues 5 fold since 2014, Apple only 1.8. Yet, AMZN stock is twice as cheap as AAPL from the price-to-sales. Remember that I am including part of stocks to buy today. In spite of my nitpicking, I suggest that this is an opportunity to swing trade it to $152. I would consider this a trade more so than an investment. Proper stops are in order.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place