The default mode for investors is to hold Square (NYSE:SQ) stock for the long term. This makes it an automatic buy-the-dip opportunity when things are tough.

Currently, Wall Street investors are on edge. It could be the fact that this is a monthly expiration week for options. But in reality, sentiment has been fickle for months. SQ stock will eventually shrug off the current negative price action.

The good news about this unease is that it doesn’t change the fundamentals. SQ has been on rails for years because of what management is accomplishing. They went from the new kid on the block, to leading the fintech pack. The impressive part is that it includes old salts like Visa (NYSE:V), MasterCard (NYSE:MA) and American Express (NYSE:AXP). Yet, SQ and PayPal (NASDAQ:PYPL) are now setting the trends.

SQ stock is still head and shoulders above the rest. It is up 324% in two years which is twice better than PYPL. V, MA and AXP are lagging miles behind.

There Are No Fundamental Concerns

The rise in stock price usually creates bloat but not in this case. The fundamental metrics that matter are not yet extreme. This means that Square management is delivering enough growth to keep things in check. Critics could complain about profitability but they’d be wrong. At this stage, SQ needs to focus more on top line increase without skimping. Expenses are a prerequisite. Just ask Amazon (NASDAQ:AMZN). The experts fought it for a decade for over-spending, the company was right to ignore them.

Now that we’ve established that the long term upside in SQ stock is good let’s talk timing. Although I don’t aim for perfection, I do want to avoid the obvious mistakes. Chasing too late is one of those avoidable faux pas that area easy to dodge. Luckily in this case there is no such risk because the stock is in a correction already.

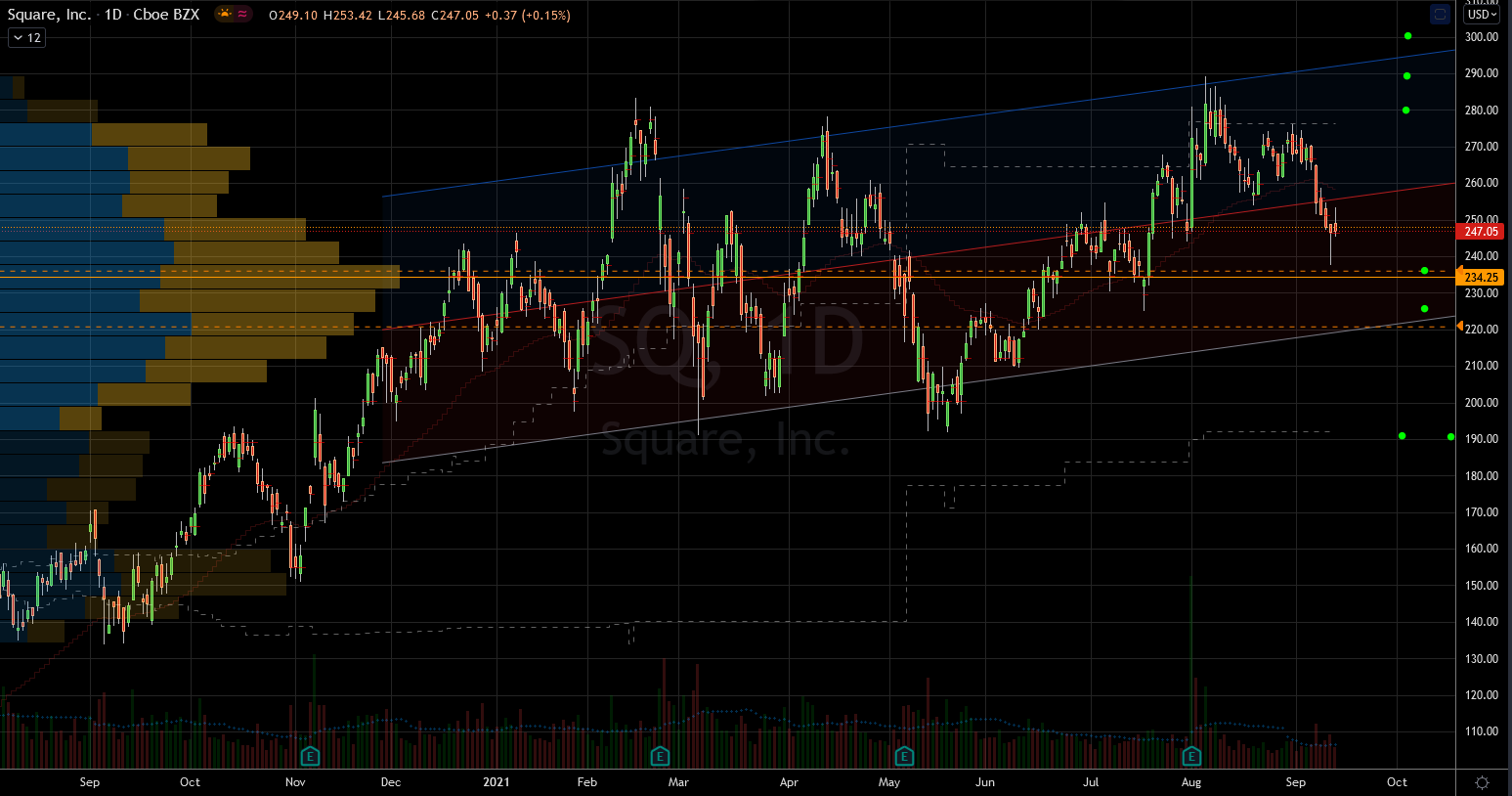

Wall Street defines a correction as a 10% drop or larger. SQ stock has already lost 15% since the August highs. The bad news is that the last two corrections did not stop here. During the February and April corrections it fell more than 30% before the stock found footing. It is possible that this time is different because of the higher-low trend.

SQ Stock Still Has a Path to New Highs

Source: Charts By TradingView

Source: Charts By TradingView

The resistance zone has been relatively constant all year. Also the trend has been making progress from higher levels. Therefore, eventually the bulls are likely to overwhelm the sellers at the highs. When that happens, the rally will extend into open air.

Meanwhile, the first order of business is to establish a floor. This should be a process not a moment in time. It starts with holding the $238 low from Monday. Nothing good can happen if the stock keeps making new lows. The lower-high trend can continue while the bulls are setting the base. Eventually the bottoming process flips bullish.

If long the stock already, investors should be comfortable even this week. The short term malaise will pass as long as the fundamentals remain static. Without a Black Swan event I bet that this too shall pass. So far, every dip in the indices ended the same way with buyers stepping in. Until that changes I don’t assume the rally is over.

The Square profit-and-loss statement is astonishingly impressive. Total revenues grew more than seven folds since 2017. They were already on a 40% clip before 2020. The pandemic took that expansion into the stratosphere. Having the lockdown made it imperative that all business get digital. That revolution went into panic mode and fintech industry blew up.

What’s also good is that the Square price-to-sales is still under nine. That’s as cheap as Apple (NASDAQ:AAPL) to name one mega cap. Except that Square offers investors hyper growth at the price of a mature company valuation.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place