Equity markets broke records again last week. This has become a habit lately. The small caps are lagging, so that’s a segment worth watching. But the bullish appetite for buying stocks has not relented in months. Shorting stocks has been painful for those who are trying it. Still, being “all in” without any protection is also wrong. Somewhere in the middle investors need to find a balance. This can happen by seeking stocks to buy on dips.

The bull market continues this strong largely due to the safety net from the Federal Reserve. It has kept rates incredibly low since 2018. In addition it has provided liquidity levels looser than ever before.

The White House has also done its fair share of infusing cash into the economy. The stimulus and government programs have reached astronomical levels. We now utter the “trillion” amount like it’s nothing. But in reality, it takes 2,740 years of spending $1 million per day to get through one trillion.

Nevertheless, it’s foolish to just chase equities willy-nilly. It could work for momentum trading, but for long-term investments we need cautious optimism. I know it’s a cliché, but it fits perfectly in this environment.

The earnings season provides perfect opportunities to find stocks to buy on dips. More often than not, if a stock trades lower on those it’s because of wrong expectations. Case in point? Look at what happened to Apple (NASDAQ:AAPL) and other mega caps. They haven’t delivered a bad report in years. Yet more than half of their reactions have been negative on the headline.

Still, one person’s panic equals another one’s opportunity. The idea is to catch falling knives that have a good story. Those are usually growth stocks where investors lose track of what’s important. Missing on earnings or estimates is not always critical to the long-term story of the company. Today we offer three that fit this bill.

The three stocks to buy on dips are:

- Coupang (NYSE:CPNG)

- Nio (NYSE:NIO)

- Baidu (NASDAQ:BIDU)

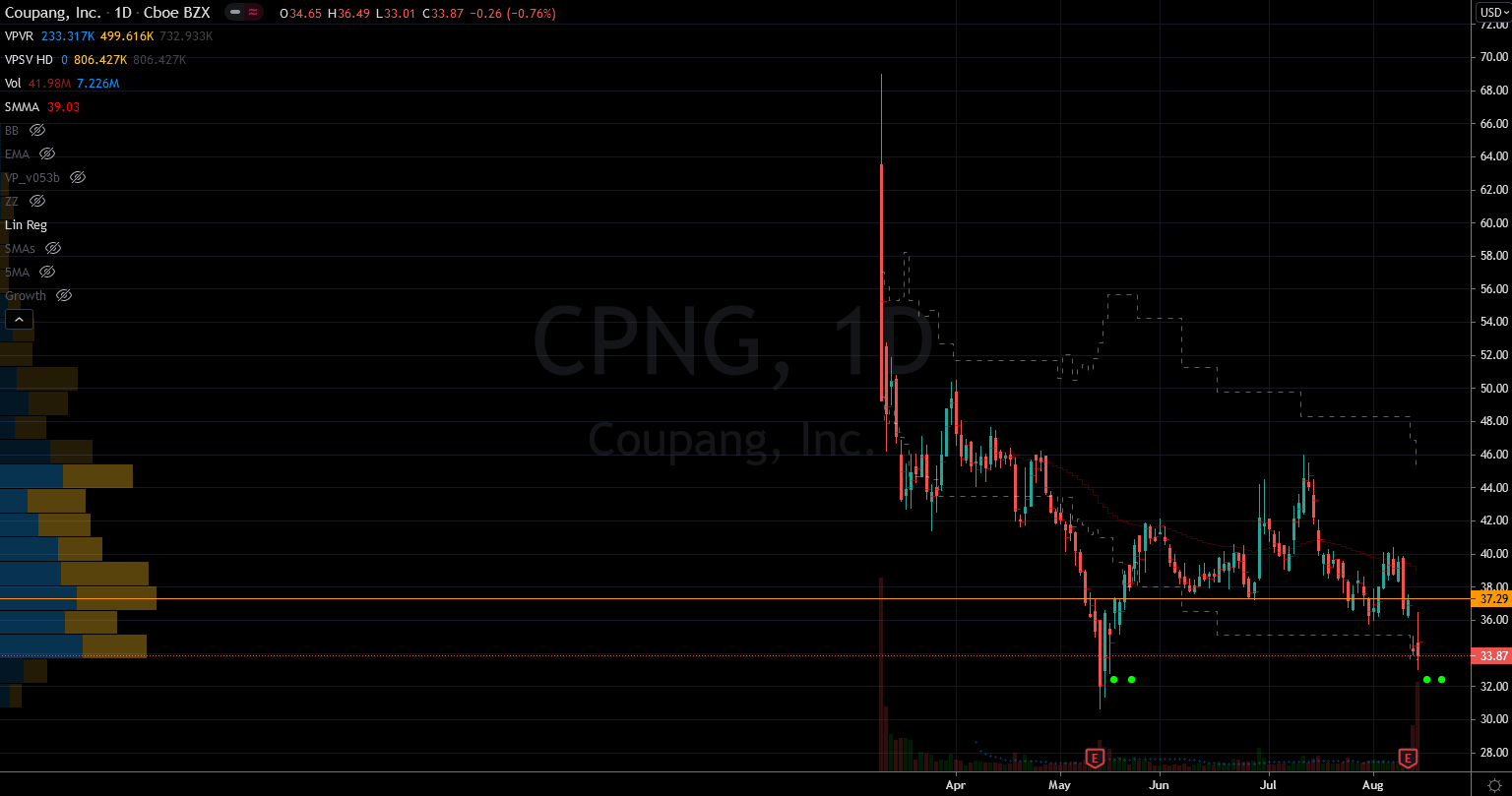

Stocks to Buy: Coupang (CPNG)

Source: Charts by TradingView

Source: Charts by TradingView

A decade ago Amazon (NASDAQ:AMZN) struggled to convince investors that it was a bargain. Experts could only focus on the fact that it was losing money. They insisted on it to be profitable and fought it all along the way. Clearly they were wrong — now it is a monster of a company and a reliable investment. It grows profits and sales at break-neck speeds.

CPNG stock is going through similar pains now. The difference is that Coupang can capitalize on the benefit of the doubt that Amazon created. E-commerce is now the place to be. The pandemic last year accelerated that trend, so CPNG has a long runway ahead of it.

Last week it reported earnings and the stock fell on the headline. Investors reacted badly to bigger losses than they had anticipated. The right thing to do is to focus on the fact that they grew revenues by 71% over last year. More importantly, Coupang has maintained 50% growth for 15 consecutive quarters. That’s an impressive rate, so don’t fret the profitability levels yet.

E-commerce is alive and well and this company seems to be on rails. CPNG could be suffering indirect negative price action from the political pressures on Alibaba (NYSE:BABA). Regardless CPNG stock does not deserve to be falling into an abyss. It has technical support, but still it’s not an all-in situation. They say to not fight the tape, so I have to respect the bearish price action for now.

Nio (NIO)

Source: Charts by TradingView

Source: Charts by TradingView

Nio stock lost over 25% since its July highs. Last week alone, it lost 12% from price action around its earnings report. Friday specifically it fell almost 4% on headlines that Citigroup lowered its price target $2 to $70 per share. That is a ridiculous reason to get rid of of winning stock. Besides, last I checked, hitting that $70 price target means an 80% profit. This is hardly a hardship situation.

The company’s earnings report was strong. It grew revenue 127% over last year, and to find fault in that is wrong. Fundamentally there is nothing alarming here. Management has quadrupled its sales in three years without inflating its valuation. Nio’s price-to-sales is under 20 which is in line with Tesla (NASDAQ:TSLA). This is also reasonable in absolute terms especially in today’s markets.

There are some clouds on the horizon after two crashes involving Nio cars recently. But overall, among a sea of hopeful EV startups, Nio stands heads and shoulders above all but one. Tesla has the absolute first mover advantage, but Nio is a close second. Long-term, this EV player is going to matter and be part of the global automotive future.

Moreover, technically Nio stock has support into $38 per share. Even if that fails, there’s more below it. Investors can be comfortable owning this company stock for the long term.

Stocks to Buy: Baidu (BIDU)

Source: Charts by TradingView

Source: Charts by TradingView

Mega-cap stocks in China are under political pressures. The destruction in equity prices has been steady and scary for months. The market cap haircuts are more like buzz cuts.

BABA may have triggered the problem last year and its stock slid 43% until now. BIDU peaked in February and has also since lost 65% of its value.

When fear is this high in good stocks, investors should get curious. BIDU stock has shed most of its fat. It is now leaner with strong fundamentals, which places it in the basket of stocks to buy. The dip was not due to bad results, since it delivered 27% revenue growth. Management spooked investors with its forecast.

They used the resurgence of Covid-19 cases to temper the forward enthusiasm. The practice of under-promise-and-over-deliver is alive and well there. Company executives use it when they have headline cover to do so.

BIDU stock is back to its November breakout zone. This usually provides support for the bulls so they can regain their footing. If not, then the recent loss of $153 per share may have $20 more in it. Regardless, this qualifies as a long-term investment. Just don’t go all in. It now sports a single-digit P/E and a price-to-sales ratio around 3.

— Nicolas Chahine

Source: Investor Place