The stock market had a bad week. Yet when discussing opportunities with traders I get a sense of urgency to buy the dip.

Last week “felt” like a disaster, but in reality the S&P 500 and the DOW were barely down 0.3%. The NASDAQ fell 1% — but the small caps were green. The markets have been so resilient that even mildly red days feel apocalyptic.

Investors are still looking for stocks to buy on the dip. Today, we’ll examine three tickers to trade off of earnings price action.

Last week’s selling was unusual because earnings results were generally quite strong. Perhaps investors were lightening up before a politically volatile weekend: there were several deadlines expiring, such as the debt ceiling limit to name one. Politicians have disappointed Wall Street many times over the years, so investors are understandably gun shy. Traders reduce their exposure to risk when they fret a headline or two.

This week the bulls will have the opportunity to flex their muscles once again. While it isn’t a certainty, I see three ways this could happen with pin action off earnings reactions.

First, there are opportunities for stocks to buy on the dip after their reports. Second, there are indices ready to break out of persistent resistance. Third, there are swing trade opportunities inside of one index trading range. The latter two will largely depend on outcomes that are still to come this week.

Today we will explore these three opportunities from three different perspectives. Here are 3 stocks to buy for profits from earnings season pin action:

- Amazon (NASDAQ:AMZN)

- SPDR Dow Jones Industrial Average ETF Trust (NYSEARCA:DIA)

- iShares Russell 2000 ETF (NYSEARCA:IWM)

However, it is important to remember that indices have rallied too long without any rest. This raises the odds of a correction. While that alone isn’t reason enough to short markets, it warrants limiting enthusiasm. It would be smart to take smaller risks than normal. Moreover, investors should also lower conviction levels regardless of thesis strength.

Stocks to Buy for Earnings Season: Amazon (AMZN)

Source: Charts by TradingView

Source: Charts by TradingView

Amazon is my pick to represent the tech sector. Yes, it might be best known as an ecommerce retailer but this technological juggernaut has earned the right to lead the NASDAQ. After all, it pretty much owns the entire cloud via AWS.

AMZN is an extremely strong company with a great track record of growth. But last week, investors expressed their disappointment with a negative -8% reaction to company earnings. However, this is by no means an indication of their quality.

AMZN once again delivered crushing numbers. The mistake was in the level of expectations from investors going into the event. I can’t even remember the last time Amazon had a bad quarter. But it has had bad earnings reactions because of expert opinions.

Remember that those do not change the fact that the growth rate is blistering. It’s funny to see analysts complaining about 27% revenue growth and 37% increase in AWS. Even great companies like Apple (NASDAQ:AAPL) would love to have such “disappointing” results (#sarcasm).

The proof is in the pudding. And so far I see nothing but a winning team executing flawlessly for a decade. AMZN stock dips are buying opportunities, although this dip isn’t yetquite big enough for me to go all in.

I consider this dip an opportunity to trade rather than a long-term investment. Moreover I was already tracking a weekly break out that could reach $4,200 per share. This breakout isn’t set in stone but still ongoing. The drop last week makes it less likely, but doesn’t completely eliminate the opportunity. The bulls have to do a bit of work this week before I’m fully convinced.

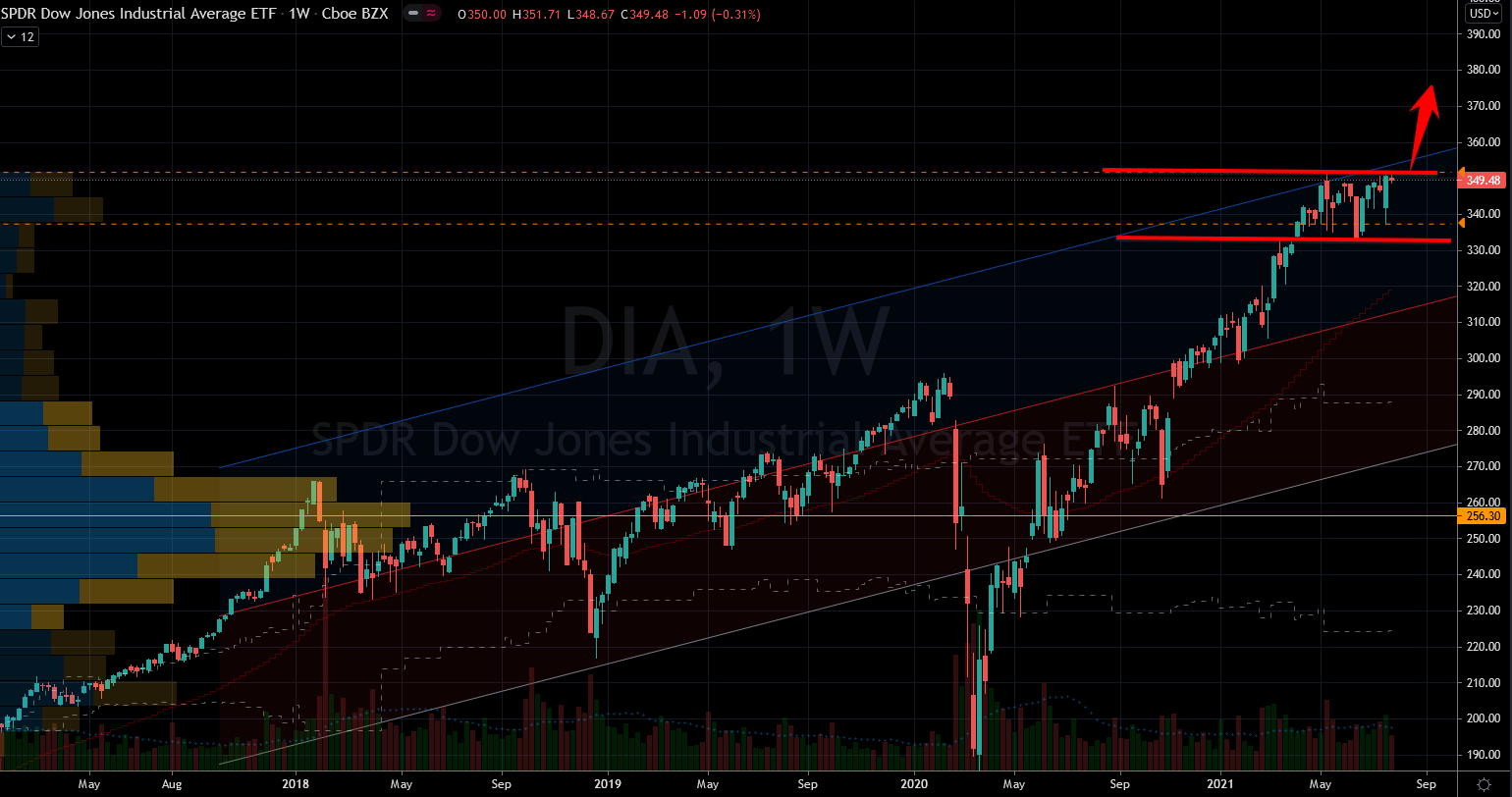

SPDR Dow Jones Industrial Average ETF Trust (DIA)

Source: Charts by TradingView

Source: Charts by TradingView

The 125 year old Dow is the second oldest U.S. index. Its calculation method gives priority to tickers with high face values, so high-dollar runaway stocks can really skew its performance. There is such an opportunity this week for the DOW to finally breakout.

Using the DIA is one easy way to trade the DOW. This ETF is both liquid and fast-moving, making it perfect for the opportunity. DIA has fallen off the radar in the past few years as investors have concentrated on trendy sectors and meme stocks. Most of those names live in the Russell small cap indices and they are certainly headline hogs.

The DOW used to represent “the market” but that age has passed. The problem with its weighting method is that it allows single stocks to yank its levels around. This week however, that could actually be the catalyst for a bull run. DIA has the opportunity to steal the show again. Oil and banks stocks could really put wind in its sails.

Oil companies will soon report their earnings, so there could be sector-wide catalysts there. Moreover, banks are coming back in favor among experts. Also tech could find its earnings footing and Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) are two DOW giants. Boeing (NYSE:BA) is also itching to pop and likewise a heavy DOW influencer.

The fact that the Dow has failed to set a new high with force is an opportunity. The line in the sand would be easily crossed, but so far the markets have hesitated for weeks.

If we see a relief pop in the markets this week, the DIA could have its day. If that happens, DIA could jump 5% or more. Since this is a trade opportunity it would be smart to set proper stop losses.

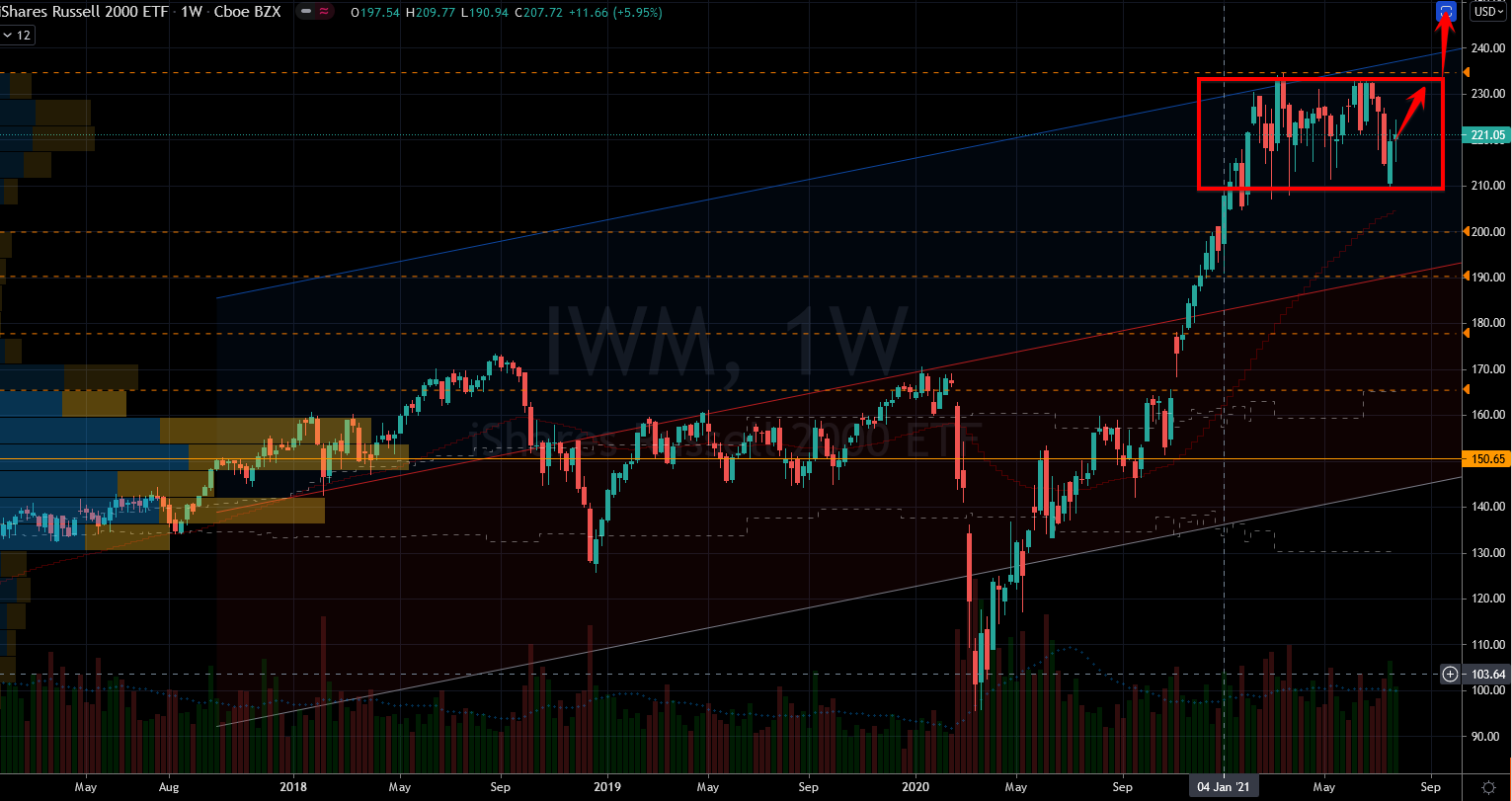

iShares Russell 2000 ETF (IWM)

Source: Charts by TradingView

Source: Charts by TradingView

The Russell 2000 index and the corresponding IWM ETF came into 2021 with a 20% rally tailwind. However since the start of the year, they have traded in a sideways channel, seemingly unable to set new records.

This has been frustrating for the bulls but they’ve had plenty of trading opportunity as a consolation. While waiting for the next leg higher, IWM traders gained and lost several 10% rallies. Two weeks ago they almost lost their footing but last week they bounced back. IWM stock now sits in the middle of its trading range and the bulls have plenty of work to do.

For the longest time experts referred to the IWM as the value index. That’s why they still refer to the rotation between the NASDAQ and small caps as growth to value. However I don’t believe those classifications are truly accurate anymore.

Nowadays, meme stocks are driving IWM price action. Most of those are heavy with froth and far from value. For example, AMC Entertainment (NYSE:AMC) is now their king. AMC stock has arguably never been more expensive, thanks to its super-fans fueling an incredible rally.

Management will have the opportunity to show us something fantastic this Friday. That’s when AMC Entertainment reports earnings and if they don’t wow us there could be a hissy fit coming. I bet that whatever way AMC stock goes, so does the IWM. It will be a binary event and with luck the bulls will shine.

By design, the Russell index should be immune to single stock influence. But the collective of meme stocks are clearly a giant motor driving price action to extremes. I prefer finding single stocks to buy on dips but sometimes it’s fun and profitable to simply cast a wide net.

— Nicolas Chahine

Legendary fund manager Louis Navellier – a man Forbes calls "the king of quants" – is going "ALL-IN" on this game-changing AI technology. He says, "This is the culmination of everything you've been reading about AI for the last 60 years."Get the details...

Source: Investor Place